Sara Lee 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 49

NOTE 14 – CONTINGENCIES AND COMMITMENTS

CONTINGENT LIABILITIES

The company is a party to various pending legal proceedings, claims

and environmental actions by government agencies. The company

records a provision with respect to a claim, suit, investigation or

proceeding when it is probable that a liability has been incurred and

the amount of the loss can reasonably be estimated. Any provisions

are reviewed at least quarterly and are adjusted to reflect the impact

and status of settlements, rulings, advice of counsel and other infor-

mation pertinent to the particular matter.

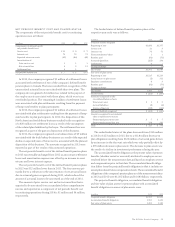

Aris This is a consolidation of cases filed by individual complainants

with the Republic of the Philippines, Department of Labor and

Employment and the National Labor Relations Commission (NLRC)

from 1998 through July 1999. The complaint alleges unfair labor

practices due to the termination of manufacturing operations in

the Philippines by Aris Philippines, Inc. (Aris), a former subsidiary

of the company. The complaint names the company as a party

defendant. In 2006, the arbitrator ruled against the company and

awarded the plaintiffs approximately $80 million in damages and

fees. This ruling was appealed by the company and subsequently set

aside by the NLRC in December 2006. Both the complainants and

the company have filed motions for reconsideration. The company

continues to believe that the plaintiffs’ claims are without merit;

however, it is reasonably possible that this case will be ruled against

the company and have a material adverse impact on the company’s

results of operations and cash flows. The company has initiated

settlement discussions for this case and has established an accrual

for the estimated settlement amount.

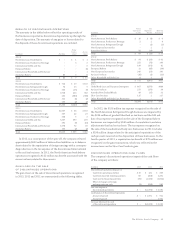

Multi-Employer Pension Plans The company participates in one

multi-employer pension plan (MEPP) that provided retirement

benefits to certain employees covered by collective bargaining agree-

ments. Participating employers in a MEPP are jointly responsible for

any plan underfunding. MEPP contributions are established by the

applicable collective bargaining agreements; however, the MEPPs

may impose increased contribution rates and surcharges based on

the funded status of the plan and the provisions of the Pension

Protection Act of 2006 (PPA). The PPA imposes minimum funding

requirements on the plans. Plans that fail to meet certain funding

standards as defined by the PPA are categorized as being either in a

critical or endangered status. We have received notice that the plan

to which we contribute has been designated in critical status. The

trustees of critical status multi-employer plans must adopt a rehabili-

tation or funding improvement plan designed to improve the plan’s

funding within a prescribed period of time. Rehabilitation and funding

improvement plans may include increased employer contributions,

reductions in benefits or a combination of the two. Unless otherwise

agreed upon, any requirement to increase employer contributions

will not take effect until the current collective bargaining agreements

expire. However, a five percent surcharge for the initial critical year

(increasing to ten percent for the following and subsequent years) is

imposed on contributions to plans in critical status and remains in

effect until the bargaining parties agree on modifications consistent

with the rehabilitation plan adopted by the trustees. In addition, the

failure of a plan to meet funding improvement targets provided in

its rehabilitation or funding improvement plan could result in the

imposition of an excise tax on contributing employers.

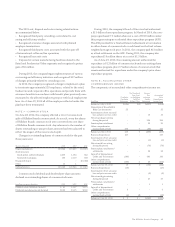

Under current law regarding multi-employer pension plans,

a withdrawal or partial withdrawal from any plan that was under-

funded would render us liable for our proportionate share of that

underfunding. This potential unfunded pension liability also applies

ratably to other contributing employers. Information regarding

underfunding is generally not provided by plan administrators and

trustees on a current basis and when provided, is difficult to inde-

pendently validate. Any public information available relative to

multi-employer pension plans may be dated as well. In the event

a withdrawal or partial withdrawal was to occur with respect to the

MEPP to which the company makes contributions, the impact to

our consolidated financial statements could be material. Withdrawal

liability triggers could include the company’s decision to close a

plant or the dissolution of a collective bargaining unit.

The company’s regularly scheduled contributions to MEPPs

related to continuing operations totaled approximately $1 million

in 2013, $2 million in 2012 and $3 million in 2011.

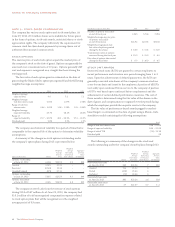

GUARANTEES

The company is a party to a variety of agreements under which it

may be obligated to indemnify a third party with respect to certain

matters. Typically, these obligations arise as a result of contracts

entered into by the company under which the company agrees to

indemnify a third party against losses arising from a breach of repre-

sentations and covenants related to matters such as title to assets

sold, the collectibility of receivables, specified environmental matters,

lease obligations assumed and certain tax matters. In each of these

circumstances, payment by the company is conditioned on the other

party making a claim pursuant to the procedures specified in the

contract. These procedures allow the company to challenge the other

party’s claims. In addition, the company’s obligations under these

agreements may be limited in terms of time and/or amount, and in

some cases the company may have recourse against third parties for

certain payments made by the company. It is not possible to predict

the maximum potential amount of future payments under certain of

these agreements, due to the conditional nature of the company’s

obligations and the unique facts and circumstances involved in each

particular agreement. Historically, payments made by the company