Sara Lee 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 35

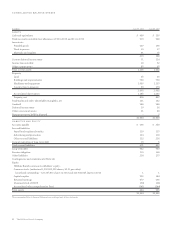

NOTE 1 – NATURE OF OPERATIONS

AND BASIS OF PRESENTATION

NATURE OF OPERATIONS

The Hillshire Brands Company (corporation, company or Hillshire

Brands) is a U.S.-based company that primarily focuses on meat and

meat-centric food products. The company’s principal product lines

are branded packaged meat products and frozen bakery products. Sales

are made in both the retail channel, to supermarkets, warehouse

clubs and national chains, and the foodservice channel.

The relative importance of each of the company’s business segments

over the past three years, as measured by sales and operating segment

income, is presented in Note 19 – Business Segment Information,

of these financial statements.

BASIS OF PRESENTATION

The Consolidated Financial Statements include the accounts of the

company and all subsidiaries where we have a controlling financial

interest. The consolidated financial statements include the accounts

of a variable interest entity (VIE) for which the company is deemed

the primary beneficiary. The results of companies acquired or dis-

posed of during the year are included in the consolidated financial

statements from the effective date of acquisition, or up to the date

of disposal. All significant intercompany balances and transactions

have been eliminated in consolidation.

The fiscal year ends on the Saturday closest to June 30. Fiscal

2013, 2012 and 2011 were 52-week years. Unless otherwise stated,

references to years relate to fiscal years.

Discontinued Operations The Australian bakery business is reported

as discontinued operations beginning in 2013. The results of the

international coffee and tea, North American foodservice beverage,

European bakery, North American fresh bakery, North American

refrigerated dough, and international household and body care busi-

nesses had previously been reported as discontinued operations in

the company’s 2012 annual report. The results of operations of

these businesses through the date of disposition are presented as

discontinued operations in the Consolidated Statements of Income

for all periods presented. For business dispositions completed prior

to 2013, the assets and liabilities of discontinued operations, prior

to disposition, were aggregated and reported on separate lines of

the Consolidated Balance Sheets.

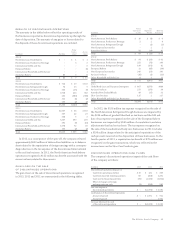

Financial Statement Corrections During 2013, the company

corrected certain balance sheet accounts as well as SG&A and

income tax expense in the income statement related to continu-

ing operations for errors that included the understatement of an

asset for deposits held as collateral by insurance companies and

the understatement of non-current deferred tax assets related to

an employee benefit plan. It also corrected certain errors related

to the tax provisions associated with the operating results for

discontinued operations and the gain/loss on sale of discontinued

operations. For the full year 2013, the correction of these errors

increased income for continuing operations by $9.5 million

pretax ($8.3 million after tax) and net income by $11.0 million.

The company evaluated these errors in relation to the period in

which they were corrected, as well as the periods in which they

originated, and concluded that these errors did not materially

misstate the 2013 financial statements or any previously issued

financial statements.

NOTE 2 – SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES

The Consolidated Financial Statements have been prepared

in accordance with generally accepted accounting principles in

the U.S. (GAAP).

The preparation of the Consolidated Financial Statements

in conformity with GAAP requires management to make use of

estimates and assumptions that affect the reported amount of

assets and liabilities, revenues and expenses and certain financial

statement disclosures. Significant estimates in these Consolidated

Financial Statements include allowances for doubtful accounts

receivable, net realizable value of inventories, sales incentives,

useful lives of property and identifiable intangible assets, the evalu-

ation of the recoverability of property, identifiable intangible assets

and goodwill, self-insurance reserves, income tax and valuation

reserves, the valuation of assets and liabilities acquired in business

combinations, assumptions used in the determination of the funded

status and annual expense of pension and postretirement employee

benefit plans, and the volatility, expected lives and forfeiture rates

for stock compensation instruments granted to employees. Actual

results could differ from these estimates.

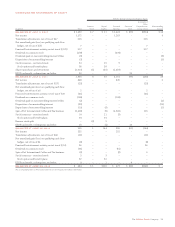

REACQUIRED SHARES

The Company is incorporated in the State of Maryland and under

the laws of that state shares of its own stock that are acquired by

the Company constitute authorized but unissued shares. The cost of

the acquisition by the Company of shares of its own stock in excess

of the aggregate par value of the shares first reduces capital surplus,

to the extent available, with any residual cost applied against

retained earnings.

SALES RECOGNITION AND INCENTIVES

The company recognizes sales when they are realized or realizable

and earned. The company considers revenue realized or realizable

and earned when persuasive evidence of an arrangement exists,

delivery of products has occurred, the sales price charged is fixed or

determinable, and collectability is reasonably assured. For the com-

pany, this generally means that we recognize sales when title to and

risk of loss of our products pass to our resellers or other customers.

In particular, title usually transfers upon receipt of our product at

our customers’ locations, or upon shipment, as determined by the

specific sales terms of the transactions.

NOTES TO FINANCIAL STATEMENTS