Sara Lee 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 51

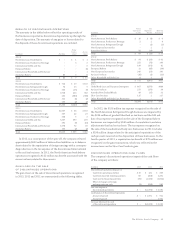

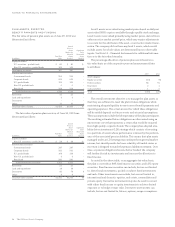

The notional values of the various derivative instruments used

by the company are summarized in the following table:

Hedge

Coverage

June 29, June 30, (Number of

In millions 2013 2012 Months)

Swap contracts

Rec. fixed/pay fixed –

cross currency swaps notional1$÷– $(40) –

Commodity contracts

Commodity future contracts2

Grains and oilseeds $34 $«56 5

Energy 29 27 11

Other commodities 20 25 6

1 The notional value is calculated using the exchange rates as the reporting date.

2 Commodity futures contracts are determined by the notional cost of the contract.

CASH FLOW PRESENTATION

The cash receipts and payments from a derivative instrument are

classified according to the nature of the instrument, when realized,

generally in investing activities unless otherwise disclosed. However,

cash flows from a derivative instrument that are accounted for as a

fair value hedge or cash flow hedge are classified in the same category

as the cash flows from the items being hedged provided the deriva-

tive does not include a financing element at inception. If a derivative

instrument includes a financing element at inception, all cash inflows

and outflows of the derivative instrument are considered cash flows

from financing activities. If, for any reason, hedge accounting is

discontinued, any remaining cash flows after that date shall be

classified consistent with mark-to-market instruments.

CONTINGENT FEATURES/

CONCENTRATION OF CREDIT RISK

All of the company’s derivative instruments are governed by

International Swaps and Derivatives Association (i.e., ISDA) master

agreements, requiring the company to maintain an investment grade

credit rating from both Moody’s and Standard & Poor’s credit rating

agencies. If the company’s credit rating were to fall below investment

grade, it would be in violation of these provisions, and the counter-

parties to the derivative instruments could request immediate

payment or demand immediate collateralization on the derivative

instruments in net liability positions. The aggregate fair value of all

derivative instruments with credit-risk-related contingent features

that are in a liability position was nil on June 29, 2013 and $40 mil-

lion on June 30, 2012, for which the company posted no collateral.

A large number of major international financial institutions are

counterparties to the company’s financial instruments. The company

enters into financial instrument agreements only with counterpar-

ties meeting very stringent credit standards (a credit rating of A-/A3

or better), limiting the amount of agreements or contracts it enters

into with any one party and, where legally available, executing master

netting agreements. The company regularly monitors these positions.

While the company may be exposed to credit losses in the event of

nonperformance by individual counterparties of the entire group

of counterparties, the company has not recognized any losses with

these counterparties in the past and does not anticipate material

losses in the future.

Trade accounts receivable due from customers that the company

identified as having low or no credit ratings were $60 million at

June 29, 2013 and $52 million at June 30, 2012.

FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset

or paid to transfer a liability (i.e., exit price) in an orderly transaction

between market participants at the measurement date. Assets and

liabilities measured at fair value must be categorized into one of

three different levels depending on the assumptions (i.e., inputs)

used in the valuation. Level 1 provides the most reliable measure of

fair value while level 3 generally requires significant management

judgment. Assets and liabilities are classified in their entirety based

on the lowest level of input significant to the fair value measurement.

The carrying amounts of cash and equivalents, trade accounts

receivables, accounts payable, derivative instruments and notes

payable approximate fair values due to their short-term nature and

are considered Level 1 based on the valuation inputs. The carrying

value of derivative instruments approximate fair value but may be

considered Level 1 or Level 2 based on the valuation inputs used

(see balance sheet classification and fair value determination in the

table presented later in this disclosure.) The fair value of the company’s

long-term debt (considered Level 2 based on the valuation inputs

used), including the current portion, is estimated using discounted

cash flows based on the company’s current incremental borrowing

rates for similar types of borrowing arrangements.

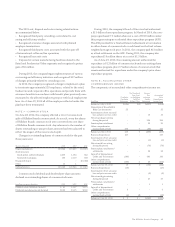

June 29, 2013 June 30, 2012

Fair Carrying Fair Carrying

In millions Value Amount Value Amount

Long-term debt, including

current portion $981 $951 $1,004 $945

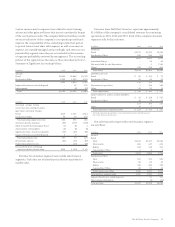

Information on the location and amounts of derivative fair

values in the Consolidated Balance Sheet at June 29, 2013 and

June 30, 2012 is as follows:

Assets Liabilities

Other Accrued

Current Assets Liabilities – Other

June 29, June 30, June 29, June 30,

In millions 2013 2012 2013 2012

Derivatives designated

as hedging instruments

Foreign exchange contracts1$– $– $– $40

Derivatives not designated

as hedging instruments

Foreign exchange contracts1–1––

Total derivatives $– $1 $– $40

1 Categorized as level 2: Fair value of level 2 assets and liabilities as of June 30, 2012 are $1 million and

$40 million, respectively.