Sara Lee 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 59

various income and/or expense items related to restructuring

actions and other gains and losses that are not considered to be part

of the core business results. The company believes that these results

are more indicative of the company’s core operating results and

improve the comparability of the underlying results from period

to period. Interest and other debt expense, as well as income tax

expense, are centrally managed, and accordingly, such items are not

presented by segment since they are not included in the measure

of segment profitability reviewed by management. The accounting

policies of the segments are the same as those described in Note 2 –

Summary of Significant Accounting Policies.

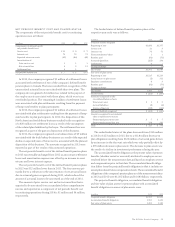

In millions 2013 2012 2011

SALES

Retail $2,894 $2,884 $2,760

Foodservice/Other 1,026 1,025 1,001

3,920 3,909 3,761

Impact of businesses exited/disposed – 55 135

Intersegment – (6) (12)

Total $3,920 $3,958 $3,884

In millions 2013 2012 2011

INCOME (LOSS) FROM

CONTINUING OPERATIONS

BEFORE INCOME TAXES

Retail $329 $«313 $«314

Foodservice/Other 75 79 102

Total operating segment income 404 392 416

General corporate expenses (93) (272) (159)

Mark-to-market derivative gain/(loss) (1) (1) 2

Amortization of intangibles (4) (4) (4)

Significant items – business segments (15) (47) (31)

Impact of businesses exited/disposed 683

Total operating income 297 76 227

Net interest expense (41) (72) (87)

Debt extinguishment costs – (39) (55)

Income (loss) from continuing

operations before income taxes $256 $÷(35) $÷«85

Net sales for a business segment may include sales between

segments. Such sales are at transfer prices that are equivalent to

market value.

Revenues from Wal-Mart Stores Inc. represent approximately

$1.0 billion of the company’s consolidated revenues for continuing

operations in 2013, 2012 and 2011. Each of the company’s business

segments sells to this customer.

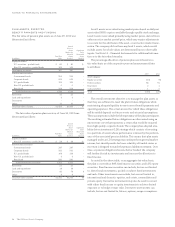

In millions 2013 2012 2011

ASSETS

Retail $1,273 $1,279 $1,282

Foodservice/Other 542 530 530

1,815 1,809 1,812

Australian Bakery –5866

Net assets held for sale/disposition – 5 7,143

Other1619 578 461

Total assets $2,434 $2,450 $9,482

DEPRECIATION

Retail $÷«÷90 $÷«101 $÷÷«79

Foodservice/Other 28 30 26

118 131 105

Discontinued operations 2 104 186

Other 28 31 11

Total depreciation $÷«148 $÷«266 $÷«302

ADDITIONS TO LONG-LIVED ASSETS

Retail $÷÷«95 $÷«128 $÷«207

Foodservice/Other 28 38 28

123 166 235

Other 1672

Total additions to long-lived assets $÷«139 $÷«173 $÷«237

1 Principally cash and cash equivalents, certain corporate fixed assets, deferred tax assets

and certain other non-current assets.

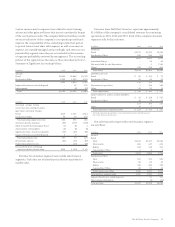

Net sales by product type within each business segment

are as follows:

In millions 2013 2012 2011

SALES

Retail

Meat $2,103 $2,117 $1,984

Meat-centric 685 647 639

Bakery 104 118 135

Commodities/Other 222

Total retail 2,894 2,884 2,760

Foodservice/Other

Meat 507 520 501

Meat-centric 88 86 81

Bakery 343 344 358

Commodities/Other 88 75 61

Total Foodservice/Other 1,026 1,025 1,001

Total business segment sales 3,920 3,909 3,761

Impact of businesses exited/disposed – 55 135

Intersegment elimination – (6) (12)

Total net sales $3,920 $3,958 $3,884