Sara Lee 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Hillshire Brands Company 21

GUARANTEES

The company is a party to a variety of agreements under which it

may be obligated to indemnify a third party with respect to certain

matters. Typically, these obligations arise as a result of contracts

entered into by the company under which the company agrees to

indemnify a third party against losses arising from a breach of repre-

sentations and covenants related to such matters as title to assets

sold, the collectibility of receivables, specified environmental matters,

lease obligations assumed and certain tax matters. In each of these

circumstances, payment by the company is conditioned on the other

party making a claim pursuant to the procedures specified in the

contract. These procedures allow the company to challenge the other

party’s claims. In addition, the company’s obligations under these

agreements may be limited in terms of time and/or amount, and in

some cases the company may have recourse against third parties for

certain payments made by the company. It is not possible to predict

the maximum potential amount of future payments under certain

of these agreements, due to the conditional nature of the company’s

obligations and the unique facts and circumstances involved in each

particular agreement. Historically, payments made by the company

under these agreements have not had a material effect on the com-

pany’s business, financial condition or results of operations. The

company believes that if it were to incur a loss in any of these matters,

such loss would not have a material effect on the company’s business,

financial condition or results of operations.

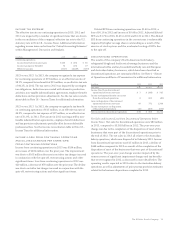

The material guarantees for which the maximum potential

amount of future payments can be determined, include the com-

pany’s contingent liability on leases on property operated by others

that is described above, and the company’s guarantees of certain

third-party debt. These debt guarantees require the company to

make payments under specific debt arrangements in the event that

the third parties default on their debt obligations. The maximum

potential amount of future payments that the company could be

required to make in the event that these third parties default on

their debt obligations is approximately $16 million. At the present

time, the company does not believe it is probable that any of these

third parties will default on the amount subject to guarantee.

RISK MANAGEMENT

CHALLENGES AND RISKS

As a consumer products company, we face certain risks and challenges

that impact our business and financial performance. The risks and

challenges described below have impacted our performance and are

likely to impact our future results as well.

The food and consumer products businesses are highly competitive.

In many product categories, we compete not only with widely adver-

tised branded products, but also with private label products that are

generally sold at lower prices. As a result, from time to time, we may

need to reduce the prices for some of our products to respond to

competitive pressures. Economic uncertainty may result in increased

pressure to reduce the prices for some of our products, limit our

ability to increase or maintain prices or lead to a continued shift

toward private label products. Any reduction in prices or our inability

to increase prices when raw material costs increase could negatively

impact profit margins and the overall profitability of our reporting

units, which could potentially trigger a goodwill impairment.

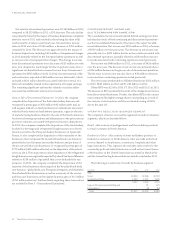

Commodity prices directly impact our business because of their

effect on the cost of raw materials used to make our products and the

cost of inputs to manufacture, package and ship our products. Many

of the commodities we use, including pork, beef, poultry, packaging,

energy, cheese, fruit, seasoning blends, flour and sugar have experi-

enced price volatility due to factors beyond our control. The company’s

objective is to offset commodity price increases with pricing actions and

to offset any operating cost increases with continuous improvement

savings. During 2013, commodity costs, excluding mark-to-market

derivative gains/losses, decreased over the prior year. The benefit of

lower commodity costs was partially offset by price reductions. The

company expects commodity costs to increase in 2014.

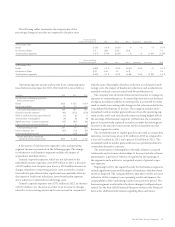

In June 2012, the company announced that it expected to

deliver $100 million of savings between 2013 and 2015. At that time,

initiatives to deliver $65 million of savings had been identified. The

company has now identified the remaining $35 million of cost savings,

as well as approximately $45 million of additional savings expected

through 2016. The cost savings are expected to result from improved

revenue management, supply chain and support processes. The

company expects to recognize cash charges of approximately $80 mil-

lion to $100 million between 2013 and 2016. Non-cash charges may

also be recognized as the initiatives are implemented. The company

recognized approximately $16 million of cash charges in 2013 related

to these new cost savings initiatives. When fully implemented,

these initiatives are expected to deliver ongoing annual savings

of $80 million.

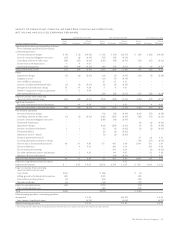

INTEREST RATE AND COMMODITY RISKS

To mitigate the risk from interest rate and commodity price

fluctuations, the company may enter into various hedging transac-

tions that have been authorized pursuant to the company’s policies

and procedures. The company does not use financial instruments

for trading purposes and is not a party to any leveraged derivatives.

Interest Rates The company has used interest rate swaps to modify

its exposure to interest rate movements, reduce borrowing costs and

to lock in interest rates on anticipated debt issuances. Interest rate

risk management is accomplished through the use of swaps to modify

interest payments under these instruments. As of the end of 2013,

the company does not have any interest rate swaps outstanding as

it has no significant exposure to changing interest rates on our long-

term debt because the interest rate is fixed on 100% of the company’s