Sara Lee 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 33

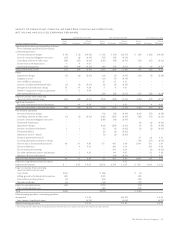

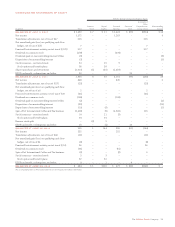

CONSOLIDATED STATEMENTS OF EQUITY

Hillshire Brands Common Stockholders’ Equity

Accumulated

Other

Common Capital Retained Unearned Comprehensive Noncontrolling

In millions Total Stock Surplus Earnings Stock Income (Loss) Interest

BALANCES AT JULY 3, 2010 $«1,459 $«7 $÷11 $«2,424 $÷(97) $(914) $«28

Net income 1,272 – – 1,263 – – 9

Translation adjustments, net of tax of $47 325 – – – – 325 –

Net unrealized gain (loss) on qualifying cash flow

hedges, net of tax of $(5) 7–––– 7 –

Pension/Postretirement activity, net of tax of $(125) 317 – – – – 317 –

Dividends on common stock (278) – – (278) – – –

Dividends paid on noncontrolling interest/Other (5) – – – – – (5)

Disposition of noncontrolling interest (3) – – – – – (3)

Stock issuances – restricted stock 34–259–––

Stock option and benefit plans 58–58––––

Share repurchases and retirement (1,313) (1) (55) (1,257) – – –

ESOP tax benefit, redemptions and other 20–––20 – –

BALANCES AT JULY 2, 2011 1,893 6 39 2,161 (77) (265) 29

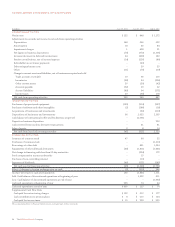

Net income 848 – – 845 – – 3

Translation adjustments, net of tax of $(17) (23) – – – – (23) –

Net unrealized gain (loss) on qualifying cash flow

hedges, net of tax of nil 2–––– 2 –

Pension/Postretirement activity, net of tax of $26 (21) – – – – (21) –

Dividends on common stock (138) – – (138) – – –

Dividends paid on noncontrolling interest/Other (2) – – – – – (2)

Disposition of noncontrolling interest (29) – – – – – (29)

Repurchase of noncontrolling interest (10) – (9) – – – (1)

Spin-off of International Coffee and Tea business (2,408) – (5) (2,566) – 163 –

Stock issuances – restricted stock 14 – 21 (7) – – –

Stock option and benefit plans 94–94––––

Reverse stock split –(5)5–– – –

ESOP tax benefit, redemptions and other 15 – (1) – 16 – –

BALANCES AT JUNE 30, 2012 235 1 144 295 (61) (144) –

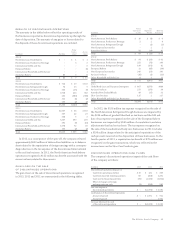

Net income 252 – – 252 – – –

Translation adjustments, net of tax of $(6) (21) – – – – (21) –

Net unrealized gain (loss) on qualifying cash flow

hedges, net of tax of $4 (8) – – – – (8) –

Pension/Postretirement activity, net of tax of $(14) 26–––– 26 –

Dividends on common stock (61) – – (61) – – –

Spin-off of International Coffee and Tea business (3) – – (9) – 6 –

Stock issuances – restricted stock 3–3–– – –

Stock option and benefit plans 52–52––––

ESOP tax benefit, redemptions and other 9–1–8 – –

BALANCES AT JUNE 29, 2013 $÷÷484 $«1 $200 $÷÷477 $÷(53) $(141) $÷«–

The accompanying Notes to Financial Statements are an integral part of these statements.