Sara Lee 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 The Hillshire Brands Company

FINANCIAL REVIEW

FINANCIAL CONDITION

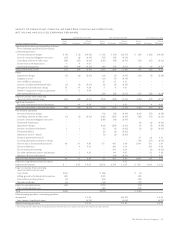

The company’s cash flow statements include amounts related to

discontinued operations through the date of disposal. The discon-

tinued operations had an impact on the cash flows from operating,

investing and financing activities in each fiscal year.

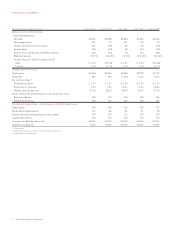

CASH FROM OPERATING ACTIVITIES

The cash from operating activities generated by continuing and

discontinued operations is summarized in the following table:

2013 2012 2011

Cash from operating activities

Continuing operations $243 $127 $138

Discontinued operations 10 122 309

Total $253 $249 $447

2013 versus 2012 The increase in cash from operating activities

of $4 million in 2013 was due to a $410 million decrease in cash

paid for restructuring actions, a $205 million decrease in pension

contributions, a $194 million decrease in cash taxes paid, as well as

improved operating results on an adjusted basis. These increases in

cash generated from operations were offset by the completion of

business dispositions in the prior fiscal year as well as an increase

in cash used to fund operating activities.

2012 versus 2011 The decrease in cash from operating activities

of $198 million in 2012 was due to the completion of business

dispositions prior to the end of 2012 and a $335 million increase in

cash paid for restructuring actions as well as an $89 million increase

in pension contributions. These uses of cash were partially offset

by improved operating results on an adjusted basis, better working

capital management and a reduction in cash taxes paid.

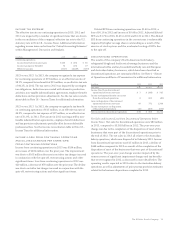

CASH FROM (USED IN) INVESTING ACTIVITIES

The cash from (used in) investing activities generated by continuing

and discontinued operations is summarized in the following table:

2013 2012 2011

Cash from (used in) investing activities

Continuing operations $(127) $(153) $÷(162)

Discontinued operations 86 (368) 2,291

Total $÷(41) $(521) $2,129

2013 versus 2012 In 2013, $41 million of cash was used in invest-

ing activities compared with $521 million in 2012. The decrease in

cash used was primarily due to a $179 million decrease in cash paid

for property and equipment, a $183 million decline in cash paid for

software and other intangibles and a $124 million increase in net

cash proceeds received related to business dispositions.

The company spent $135 million in 2013 for the purchase

of property and equipment as compared to $314 in 2012, which

included $158 million related to discontinued operations. The

year-over-year decline related to continuing operations was due

primarily to the higher expenditures in 2012 related to expanded

meat production capacity.

Capital expenditures for property and equipment related to

continuing operations for 2013 was $134 million. In 2014 the company

expects such expenditures to equal approximately 4% of net sales.

The cash paid for the purchase of software and other intangibles

declined by $183 million as the prior year included a $153 million

payment to acquire the remaining ownership interest in the Senseo

coffee trademark, which was subsequently transferred to DEMB as

part of the spin-off.

The company received $96 million on the disposition of businesses

in 2013, of which approximately $85 million (82 million AUD) was

received upon the disposition of its Australian bakery business. In

2012, business dispositions resulted in a net use of cash of $28 million

as the $2.033 billion of cash received from various business disposi-

tions was offset by $2.061 billion of cash transferred as part of the

spin-off. The $30 million of expenditures for business acquisitions

in 2012 related to beverage companies that were subsequently

transferred to DEMB as part of the spin-off.

2012 versus 2011 In 2012, $521 million of cash was used in investing

activities while in 2011, $2.129 billion of cash was received from

investing activities. The decrease in cash generated by investing

activities was due to $2.061 billion of cash transferred as part of the

spin-off of the international coffee and tea business; a $475 million

decline in the cash received from business dispositions, including the

deposit received in 2011; and an increase in cash paid for software

and other intangibles, which is primarily related to the $153 million

(€115 million) paid to acquire the remaining ownership interest

in the Senseo coffee trademark. In addition, $31 million of cash

was received from derivative transactions in 2012, which related

primarily to hedges of foreign currency exposures, as compared to

$81 million in 2011.

The company received $2.033 billion on the disposition

of businesses in 2012 related primarily to the disposition of its

North American fresh bakery, refrigerated dough and foodservice

beverage businesses and its international bakery businesses. In 2011,

the company received $2.3 billion related to the disposition of the

majority of the international household and body care business

and also received a $203 million deposit related to the disposition

of its insecticides business that closed in the first half of 2012.