Sara Lee 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 The Hillshire Brands Company

FINANCIAL REVIEW

Net sales for discontinued operations were $5.365 billion in 2012,

compared to $8.223 billion in 2011, a 35% decrease. The sales decline

was primarily driven by the impact of business dispositions completed

after the start of 2011 and resulted in there being less than a full

twelve months of sales in each fiscal year. Income before income

taxes in 2012 was a loss of $140 million, a decrease of $705 million

compared to 2011. The decrease was again driven by the impact of

business dispositions including $414 million of impairment charges

in 2012 primarily related to the European bakery operations as well

as various restructuring and other charges. The change in income

from discontinued operations was a decrease of $20 million over the

prior year despite the much larger decline in pretax income due to

significant tax benefits that increased income from discontinued

operations by $685 million in 2012. In 2012, the international coffee

and tea business reported a $438 million income tax benefit, which

included a $623 million benefit associated with the reversal of a

deferred tax liability related to the repatriation of foreign earnings.

The remaining significant tax benefits related to tax basis differ-

ences and tax settlements and reserve reversals.

Gain on Sale of Discontinued Operations In 2013, the company

completed the disposition of the Australian bakery business and

recognized a pretax gain of $56 million ($42 million after tax), as

well as gains related to a final purchase price adjustment associated

with the North American fresh bakery operation, a gain on the sale

of manufacturing facilities related to the sale of the North American

foodservice beverage operations and adjustments to the prior year tax

provision estimates associated with previous business dispositions.

In 2012, the company completed the disposition of the fresh bakery,

foodservice beverage and refrigerated dough businesses in North

America as well as the European bakery businesses in Spain and

France. It also completed the disposition of the remainder of the

businesses that comprised the household and body care business,

primarily the non-European insecticides business and portions of

the air care and shoe care businesses. It recognized a pretax gain of

$772 million ($405 million after tax) on the disposition of these busi-

nesses in 2012. The tax provision on the disposition of the refrigerated

dough business was negatively impacted by a book/tax basis difference

related to $254 million of goodwill that is not deductible for tax

purposes. In 2011, the company completed the disposition of the

majority of the businesses that comprised the household and body

care business – global body care, European detergents, and Australia/

New Zealand bleach businesses as well as a majority of the air care

and shoe care businesses and recognized a pretax gain of $1.3 billion

($731 million after tax). Further details regarding these transactions

are included in Note 5 – Discontinued Operations.

CONSOLIDATED NET INCOME AND

DILUTED EARNINGS PER SHARE (EPS)

The consolidated net income and related diluted earnings per share

includes the results of both continuing and discontinued operations –

see the Consolidated Statements of Income in this report for addi-

tional information. Net income was $252 million in 2013, a decrease

of $596 million over the prior year. The decrease in net income was

primarily due to a $800 million decline in the results associated with

discontinued operations, partially offset by a $204 million increase

in results associated with continuing operations noted previously.

Net income was $848 million in 2012, a decrease of $424 million

over the prior year. The decrease in net income was primarily due to

a $326 million decrease in the gain on sale of discontinued operations.

The decrease in net income was also due to a $78 million reduction

in income from continuing operations noted previously.

The net income attributable to Hillshire Brands was $252 million

in 2013, $845 million in 2012 and $1.263 billion in 2011.

Diluted EPS were $2.04 in 2013, $7.13 in 2012 and $10.11 in 2011.

The decrease in EPS is primarily the result of the change in net income

from discontinued businesses. Further, the diluted EPS in the current

year is impacted by higher average shares outstanding as a result of

the exercise of stock options and the accelerated vesting of RSUs

due to the spin-off.

OPERATING RESULTS BY BUSINESS SEGMENT

The company’s structure is currently organized around two business

segments, which are described below:

Retail sells a variety of packaged meat and frozen bakery products

to retail customers in North America.

Foodservice/Other sells a variety of meat and bakery products to

foodservice customers in North America. Sales are made in the food-

service channel to distributors, restaurants, hospitals and other

large institutions. This segment also includes sales results for the

commodity pork and turkey businesses as well as the former Senseo

coffee business in the United States that was exited in March 2012

and the former live hog business that was exited in September 2011.

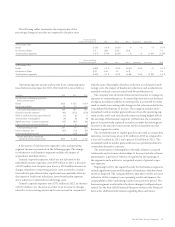

The following is a summary of results by business segment:

In millions 2013 2012 2011

Sales

Retail $2,894 $2,884 $2,760

Foodservice/Other 1,026 1,025 1,001

3,920 3,909 3,761

Impact of businesses exited/disposed – 55 135

Intersegment – (6) (12)

Total $3,920 $3,958 $3,884