Sara Lee 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 45

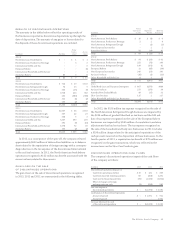

The 2013 exit, disposal and restructuring related actions

are summarized below:

• Recognized third-party consulting costs related to cost

saving and efficiency studies

• Recognized severance charges associated with planned

employee terminations

• Recognized third-party costs associated with the spin-off

of international coffee and tea operations

• Recognized lease exit costs

• Disposed of certain manufacturing facilities related to the

Retail and Foodservice/Other segments and recognized a pretax

gain of $6 million.

During 2013, the company began implementation of various

cost saving and efficiency initiatives and recognized $17 million

of charges primarily related to consulting costs.

In 2012, the company recognized a charge to implement a plan

to terminate approximately 520 employees, related to the retail,

foodservice and corporate office operations and provide them with

severance benefits in accordance with benefit plans previously com-

municated to the affected employee group or with local employment

laws. As of June 29, 2013 all of the employees affected under this

plan have been terminated.

NOTE 7 – COMMON STOCK

On June 28, 2012, the company effected a 1-for-5 reverse stock

split of Hillshire Brands common stock. As a result, every five shares

of Hillshire Brands common stock were converted into one share

of Hillshire Brands common stock. Any reference to the number of

shares outstanding or any per share amounts has been adjusted to

reflect the impact of this reverse stock split.

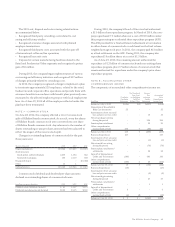

Changes in outstanding shares of common stock for the past

three years were:

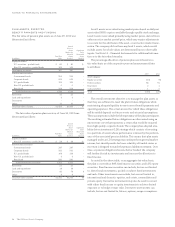

Shares in thousands 2013 2012 2011

Beginning balances 120,644 117,420 132,424

Stock issuances

Stock option and benefit plans 2,436 1,104 642

Restricted stock plans 155 2,119 398

Reacquired shares – – (16,044)

Other 131–

Ending balances 123,248 120,644 117,420

Common stock dividends and dividend-per-share amounts

declared on outstanding shares of common stock were:

In millions except per share data 2013 2012 2011

Common stock dividends declared $÷«61 $«137 $«275

Dividends per share amount declared $0.50 $1.15 $2.30

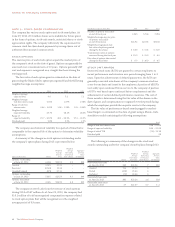

During 2010, the company’s Board of Directors had authorized

a $3.0 billion share repurchase program. In March of 2010, the com-

pany repurchased 7.3 million shares at a cost of $500 million under

this program using an accelerated share repurchase program (ASR).

The ASR provided for a final settlement adjustment at termination

in either shares of common stock or cash based on the final volume

weighted average stock price. In 2011, the company paid $13 million

as a final settlement on the ASR. During 2011, the company also

repurchased 16 million shares at a cost of $1.3 billion.

As of June 29, 2013, the remaining amount authorized for

repurchase is $1.2 billion of common stock under an existing share

repurchase program, plus 2.7 million shares of common stock that

remain authorized for repurchase under the company’s prior share

repurchase program.

NOTE 8 – ACCUMULATED OTHER

COMPREHENSIVE INCOME

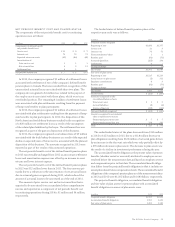

The components of accumulated other comprehensive income are:

Net Unrealized Pension/

Gain (Loss) Post- Accumulated

Cumulative on Qualifying retirement Other

Translation Cash Flow Liability Comprehensive

In millions Adjustment Hedges/Other Adjustment Income (Loss)

Balance at July 3, 2010 $(106) $(1) $(807) $(914)

Disposition of Household &

Body Care businesses 55 – – 55

Amortization of net actuarial

loss and prior service credit – – 16 16

Net actuarial gain arising

during the period – – 326 326

Pension plan curtailment – – 25 25

Other comprehensive

income (loss) activity 270 7 (50) 227

Balance at July 2, 2011 219 6 (490) (265)

Business dispositions 127 – – 127

Amortization of net actuarial

loss and prior service credit – – (1) (1)

Net actuarial loss arising

during the period – – (70) (70)

Pension plan curtailments/

settlements – – 24 24

Spin-off of International

Coffee and Tea business (180) – 343 163

Other comprehensive

income (loss) activity (150) 2 26 (122)

Balance at June 30, 2012 16 8 (168) (144)

Business dispositions (15) – – (15)

Amortization of net actuarial

loss and prior service credit – – (2) (2)

Net actuarial gain arising

during the period – – 27 27

Pension plan curtailments/

settlements ––1 1

Spin-off of International

Coffee and Tea business 6–– 6

Other comprehensive

income (loss) activity (6) (8) – (14)

Balance at June 29, 2013 $÷÷«1 $«– $(142) $(141)