Sara Lee 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 47

As of June 29, 2013, the company had $12 million of total

unrecognized compensation expense related to stock unit plans that

will be recognized over the weighted average period of 1.8 years.

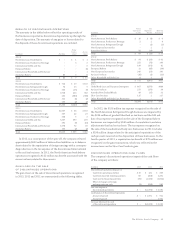

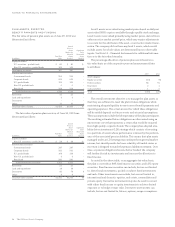

In millions except per share data 2013 2012 2011

Stock Unit Awards

Fair value of share-based units

that vested during the fiscal year $÷÷÷«4 $«÷÷88 $«÷÷42

Weighted average grant date

fair value of share based units

granted during the fiscal year $25.02 $29.09 $23.40

All Stock-Based Compensation

Total compensation expense $÷÷«13 $«÷÷35 $«÷÷41

Tax benefit on compensation expense $÷÷÷«5 $÷«÷11 $÷«÷15

NOTE 10 – EMPLOYEE STOCK OWNERSHIP PLANS (ESOP)

The company maintains an ESOP that holds common stock of the

company that is used to fund a portion of the company’s matching

program for its 401(k) savings plan for domestic non-union employ-

ees. The purchase of the original stock by the ESOP was funded both

with debt guaranteed by the company and loans from the company.

The debt guaranteed by the company was fully paid in 2004 and only

loans from the company to the ESOP remain. Each year, the company

makes contributions that, with the dividends on the common stock

held by the ESOP, are used to pay loan interest and principal. Shares

are allocated to participants based upon the ratio of the current year’s

debt service to the sum of the total principal and interest payments

over the remaining life of the loan. The number of unallocated

shares in the ESOP was 3 million at June 29, 2013 and 5 million at

June 30, 2012. Expense recognition for the ESOP is accounted for

under the grandfathered provisions contained within US GAAP.

The expense for the 401(k) savings plan recognized by the ESOP

amounted to $5 million in 2013, $14 million in 2012 and $15 million

in 2011. Payments to the ESOP were $10 million in 2013, $6 million

in 2012 and $23 million in 2011.

NOTE 11 – EARNINGS PER SHARE

Net income (loss) per share – basic is computed by dividing income

(loss) attributable to Hillshire Brands by the weighted average number

of common shares outstanding for the period. Net income (loss)

per share – diluted reflects the potential dilution that could occur

if options and fixed awards to be issued under stock-based compen-

sation arrangements were converted into common stock.

Options to purchase 2.2 million shares of common stock at

June 29, 2013, 847 thousand shares of common stock at June 30,

2012 and 6.2 million shares of common stock at July 2, 2011 were

not included in the computation of diluted earnings per share because

these options were either anti-dilutive or the exercise price was

greater than the average market price of the company’s outstanding

common stock. In 2012, the dilutive effect of stock options and

award plans were excluded from the earnings per share calculation

because they would be antidilutive given the loss in the period.

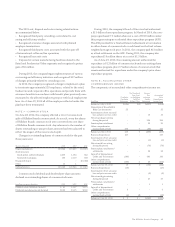

The following is a reconciliation of net income to net income

per share – basic and diluted – for the years ended June 29, 2013,

June 30, 2012 and July 2, 2011:

In millions except earnings per share 2013 2012 2011

Income (loss) from continuing operations

attributable to Hillshire Brands $«184 $÷«(20) $÷÷«58

Net income from discontinued operations

attributable to Hillshire Brands 68 865 1,205

Net income attributable to Hillshire Brands $«252 $÷845 $1,263

Average shares outstanding – basic 123 119 124

Dilutive effect of stock compensation ––1

Diluted shares outstanding 123 119 125

Income (loss) per common share – Basic

Income (loss) from continuing operations $1.50 $(0.16) $÷0.47

Income from discontinued operations 0.55 7.29 9.69

Net income $2.05 $«7.13 $10.16

Income (loss) per common share – Diluted

Income (loss) from continuing operations $1.49 $(0.16) $÷0.46

Income from discontinued operations 0.55 7.29 9.65

Net income $2.04 $«7.13 $10.11

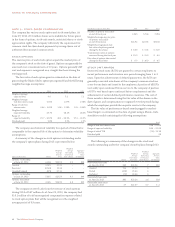

NOTE 12 – DEBT INSTRUMENTS

The composition of the company’s long-term debt, which includes

capital lease obligations, is summarized in the following table:

In millions Maturity Date 2013 2012

Senior debt

10% zero coupon notes

($19 million face value) 2014 $÷18 $÷16

10% – 14.25% zero coupon notes

($105 million face value) 2015 93 82

2.75% notes 2016 400 400

4.1% notes 2021 278 278

6.125% notes 2033 152 152

Total senior debt 941 928

Obligations under capital lease –2

Other debt 11 15

Total debt 952 945

Unamortized discounts (1) (1)

Total long-term debt 951 944

Less current portion (19) (5)

$932 $939