Sara Lee 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 43

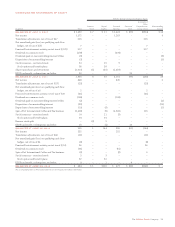

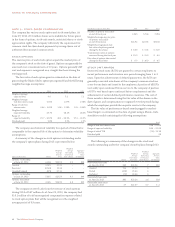

RESULTS OF DISCONTINUED OPERATIONS

The amounts in the tables below reflect the operating results of

the businesses reported as discontinued operations up through the

date of disposition. The amounts of any gains or losses related to

the disposal of these discontinued operations are excluded.

Pretax

Income Income

In millions Net Sales (Loss) (Loss)

2013

North American Fresh Bakery $÷÷÷«– $÷÷«1 $÷÷«1

North American Foodservice Beverage –32

International Coffee and Tea ––6

European Bakery – – (3)

International Household and Body Care ––1

Australian Bakery 8038

Total $÷÷«80 $÷÷«7 $÷«15

2012

North American Fresh Bakery $÷«724 $÷«29 $«163

North American Refrigerated Dough 74 13 9

North American Foodservice Beverage 330 (15) (9)

International Coffee and Tea 3,728 224 662

European Bakery 262 (384) (358)

International Household and Body Care 111 (5) (2)

Australian Bakery 136 (2) (2)

Total $5,365 $(140) $«463

2011

North American Fresh Bakery $2,037 $÷«58 $«159

North American Refrigerated Dough 307 42 27

North American Foodservice Beverage 53853

International Coffee and Tea 3,537 399 276

European Bakery 591 (9) (16)

International Household and Body Care 1,078 72 36

Australian Bakery 135 (2) (2)

Total $8,223 $«565 $«483

In 2012, as a consequence of the spin-off, the company released

approximately $623 million of deferred tax liabilities on its balance

sheet related to the repatriation of foreign earnings with a correspon-

ding reduction in the tax expense of the discontinued international

coffee and tea business. In 2011, the North American fresh bakery

operations recognized a $122 million tax benefit associated with the

excess tax basis related to these assets.

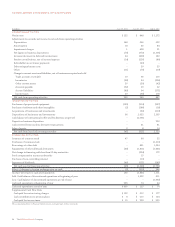

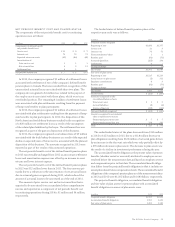

GAIN (LOSS) ON THE SALE

OF DISCONTINUED OPERATIONS

The gain (loss) on the sale of discontinued operations recognized

in 2013, 2012 and 2011 are summarized in the following tables.

Pretax Tax

Gain (Loss) (Expense)/ After Tax

In millions on Sale Benefit Gain (Loss)

2013

North American Fresh Bakery $÷÷«10 $÷÷(4) $÷÷6

North American Foodservice Beverage 224

North American Refrigerated Dough – (1) (1)

Non-European Insecticides –22

Australian Bakery 56 (14) 42

Total $÷÷«68 $÷(15) $÷53

2012

North American Fresh Bakery $÷÷«94 $÷(33) $÷61

North American Foodservice Beverage 222 (76) 146

North American Refrigerated Dough 198 (156) 42

European Bakery 11 (45) (34)

Non-European Insecticides 249 (59) 190

Air Care Products (10) (1) (11)

Other Household and Body Care 8311

Total $÷«772 $(367) $405

2011

Global Body Care and European Detergents $÷«867 $(379) $488

Air Care Products 273 (179) 94

Australia/New Zealand Bleach 48 (17) 31

Shoe Care Products 115 2 117

Other Household and Body Care Businesses 1–1

Total $1,304 $(573) $731

In 2012, the $156 million tax expense recognized on the sale of

the North American Refrigerated Dough business was impacted by

the $254 million of goodwill that had no tax basis and the $45 mil-

lion of tax expense recognized on the sale of the European Bakery

businesses was impacted by $140 million of cumulative translation

adjustments that had no tax basis. The tax expense recognized on

the sale of the household and body care businesses in 2011 includes

a $190 million charge related to the anticipated repatriation of the

cash proceeds received on the disposition of these businesses. In the

fourth quarter of 2011, a repatriation tax benefit of $79 million was

recognized on the gain transactions, which was reflected in the

income taxes on the Shoe Care Products gain.

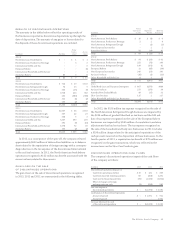

DISCONTINUED OPERATIONS CASH FLOWS

The company’s discontinued operations impacted the cash flows

of the company as follows:

In millions 2013 2012 2011

Discontinued operations impact on

Cash from operating activities $«10 $÷÷122 $÷÷309

Cash from (used in) investing activities 86 (368) 2,291

Cash used in financing activities (95) (1,530) (1,804)

Effect of changes in foreign

exchange rates on cash (1) (216) 285

Net cash impact of

discontinued operations $÷«– $(1,992) $«1,081

Cash balance of discontinued operations

At start of period $÷«– $«1,992 $÷÷911

At end of period – – 1,992

Increase (decrease) in cash

of discontinued operations $÷«– $(1,992) $«1,081