Sara Lee 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

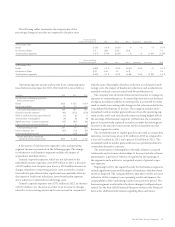

The Hillshire Brands Company 17

The company expended $30 million in 2012 for the acquisition

of several coffee companies which were transferred as part of the

spin-off of the international coffee and tea business. During 2011,

the company expended $119 million of cash for the acquisition of

two businesses, Aidells, a retail sausage business and Damasco, a

Brazilian coffee company.

The company spent $314 million for the purchase of property

and equipment in 2012 as compared to $337 million in 2011. The

slightly higher level of spending in 2011 was due to the higher

expenditures related to the expansion of meat production capacity

in North America.

CASH USED IN FINANCING ACTIVITIES

The net cash used in financing activities is split between continuing

and discontinued operations as follows:

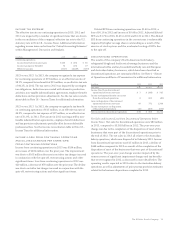

2013 2012 2011

Cash from (used in) financing activities

Continuing operations $«50 $÷÷184 $÷÷÷53

Discontinued operations (95) (1,530) (1,804)

Total $(45) $(1,346) $(1,751)

The cash used in the financing activities of the discontinued

operations primarily represents the net transfers of cash with the

corporate office as most of the cash of these businesses has been

retained as a corporate asset, with the exception of the cash related

to the international coffee and tea business, which was transferred

as part of the spin-off.

2013 versus 2012 The cash used in financing activities in 2013

decreased by $1.301 billion over the prior year driven primarily by

$1.164 billion in net debt repayments in 2012 and a year-over-year

decrease in dividends paid of $225 million, partially offset by a

decrease in cash received related to common stock issuances. In 2013,

the company paid approximately $40 million upon the settlement of

two cross currency swaps maturing in June 2013 that were associated

with certain foreign denominated debt instruments. In 2012, the

company repaid $348 million of its 6.125% Notes due November 2032

and $122 million of its 4.10% Notes due 2020 as part of a tender

offer. It also redeemed all of its 3.875% Notes due 2013, which

had an aggregate principal amount of $500 million. The company

also repaid $841 million of long-term debt and derivatives, which

included the payment of $156 million related to derivatives associ-

ated with this debt, and $204 million of debt with maturities less

than 90 days. The company utilized cash on hand and new borrow-

ings to repay this debt. The company issued $851 million of new

borrowings in 2012, which included a note purchase agreement with

a group of institutional investors related to the private placement

of $650 million aggregate principal amount of indebtedness. On

June 28, 2012, the company transferred its obligation under the

private placement debt as part of the spin-off.

Additionally, in 2012 the company recognized a $15 million

windfall tax benefit related to stock compensation that occurs when

compensation cost from non-qualified share-based compensation

recognized for tax purposes exceeds compensation cost from equity-

based compensation recognized in the financial statements. This tax

benefit increased net cash provided by financing activities.

Dividends paid during 2013 were $46 million as compared to

$271 million in 2012. The dividends paid in 2013 represent the first

three quarterly dividends of Hillshire Brands.

Cash from stock issuances totaled $47 million in 2013 compared

to $84 million in 2012, driven primarily by stock award activity.

2012 versus 2011 The cash used in financing activities in 2012

decreased by $405 million over the prior year due to a $1.3 billion

reduction in cash paid to repurchase shares of its common stock

partially offset by a $959 million increase in the net repayments

of debt. The 2012 debt repayment activity is outlined above.

In 2011, the company repurchased 16.0 million shares of common

stock for $1.3 billion. In 2010, the company expended $500 million

to repurchase 7.3 million shares of its common stock under an accel-

erated share repurchase program. There were no repurchases of

common stock in 2012.

During 2011, the company repaid its $1.1 billion 6.25% Note due

in September 2011 and issued $400 million of 2.75% Notes due in

September 2015 and $400 million of 4.1% Notes due in September

2020. The remaining portion of the debt repayment was funded

through short term borrowings and cash on hand.

Dividends paid during 2012 were $271 million as compared to

$285 million in 2011. The reduction in dividends is due in part to

the impact of the share repurchases.

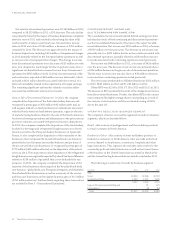

LIQUIDITY

CASH AND EQUIVALENTS, SHORT-TERM

INVESTMENTS AND CASH FLOW

At the end of 2013, the company’s cash and cash equivalents balance

was $400 million, which was primarily invested in prime money

market funds. A portion of cash is expected to be used over the next

two fiscal years to fund the company’s share repurchase program. A

portion of this cash is also expected to be used to fund cash commit-

ments of approximately $145 – $155 million over the next several

years primarily related to consulting and other costs related to the

company’s efficiency initiatives, as well as the remaining legacy obli-

gations. The majority of these commitments are expected to be paid

in 2014. At the end of 2013, the company had recognized a liability

for restructuring actions of approximately $38 million. These amounts

will be paid when the obligations become due, and the company

expects a significant portion of these amounts will be paid in 2014.