Sara Lee 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42 The Hillshire Brands Company

NOTES TO FINANCIAL STATEMENTS

INTERNATIONAL OPERATIONS

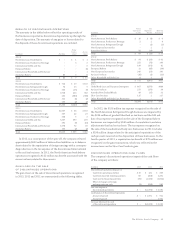

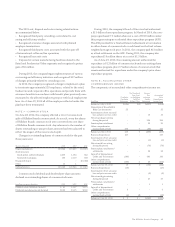

Australian Bakery In February 2013, the company completed

the sale of its Australian Bakery business. Using foreign currency

exchange rates on the date of the transaction, the company received

cash proceeds of $85 million and reported an after tax gain on

disposition of $42 million.

International Coffee and Tea On June 28, 2012, the company’s

international coffee and tea business was spun off into a new public

company called D.E MASTER BLENDERS 1753 N.V. The separation

was effected as follows: a distribution of all of the common stock of

a U.S. subsidiary that held all of the company’s international coffee

and tea business (“CoffeeCo”) was made to an exchange agent on

behalf of the company’s shareholders of record. Immediately after

the distribution of CoffeeCo common stock, CoffeeCo paid a $3.00

per share dividend, which totaled $1.8 billion. After the payment of

the dividend, CoffeeCo merged with a subsidiary of D.E MASTER

BLENDERS 1753 N.V. As a result of the spin-off, the historical

results of the international coffee and tea business have been

reported as a discontinued operation in the company’s consolidated

financial statements. The company entered into a master separation

agreement that provided for the orderly separation of the business

and transition of various administrative functions and processes

and a separate tax sharing agreement whereby DEMB agreed to

indemnify the company for certain tax liabilities that could result

from the spin-off and certain related transactions. The company

does not have any significant continuing involvement in the busi-

ness and does not expect any material direct cash inflows or

outflows with this business.

European Bakery During the first quarter of 2012, management

decided to divest the Spanish bakery and French refrigerated dough

businesses, collectively referred to as European Bakery, requiring

that these businesses be tested for impairment under the available

for sale model. Based on an estimate of the anticipated proceeds

for these businesses, the company recognized a pretax impairment

charge of $379 million for the Spanish bakery and French refrigerated

dough businesses in 2012. A tax benefit of $38 million was recognized

on these impairment charges. On October 10, 2011, the company

announced that it had signed an agreement to sell the Spanish bakery

business to Grupo Bimbo for €115 million and closed the transaction

in the second quarter of 2012. In the third quarter of 2012, the

company also completed the disposition of its French refrigerated

dough business for €115 million. A $11 million pretax gain was

recognized in 2012 on the sale of both the Spanish bakery and

French refrigerated dough businesses.

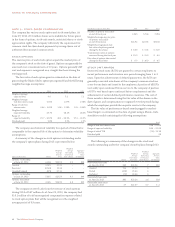

Global Body Care and European Detergents In December 2010,

the company completed the disposition of its global body care and

European detergents business. Using foreign currency exchange

rates on the date of the transaction, the company received cash pro-

ceeds of $1.6 billion and reported an after tax gain on disposition

of $488 million. The company entered into a customary transitional

services agreement with the purchaser of this business to provide

for the orderly separation of the business and the orderly transition

of various functions and processes which was completed by the

end of 2011.

Air Care Products Business In July 2010, the company sold a

majority of its air care products business. Using foreign currency

exchange rates on the date of the transaction, the company received

cash proceeds of $411 million, which represented the majority of

the proceeds received on the disposition of the Air Care business, and

reported an after tax gain on disposition of $94 million. When this

business was sold, certain operations were retained in Spain, until

production related to non-air care businesses ceased at the facility.

The sale of the Spanish facility closed in the third quarter of 2012

and the company received $44 million of proceeds and recognized

a pretax loss on the sale of this facility of $10 million.

Australia/New Zealand Bleach In February 2011, the company

completed the sale of its Australia/New Zealand Bleach business.

Using foreign currency exchange rates on the date of the transaction,

the company received cash proceeds of $53 million and reported an

after tax gain on disposition of $31 million.

Shoe Care Business In May 2011, the company completed the sale

of the majority of its shoe care businesses. Using foreign currency

exchange rates on the date of the transaction, the company received

cash proceeds of $276 million and reported an after tax gain on dis-

position of $117 million. Certain other shoe care businesses were to

be sold on a delayed basis. In 2012, the company closed on the sale of

its shoe care business in Malaysia, China and Indonesia and received

$56 million of proceeds, which included working capital adjustments.

Non-Indian Insecticides Business The company entered into

an agreement to sell all of its Non-Indian Insecticides business for

€154 million to SC Johnson and received a deposit of €152 million

in December 2010 on the sale of these businesses. Due to competition

concerns raised by the European Commission, the two parties aban-

doned the transaction as originally agreed but were able to complete

the sale of the insecticides businesses outside the European Union

(Malaysia, Singapore, Kenya and Russia) as well as a limited number

of businesses inside the European Union in 2012. The company also

divested the remaining insecticides businesses inside the European

Union to another buyer and transferred the net proceeds received

from the divestiture of those businesses to SC Johnson. The company

recognized a pretax gain of $255 million on the dispositions in 2012.