Sara Lee 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 The Hillshire Brands Company

FINANCIAL REVIEW

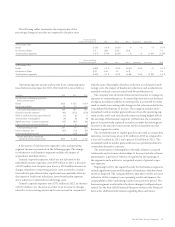

Total selling, general and administrative (SG&A) expenses

in 2012 increased $47 million, or 5.4% from 2011. Measured as

a percent of sales, SG&A expenses increased from 22.7% in 2011

to 23.5% in 2012. The results reflect the impact of an increase in

charges related to restructuring and spin-off actions and higher MAP

expenses partially offset by the benefits of cost saving initiatives

and lower general corporate expenses, excluding restructuring and

spin-off related charges. SG&A expenses as a percent of sales

decreased in each of the business segments.

Total SG&A expenses reported in 2012 by the business segments

decreased by $14 million, or 1.8%, versus 2011 primarily due to the

benefits of cost saving initiatives partially offset by higher MAP

spending and the impact of inflation on wages and employee benefits.

Unallocated general corporate expenses increased by $59 million

in 2012 from 2011 due to a $148 million increase in restructuring

actions and other significant items partially offset by a reduction in

information technology costs, the impact of headcount reductions

and lower stranded overhead costs related to sold businesses.

As previously noted, reported SG&A reflects amounts recognized

for restructuring actions, spin-off related costs and other significant

amounts. These amounts include the following:

In millions 2013 2012 2011

Restructuring/spin-off costs $«57 $137 $36

Gain on HBI tax settlement – (15) –

Litigation accrual –11 –

Pension settlement 51–

Foreign tax indemnification charge (10) (3) –

Workers’ compensation deposit adjustment (7)––

Other –1–

Total $«45 $132 $36

Additional information regarding the restructuring and

spin-off related costs can be found in Note 6 – Exit, Disposal and

Transformation Activities.

EXIT ACTIVITIES, ASSET AND BUSINESS DISPOSITIONS

Exit activities, asset and business dispositions are as follows:

In millions 2013 2012 2011

Charges for exit activities

Severance $÷3 $27 $29

Exit of leases and other

contractual obligations 12 54 9

Business disposition gains (6)––

Total $÷9 $81 $38

The net charges in 2013 are $72 million lower than 2012 as a result

of lower severance and lease and contractual obligation exit costs.

The 2012 charges were incurred in conjunction with the spin-off.

The net charges in 2012 are $43 million higher than 2011 as a

result of a $45 million increase in lease and contractual obligation

exit costs, which were incurred in conjunction with the spin-off.

IMPAIRMENT CHARGES

In 2013, the company recognized a $1 million impairment charge,

which related to the writedown of machinery and equipment associ-

ated with the Retail segment that was determined to no longer have

any future use by the company. In 2012, the company recognized a

$14 million impairment charge, which related to the writedown of

computer software which was no longer in use. The charge was recog-

nized as part of general corporate expenses. In 2011, the company

recognized a $15 million impairment charge, which related to the

writedown of manufacturing equipment associated with the North

American foodservice bakery reporting unit.

Additional details regarding these impairment charges are

discussed in Note 4 – Impairment Charges.

NET INTEREST EXPENSE

Net interest expense of $41 million in 2013 was $31 million lower

than the prior year. This was due to a decline in interest expense

as a result of the repayment of approximately $2 billion of debt

during 2012 primarily using proceeds from the completed business

dispositions, as well as the transfer of $650 million of debt to DEMB

as part of the spin-off. Net interest expense decreased by $15 mil-

lion in 2012 from 2011 to $72 million due to a decline in interest

expense as a result of the repayment of approximately $970 million

of debt in April 2012 using existing cash on hand. Interest income

remained unchanged.

DEBT EXTINGUISHMENT COSTS

In 2012, the company completed a cash tender offer for $348 million

of its 6.125% Notes due November 2032 and $122 million of its 4.10%

Notes due 2020 and it redeemed all of its 3.875% Notes due 2013,

with an aggregate principal amount of $500 million, and recognized

$39 million of charges associated with the early extinguishment of

this debt. In 2011, the company redeemed its $1.1 billion 6.25%

Notes due September 15, 2011 and recognized a $55 million charge

associated with the early redemption of this debt.