Sara Lee 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

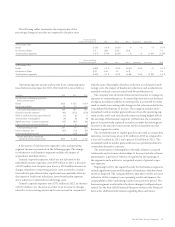

6The Hillshire Brands Company

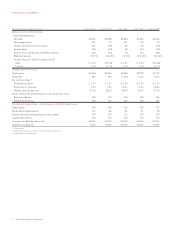

FINANCIAL SUMMARY

Dollars in millions except per share data June 29, 2013 June 30, 2012 July 2, 2011 July 3, 20101 June 27, 2009

RESULTS OF OPERATIONS

Continuing operations

Net sales $3,920 $3,958 $3,884 $3,842 $4,023

Operating income 297 76 227 175 95

Income (loss) before income taxes 256 (35) 85 59 (37)

Income (loss) 184 (20) 58 124 (31)

Income (loss) attributable to Hillshire Brands 184 (20) 58 124 (31)

Effective tax rate 28.1% (44.2)fi 31.8% (111.7)fi (16.5)fi

Income (loss) per share of common stock2

Basic $÷1.50 $«(0.16) $÷0.47 $÷0.90 $«(0.22)

Diluted 1.49 (0.16) 0.46 0.90 (0.22)

FINANCIAL POSITION

Total assets $2,434 $2,450 $9,482 $8,778 $9,376

Total debt 951 944 2,109 2,247 2,247

Per common share2

Dividends declared $÷0.50 $÷1.15 $÷2.30 $÷2.20 $÷2.20

Book value at year-end 3.93 1.95 16.12 11.00 14.42

Market value at year-end 33.08 28.99 96.60 69.95 47.90

Shares used in the determination of net income per share2

Basic (in millions) 123 119 124 138 140

Diluted (in millions) 123 119 125 138 140

OTHER INFORMATION – CONTINUING OPERATIONS ONLY

Depreciation 146 162 116 133 127

Media advertising expense 113 86 81 91 58

Total media advertising and promotion expense 174 136 121 143 106

Capital expenditures 139 173 138 175 136

Common stockholders of record348,000 52,000 60,000 64,000 67,000

Number of employees 9,100 9,500 10,000 10,000 11,000

1 53-week year.

2 Reflects the impact of a 1-for-5 reverse stock split in June 2012.

3 As of the latest practicable date.