Sara Lee 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

Valuation allowances have been established on net operating

losses and other deferred tax assets in certain U.S. state jurisdic-

tions as a result of the company’s determination that there is less

than a 50% likelihood that these assets will be realized.

The company records tax reserves for uncertain tax positions

taken, or expected to be taken, on a tax return. For those tax benefits

to be recognized, a tax position must be more-likely-than-not to be

sustained upon examination by the tax authorities. The amount

recognized is measured as the largest amount of benefit that is

greater than 50% likely of being realized upon audit settlement.

Due to the inherent complexities arising from the nature of

the company’s businesses, and from conducting business and being

taxed in a substantial number of jurisdictions, significant judgments

and estimates are required to be made. Agreement of tax liabilities

between Hillshire Brands and the many tax jurisdictions in which

the company files tax returns may not be finalized for several years.

Thus, the company’s final tax-related assets and liabilities may

ultimately be different from those currently reported.

Our total unrecognized tax benefits that, if recognized, would

affect our effective tax rate were $65 million as of June 29, 2013.

This amount differs from the balance of unrecognized tax benefits

as of June 30, 2012 primarily due to uncertain tax positions that

created deferred tax assets in jurisdictions which have not been real-

ized due to a lack of profitability in the respective jurisdictions. At

this time, the company estimates that it is reasonably possible that

the liability for unrecognized tax benefits will decrease by approxi-

mately $5 to $30 million in the next 12 months from a variety of

uncertain tax positions as a result of the completion of various

worldwide tax audits currently in process and the expiration of the

statute of limitations in several jurisdictions.

The company recognizes interest and penalties related to

unrecognized tax benefits in tax expense. During the years ended

June 29, 2013, June 30, 2012 and July 2, 2011, the company recog-

nized a benefit of $1 million, benefit of $3 million and an expense

of $2 million, respectively, of interest and penalties in continuing

operations tax expense. The tax benefits in 2012 and 2013 were the

result of the finalization of tax reviews and audits and changes in

estimates of tax contingencies. As of June 29, 2013, June 30, 2012

and July 2, 2011, the company had accrued interest and penalties of

approximately $8 million, $10 million and $21 million, respectively.

The company’s tax returns are routinely audited by federal, state

and foreign tax authorities and these audits are at various stages of

completion at any given time. The Internal Revenue Service (IRS) has

completed examinations of the company’s U.S. income tax returns

through June 28, 2008. With few exceptions, the company is no

longer subject to state and local income tax examinations by tax

authorities for years before July 2, 2005.

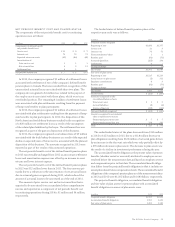

The following table presents a reconciliation of the beginning

and ending amount of unrecognized tax benefits for the years ended

June 29, 2013, June 30, 2012 and July 2, 2011:

June 29, June 30, July 2,

In millions Year ended 2013 2012 2011

Unrecognized tax benefits

Beginning of year balance $74 $«83 $88

Increases based on current

period tax positions –58

Increases based on prior

period tax positions –24 –

Decreases based on prior

period tax positions – (4) (5)

Decreases related to settlements

with tax authorities – (33) (4)

Decreases related to a lapse of

applicable statute of limitation (7) (1) (4)

End of year balance $67 $«74 $83

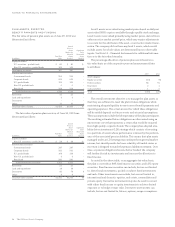

NOTE 19 – BUSINESS SEGMENT INFORMATION

The following are the company’s two business segments and the

types of products and services from which each reportable segment

derives its revenues.

• Retail sells a variety of packaged meat and frozen bakery

products to retail customers in North America. It also includes

gourmet artisanal sausage and salami products.

• Foodservice/Other sells a variety of meats and bakery products

to foodservice customers in North America such as broad-line

foodservice distributors, restaurants, hospitals and other large

institutions and includes commodity meat products.

The company’s management uses operating segment income in

order to evaluate segment performance and allocate resources, which

is defined as operating income before general corporate expenses;

mark-to-market derivative gains/(losses); and amortization of

trademarks and customer relationship intangibles. Beginning in

2013, the reported operating results for the business segments also

excludes significant items and the impact of businesses that have

been exited or disposed. The business segment results reflect the

above changes for all periods presented. Significant items represent