Sara Lee 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

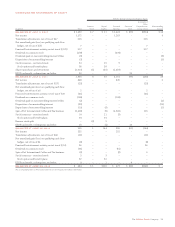

BUSINESS ACQUISITIONS

With respect to business acquisitions, the company is required to

recognize and measure the identifiable assets acquired, liabilities

assumed, contractual contingencies, contingent consideration and

any noncontrolling interest in an acquired business at fair value

on the acquisition date. In addition, the accounting guidance also

requires expensing acquisition costs when incurred, restructuring

costs in periods subsequent to the acquisition date, and any adjust-

ments to deferred tax asset valuation allowances and acquired

uncertain tax positions after the measurement period to be

reflected in income tax expense.

FOREIGN CURRENCY TRANSLATION

Foreign currency denominated assets and liabilities are translated

into U.S. dollars at exchange rates existing at the respective balance

sheet dates. Translation adjustments resulting from fluctuations

in exchange rates are recorded as a separate component of other

comprehensive income within common stockholders’ equity. The

company translates the results of operations of its foreign sub-

sidiaries at the average exchange rates during the respective periods.

Gains and losses resulting from foreign currency transactions, the

amounts of which are not material, are included in selling, general

and administrative expense.

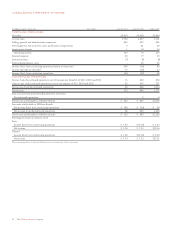

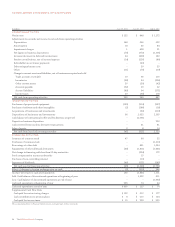

NOTE 3 – INTANGIBLE ASSETS AND GOODWILL

The primary components of the intangible assets reported in

continuing operations and the related amortization expense follows:

Accumulated Net Book

In millions Gross Amortization Value

2013

Intangible assets subject to amortization

Trademarks and brand names $÷31 $÷÷4 $÷27

Customer relationships 72 46 26

Computer software 133 112 21

Other contractual agreements 3–3

$239 $162 77

Trademarks and brand names

not subject to amortization 44

Net book value of intangible assets $121

2012

Intangible assets subject to amortization

Trademarks and brand names $÷31 $÷÷2 $÷29

Customer relationships 72 44 28

Computer software 128 100 28

Other contractual agreements 3–3

$234 $146 88

Trademarks and brand names

not subject to amortization 44

Net book value of intangible assets $132

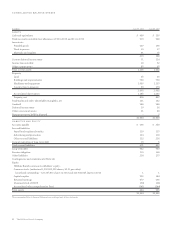

The year-over-year change in the value of trademarks and brand

names and customer relationships is primarily due to the impact of

amortization during the year. The amortization expense reported in

continuing operations for intangible assets subject to amortization

was $17 million in 2013, $21 million in 2012 and $31 million in

2011. The estimated amortization expense for the next five years,

assuming no change in the estimated useful lives of identifiable

intangible assets or changes in foreign exchange rates, is as follows:

$17 million in 2014, $7 million in 2015, $6 million in 2016, $6 mil-

lion in 2017 and $4 million in 2018. At June 29, 2013, the weighted

average remaining useful life for trademarks is 18 years; customer

relationships is 13 years; computer software is 2 years; and other

contractual agreements is 8 years.

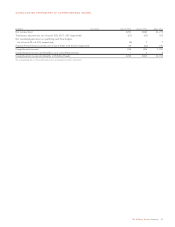

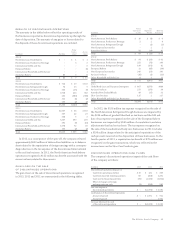

GOODWILL

The goodwill reported in continuing operations associated with

each business segment and the changes in those amounts during

2013 and 2012 are as follows:

Foodservice/

In millions Retail Other Total

Net book value at July 2, 2011

Gross goodwill $139 $«591 $«730

Accumulated impairment losses – (382) (382)

Net goodwill 139 209 348

Net book value at June 30, 2012

Gross goodwill 139 591 730

Accumulated impairment losses – (382) (382)

Net goodwill 139 209 348

Net book value at June 29, 2013

Gross goodwill 139 591 730

Accumulated impairment losses – (382) (382)

Net goodwill $139 $«209 $«348

NOTE 4 – IMPAIRMENT CHARGES

The company recognized impairment charges in 2013, 2012

and 2011 and the significant impairments are reported on the

“Impairment charges” line of the Consolidated Statements of Income.

The impact of these charges is summarized in the following table:

Pretax

Impairment

In millions Charge

2013

Retail $÷1

2012

General corporate expenses $14

2011

Foodservice/Other $15