Sara Lee 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

The cash used in financing activities primarily represents the

net transfers of cash with the corporate office. The net assets of

the discontinued operations includes only the cash noted above

as most of the cash of those businesses, with the exception of the

international coffee and tea business, has been retained as a

corporate asset.

There were no assets held for sale or disposition as of June 29,

2013. The assets held for sale of $5 million as of June 30, 2012

represented property, plant and equipment.

NOTE 6 – EXIT, DISPOSAL

AND RESTRUCTURING ACTIVITIES

The company has incurred exit, disposition and restructuring

charges for initiatives designed to improve its operational perform-

ance and reduce cost. Details on exited businesses is provided in

Note 5 – Discontinued Operations, of these financial statements.

In addition, in June 2012, the company completed the spin-off of

its international coffee and tea operations into a new public com-

pany, which resulted in the company incurring certain costs in

conjunction with the spin-off. These costs include restructuring

actions such as employee termination costs and costs related to

renegotiating contractual agreements; third-party professional fees

for consulting and other services that are directly related to the

spin-off; and the costs of employees solely dedicated to activities

directly related to the spin-off.

The nature of the costs incurred includes the following:

Exit Activities, Asset and Business Disposition Actions

These amounts primarily relate to:

• Employee termination costs

• Lease and contractual obligation exit costs

• Gains or losses on the disposition of assets or asset

groupings that do not qualify as discontinued operations

Restructuring/Spin-off Costs Recognized in Cost of Sales and

Selling, General and Administrative Expenses

These amounts primarily relate to:

• Expenses associated with the installation of information systems

• Consulting costs

• Costs associated with the renegotiation of contracts for

services with outside third-party vendors as part of the spin-off

of the international coffee and tea operations

Certain of these costs are recognized in Cost of Sales or

Selling, General and Administrative Expenses in the Consolidated

Statements of Income as they do not qualify for treatment as an

exit activity or asset and business disposition pursuant to the

accounting rules for exit and disposal activities. However, manage-

ment believes that the disclosure of these charges provides the

reader with greater transparency to the total cost of the initiatives.

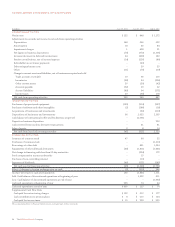

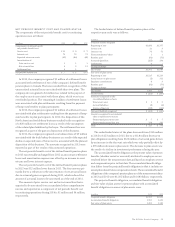

The following is a summary of the (income) expense associated

with these actions, and also highlights where the costs are reflected

in the Consolidated Statements of Income:

In millions 2013 2012 2011

Exit and business dispositions $÷9 $÷81 $38

Selling, general and

administrative expenses 39 115 36

Total $48 $196 $74

The impact of these actions on the company’s business segments

and unallocated corporate expenses is summarized as follows:

In millions 2013 2012 2011

Retail $«(1) $÷14 $11

Foodservice/Other (2)43

(Increase) Decrease in business segment income (3) 18 14

Increase in general corporate expenses 51 178 60

Total $48 $196 $74

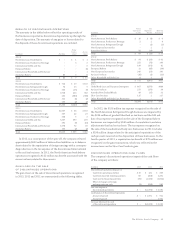

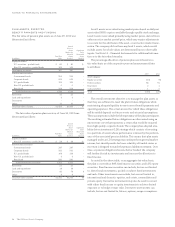

The following table summarizes the activity during 2013 related to

exit, disposal and restructuring related actions and the status of the

related accruals as of June 29, 2013. The accrued amounts remaining

represent the estimated cash expenditures necessary to satisfy

remaining obligations. The majority of the cash payments to satisfy

the accrued costs are expected to be paid in the next 12 months.

Non-

Employee cancellable Asset and

Termination IT and Leases/ Business

and Other Other Contractual Disposition

In millions Benefits Costs Obligations Actions Total

Accrued costs as of

June 30, 2012 $«42 $«16 $«21 $«– $«79

Exit, disposal and

other costs (income)

recognized during 2013 6 40 12 (6) 52

Cash payments (28) (44) (27) – (99)

Non-cash charges (5) (8) 17 – 4

Charges (income) in

discontinued operations (2) 2 – – –

Change in estimate (3) (1) – – (4)

Asset and business

disposition action –– – 66

Accrued costs as of

June 29, 2013 $«10 $÷«5 $«23 $«– $«38