Sara Lee 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

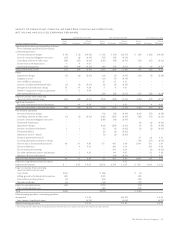

The Hillshire Brands Company 15

2013 versus 2012 Net sales, which excludes the impact of business

dispositions, increased by $1 million, or 0.1%. The favorable impact

of higher volumes was mostly offset by an unfavorable shift in sales

mix and negative pricing actions in response to lower commodity

costs. Volumes increased 4.5% as higher volumes for processed meat

and commodity meat products were only partially offset by lower

bakery volumes due to the continued weak economic conditions.

Operating segment income, which excludes the impact of

restructuring charges, other significant items and business disposi-

tions, decreased by $4 million, or 5.0%. The decrease was primarily

driven by an unfavorable shift in sales mix and investments in bakery

plant improvements partially offset by increased volumes and lower

commodity costs. Increased investments in MAP were offset by

lower SG&A costs.

2012 versus 2011 Net sales increased by $24 million, or 2.4%. The

impact of price increases in response to higher commodity costs and

an increase in sales of commodity products offset lower foodservice

bakery volumes. The pricing actions increased sales by 3.2%. Overall,

net unit volumes declined 0.1% as lower bakery volumes, due to

demand softness caused by the continued weak economic conditions

and the impact of production disruptions resulting from manufac-

turing plant upgrades at the company’s Tarboro, NC facility, were

only partially offset by higher volumes for meat products.

Operating segment income decreased by $23 million, or 22.4%,

as the unfavorable impact of higher commodity costs, net of pricing

actions, the impact of lower volumes for non-commodity products,

the manufacturing plant disruptions noted above, which reduced

operating segment income by approximately $9 million, higher

trade spending and discounts for aged inventory were only partially

offset by continuous improvement savings and lower SG&A costs.

FOODSERVICE/OTHER

Dollar Percent Dollar Percent

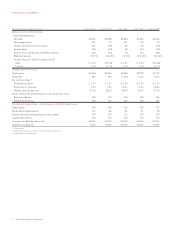

In millions 2013 2012 Change Change 2012 2011 Change Change

Net sales $1,026 $1,025 $«1 0.1fi $1,025 $1,001 $«24 2.4fi

Operating segment income $÷÷«75 $÷÷«79 $(4) (5.0)fi $÷÷«79 $÷«102 $(23) (22.4)fi