Sara Lee 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

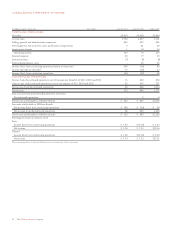

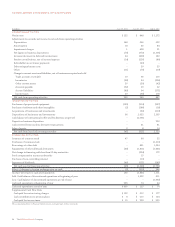

DEFINED BENEFIT PENSION PLANS

See Note 16 – Defined Benefit Pension Plans, for information

regarding plan obligations, plan assets and the measurements

of these amounts, as well as the net periodic benefit cost and the

reasons for changes in this cost.

Pension costs and obligations are dependent on assumptions

used in calculating such amounts. These assumptions include

estimates of the present value of projected future pension payments

to all plan participants, taking into consideration the likelihood of

potential future events such as salary increases and demographic

experience. The assumptions used in developing the required esti-

mates include the following key factors: discount rates, expected

return on plan assets, retirement rates and mortality.

In determining the discount rate, the company utilizes a yield

curve based on high-quality fixed-income investments that have a

AA bond rating to discount the expected future benefit payments

to plan participants. In determining the long-term rate of return

on plan assets, the company assumes that the historical long-term

compound growth rate of equity and fixed-income securities will

predict the future returns of similar investments in the plan portfolio.

Investment management and other fees paid out of plan assets

are factored into the determination of asset return assumptions.

Retirement rates are based primarily on actual plan experience,

while standard actuarial tables are used to estimate mortality.

Results that differ from these assumptions are accumulated and

amortized over future periods and, therefore, generally affect the

net periodic benefit cost in future periods.

Net periodic benefit costs for the company’s defined benefit

pension plans related to continuing operations were nil in 2013,

$1 million in 2012 and $13 million in 2011, and the projected benefit

obligation was $1.562 billion at the end of 2013 and $1.680 billion

at the end of 2012. The company currently expects its net periodic

benefit cost for 2014 to be approximately $3 million of income. The

year-over-year change versus 2013 is primarily due to the recognition

of $6 million of settlement losses in 2013 which related to a Canadian

plan, an increase in interest expense resulting from a higher discount

rate and a decrease in expected return on assets. The decrease in

expected return on assets results from lower plan assets at the end

of 2013 due to benefit payments partially offset by a decrease in

the amortization related to actuarial gains/losses.

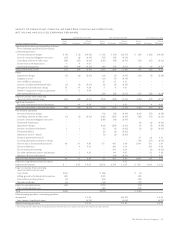

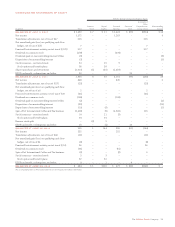

The following information illustrates the sensitivity of the net

periodic benefit cost and projected benefit obligation to a change

in the discount rate and return on plan assets. Amounts relating to

foreign plans are translated at the spot rate at the close of 2013.

The sensitivities reflect the impact of changing one assumption

at a time and are specific to base conditions at the end of 2013.

It should be noted that economic factors and conditions often

affect multiple assumptions simultaneously and that the effects

of changes in assumptions are not necessarily linear.

Increase/(Decrease) in

2013

2014 Projected

Net Periodic Benefit

Assumption Change Benefit Cost Obligation

Discount rate 1% increase $÷(1) $(187)

1% decrease 6 213

Asset return 1% increase (14) –

1% decrease 14 –

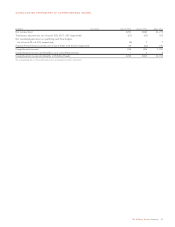

The company’s defined benefit pension plans had a net

unamortized actuarial loss of $228 million in 2013 and $263 mil-

lion in 2012. The unamortized actuarial loss is reported in the

Accumulated other comprehensive loss line of the Consolidated

Balance Sheet. The decrease in the unamortized net actuarial

loss in 2013 was primarily due to a net actuarial gain in 2013

resulting from a decrease in plan liabilities due to the increase in

the weighted average discount rate partially offset by decline in

actual asset performances.

As indicated above, changes in the bond yields, expected

future returns on assets, and other assumptions can have a material

impact upon the funded status and the net periodic benefit cost of

defined benefit pension plans. It is reasonably likely that changes

in these external factors will result in changes to the assumptions

used by the company to measure plan obligations and net periodic

benefit cost in future periods.

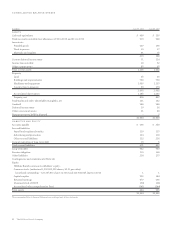

ISSUED BUT NOT YET EFFECTIVE

ACCOUNTING STANDARDS

Following is a discussion of recently issued accounting standards

that the company will be required to adopt in a future period.

Offsetting Assets and Liabilities In December 2011, the FASB

issued an amendment on disclosures about offsetting assets and

liabilities. The amendment requires additional disclosures showing

the effect or potential effect of netting arrangements on an entity’s

financial position, including the effect or potential effect of rights of

set-off associated with certain financial instruments and derivative

instruments. The amendment is retroactively effective for the

company beginning in the first quarter of fiscal 2014. This standard

will only impact the company’s disclosures in the Financial Instruments

note to the financial statements and will not have an impact on our

consolidated results of operations, financial position or cash flows.

28 The Hillshire Brands Company

FINANCIAL REVIEW