Sara Lee 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

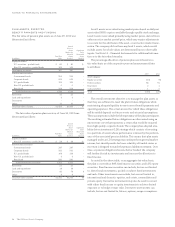

NOTE 9 – STOCK-BASED COMPENSATION

The company has various stock option and stock award plans. At

June 29, 2013, 20.3 million shares were available for future grant

in the form of options, stock unit awards, restricted shares or stock

appreciation rights. The company will satisfy the requirement for

common stock for share-based payments by issuing shares out of

authorized but unissued common stock.

STOCK OPTIONS

The exercise price of each stock option equals the market price of

the company’s stock on the date of grant. Options can generally be

exercised over a maximum term of 10 years. Options generally cliff

vest and expense is recognized on a straight-line basis during the

vesting period.

The fair value of each option grant is estimated on the date of

grant using the Black-Scholes option-pricing model and the following

weighted average assumptions:

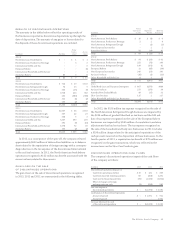

2013 2012 2011

Weighted average

expected lives 6.0 7.0 7.2

Weighted average

risk-free interest rates 0.95% 1.37% 2.08%

Range of risk-free

interest rates 0.94 – 1.03% 1.28 – 1.38% 1.91 – 2.66%

Weighted average

expected volatility 29.7% 28.1% 28.0%

Range of

expected volatility 29.7 – 30.0% 28.1 – 28.3% 27.3 – 30.0%

Dividend yield 2.0% 2.5% 2.9%

The company uses historical volatility for a period of time that is

comparable to the expected life of the option to determine volatility

assumptions.

A summary of the changes in stock options outstanding under

the company’s option plans during 2013 is presented below:

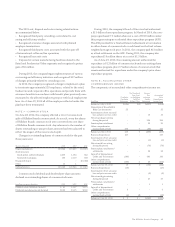

Weighted

Weighted Average Aggregate

Average Remaining Intrinsic

Exercise Contractual Value

Shares in thousands Shares Price Term (Years) (in millions)

Options outstanding

at June 30, 2012 6,264 $23.01 3.2 $38

Granted 2,525 25.99 – –

Exercised (2,563) 19.34 – –

Canceled/expired (371) 27.16 – –

Options outstanding

at June 29, 2013 5,855 $25.59 6.3 $44

Options exercisable

at June 29, 2013 3,065 $24.92 3.8 $25

The company received cash from the exercise of stock options

during 2013 of $47 million. As of June 29, 2013, the company had

$10.1 million of total unrecognized compensation expense related

to stock option plans that will be recognized over the weighted

average period of 0.9 years.

In millions except per share data 2013 2012 2011

Number of options exercisable

at end of fiscal year 3,065 5,704 7,784

Weighted average exercise price

of options exercisable

at end of fiscal year $24.92 $22.65 $26.38

Weighted average grant date

fair value of options granted

during the fiscal year $÷6.08 $÷6.35 $÷5.29

Total intrinsic value of options

exercised during the fiscal year $÷22.9 $÷23.5 $÷÷8.0

Fair value of options that vested

during the fiscal year $÷÷0.3 $÷16.9 $÷÷4.5

STOCK UNIT AWARDS

Restricted stock units (RSUs) are granted to certain employees to

incent performance and retention over periods ranging from 1 to 3

years. Upon the achievement of defined parameters, the RSUs are

generally converted into shares of the company’s common stock on

a one-for-one basis and issued to the employees. A portion of all RSUs

vest solely upon continued future service to the company. A portion

of RSUs vest based upon continued future employment and the

achievement of certain defined performance measures. The cost of

these awards is determined using the fair value of the shares on the

date of grant, and compensation is recognized over the period during

which the employees provide the requisite service to the company.

The fair value of performance-based awards pegged to market-

based targets is estimated on the date of grant using a Monte-Carlo

simulation model containing the following assumptions:

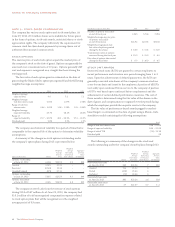

2013

Range of risk-free interest rates 0.28 – 0.35%

Range of expected volatility 24.0 – 25.0%

Range of initial TSR (7.3) – 13.1%

Dividend yield 2%

The following is a summary of the changes in the stock unit

awards outstanding under the company’s benefit plans during 2013:

Weighted

Weighted Average Aggregate

Average Remaining Intrinsic

Grant Date Contractual Value

Shares in thousands Shares Fair Value Term (Years) (in millions)

Nonvested share units

at June 30, 2012 340 $26.24 .7 $10

Granted 734 25.02 0 –

Vested (158) 25.66 0 –

Forfeited (71) 26.64 0 –

Nonvested share units

at June 29, 2013 845 $25.26 1.6 $28

Exercisable share units

at June 29, 2013 57 $22.07 5.7 $÷2