Sara Lee 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8The Hillshire Brands Company

FINANCIAL REVIEW

FISCAL YEAR 2014 OUTLOOK

The company expects Fiscal 2014 results to be impacted by a number

of factors including higher raw material costs, continued investments

in brand building and innovation, the wrapping of non-recurring

favorable SG&A costs, and competitive dynamics. These factors will

be partially offset by expected savings from the company’s produc-

tivity programs.

REVIEW OF CONSOLIDATED RESULTS

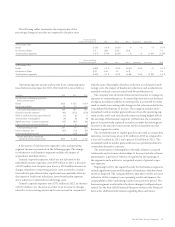

The following tables summarize net sales and operating income

for 2013 versus 2012, and 2012 versus 2011 and certain items that

affected the comparability of these amounts:

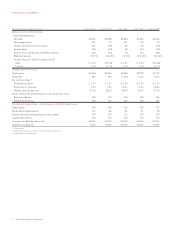

2013 VERSUS 2012

Dollar Percent

In millions 2013 2012 Change Change

Net sales $3,920 $3,958 $÷(38) (1.0)fi

Less: net sales from

Dispositions – 55 (55)

Adjusted net sales $3,920 $3,903 $÷«17 0.4fi

Operating income $÷«297 $÷÷«76 $«221 NM

Less: Impact of Significant

items on operating income $÷÷(72) $««(255) $(183)

Dispositions 6 8 (2)

Adjusted operating income $÷«363 $÷«323 $«««40 12.5fi

2012 VERSUS 2011

Dollar Percent

In millions 2012 2011 Change Change

Net sales $3,958 $3,884 $÷«74 1.9fi

Less: net sales from

Dispositions 55 135 (80)

Adjusted net sales $3,903 $3,749 $«154 4.1fi

Operating income $÷«÷76 $÷«227 $(151) (66.5)fi

Less: Impact of Significant

items on operating income $÷(255) $«÷«(91) $(164)

Dispositions 835

Adjusted operating income $÷«323 $÷«315 $«««÷8 2.5fi

NON-GAAP MEASURES

Management measures and reports Hillshire Brands’ financial results

in accordance with U.S. generally accepted accounting principles

(“GAAP”). In this report, Hillshire Brands highlights certain items

that have significantly impacted the company’s financial results and

uses several non-GAAP financial measures to help investors under-

stand the financial impact of these significant items. The non-GAAP

financial measures used by Hillshire Brands in this annual report

are adjusted net sales and adjusted operating income which exclude

from a financial measure computed in accordance with GAAP the

impact of significant items and the impact of businesses that have

been exited or disposed of for all periods presented. Another

non-GAAP financial measure is Adjusted EPS which excludes from

reported diluted EPS from continuing operations the impact of

significant items.

Management believes that these non-GAAP financial measures

reflect an additional way of viewing aspects of Hillshire Brands’

business that, when viewed together with Hillshire Brands’ financial

results computed in accordance with GAAP, provide a more complete

understanding of factors and trends affecting Hillshire Brands’

historical financial performance and projected future operating

results, greater transparency of underlying profit trends and greater

comparability of results across periods. These non-GAAP financial

measures are not intended to be a substitute for the comparable

GAAP measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Management also uses certain of these non-GAAP financial

measures, in conjunction with the GAAP financial measures, to

understand, manage and evaluate our businesses, in planning for

and forecasting financial results for future periods, and as one factor

in determining achievement of incentive compensation. Two of the

five performance measures under Hillshire Brands’ annual incentive

plan are net sales and earnings before interest and taxes, which are

the reported amounts as adjusted for significant items and possibly

other items. Many of the significant items will recur in future periods;

however, the amount and frequency of each significant item varies

from period to period.

See “Non-GAAP Measures Definitions” in the Financial Review

section of this report for additional information regarding these

financial measures.