Sara Lee 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

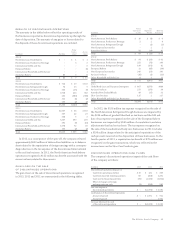

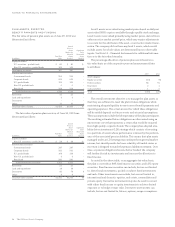

Information related to our cash flow hedges, net investment

hedges, fair value hedges and other derivatives not designated as

hedging instruments for the periods ended June 29, 2013, and

June 30, 2012, follows:

Interest Rate Foreign Exchange Commodity

Contracts Contracts Contracts Total

June 29, June 30, June 29, June 30, June 29, June 30, June 29, June 30,

In millions Year ended 2013 2012 2013 2012 2013 2012 2013 2012

CASH FLOW DERIVATIVES

Amount of gain (loss) recognized in

other comprehensive income (OCI)1$– $(8) $– $÷÷«– $÷6 $13 $÷6 $÷÷«5

Amount of gain (loss) reclassified

from AOCI into earnings 1, 2 –(3)–2182181

Amount of ineffectiveness recognized in earnings3, 4 – – – (2) (1) 2 (1) –

Amount of gain (loss) expected to be reclassified

into earnings during the next twelve months ––––(2)10(2)10

NET INVESTMENT DERIVATIVES

Amount of gain (loss) recognized in OCI1–––604–––604

Amount of gain (loss) recognized from OCI into earnings6– – – (446)–––(446)

Amount of gain (loss) recognized from OCI into spin-off dividend7–––324–––324

FAIR VALUE DERIVATIVES

Amount of derivative gain (loss) recognized in earnings5–1–––––1

Amount of hedged item gain (loss) recognized in earnings5–4–––––4

DERIVATIVES NOT DESIGNATED

AS HEDGING INSTRUMENTS

Amount of gain (loss) recognized in Cost of Sales ––––(2)(2)(2)(2)

Amount of gain (loss) recognized in SG&A –––(15)2–2(15)

1 Effective portion.

2 Gain (loss) reclassified from AOCI into earnings is reported in interest or debt extinguishment, for interest rate swaps, in selling, general, and administrative (SG&A) expenses for foreign exchange contracts and in cost

of sales for commodity contracts.

3 Gain (loss) recognized in earnings is related to the ineffective portion and amounts excluded from the assessment of hedge effectiveness.

4 Gain (loss) recognized in earnings is reported in interest expense for foreign exchange contract and SG&A expenses for commodity contracts.

5 The amount of gain (loss) recognized in earnings on the derivative contracts and the related hedged item is reported in interest or debt extinguishment, for the interest rate contracts and SG&A for the foreign exchange contracts.

6 The gain (loss) recognized from OCI into earnings is reported in gain on sale of discontinued operations.

7 The gain/(loss) recognized from OCI into the spin-off dividend is reported in Retained Earnings as a result of the spin-off.

NOTE 16 – DEFINED BENEFIT PENSION PLANS

The company sponsors two U.S. and one Canadian pension plans

to provide retirement benefits to certain employees. The benefits

provided under these plans are based primarily on years of service

and compensation levels.

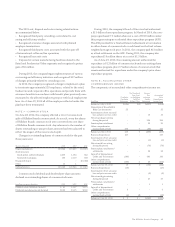

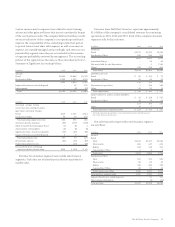

MEASUREMENT DATES AND ASSUMPTIONS

A fiscal year end measurement date is utilized to value plan assets

and obligations for all of the company’s defined benefit pension plans.

The weighted average actuarial assumptions used in measuring

the net periodic benefit cost and plan obligations of continuing

operations were as follows:

2013 2012 2011

Net periodic benefit cost

Discount rate 4.2% 5.5% 5.4%

Long-term rate of return on plan assets 6.2% 6.5% 7.3%

Plan obligations

Discount rate 4.8% 4.2% 5.5%

The discount rate is determined by utilizing a yield curve based

on high-quality fixed-income investments that have a AA bond rating

to discount the expected future benefit payments to plan participants.

Compensation increase assumptions are based upon historical expe-

rience and anticipated future management actions. Compensation

changes for participants in the U.S. plans no longer have an impact

on the benefit cost or plan obligations as the participants in the U.S.

salaried plan will no longer accrue additional benefits. In determining

the long-term rate of return on plan assets, the company assumes

that the historical long-term compound growth rates of equity and

fixed-income securities and other plan investments will predict the

future returns of similar investments in the plan portfolio. Investment

management and other fees paid out of plan assets are factored into

the determination of asset return assumptions.