Sara Lee 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Hillshire Brands Company 13

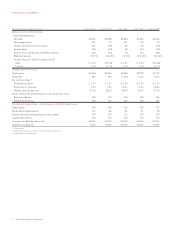

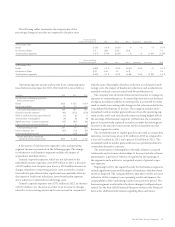

The following tables summarize the components of the

percentage change in net sales as compared to the prior year:

Volume (Excluding

Acquisition/Disposition) Mix Price Other Acquisition Disposition Total

2013 versus 2012

Retail (0.1)fi 0.6fi (0.2)fi –fi –% –fi 0.3fi

Foodservice/Other 4.5 (3.6) (0.4) (0.4) – – 0.1

Total business segments 1.4fi (0.7)fi (0.3)fi –fi –% (1.4)fi (1.0)fi

Volume (Excluding

Acquisition/Disposition) Mix Price Other Acquisition Disposition Total

2012 versus 2011

Retail (3.8)fi 0.5fi 4.6% (0.6)fi 3.8% –fi 4.5fi

Foodservice/Other (0.1) (0.5) 3.2 (0.2) – – 2.4

Total business segments (2.6)fi 0.1fi 4.2% (0.4)fi 2.8% (2.2)fi 1.9fi

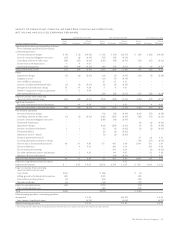

Operating segment income and income from continuing opera-

tions before income taxes for 2013, 2012 and 2011 are as follows:

In millions 2013 2012 2011

Income from continuing operations

before income taxes

Retail $329 $«313 $«314

Foodservice/Other 75 79 102

Total operating segment income 404 392 416

General corporate expenses (93) (272) (159)

Mark-to-market derivative gains/(losses) (1) (1) 2

Amortization of intangibles (4) (4) (4)

Significant items – business segments (15) (47) (31)

Impact of businesses exited/disposed 683

Total operating income 297 76 227

Interest expense, net (41) (72) (87)

Debt extinguishment costs – (39) (55)

Income (loss) from continuing

operations before income taxes $256 $÷(35) $÷«85

A discussion of each business segment’s sales and operating

segment income is presented on the following pages. The change

in volumes for each business segment excludes the impact of

acquisitions and dispositions.

General corporate expenses, which are not allocated to the

individual business segments, were $93 million in 2013, a decrease

of $179 million over the prior year due to a $151 million decrease in

charges related to restructuring actions, costs incurred in conjunc-

tion with the spin-off and other significant items partially offset by

the impact of headcount reductions, lower benefit plan expenses

and a reduction in information technology costs.

General corporate expenses were $272 million in 2012, an increase

of $113 million over the prior year due to an increase in charges

related to restructuring actions and costs incurred in conjunction

with the spin-off partially offset by a reduction in information tech-

nology costs, the impact of headcount reductions and a reduction in

stranded overhead costs associated with divested businesses.

The company uses derivative financial instruments to manage its

exposure to commodity prices. A commodity derivative not declared

a hedge in accordance with the accounting rules is accounted for under

mark-to-market accounting with changes in fair value recorded in the

Consolidated Statements of Income. The company excludes these

unrealized mark-to-market gains and losses from the operating seg-

ment results until such time that the exposure being hedged affects

the earnings of the business segment. At that time, the cumulative

gain or loss previously reported as mark-to-market derivative gains/

(losses) for the derivative instrument will be reclassified into the

business segment’s results.

The unrealized mark-to-market gain/loss incurred on commodity

derivative contracts was a loss of $1 million in 2013 as compared to

a loss of $1 million in 2012 and a gain of $2 million in 2011. The

unrealized mark-to-market gains and losses are primarily related to

commodity derivative contracts.

The amortization of intangibles in the table relates to acquired

trademarks and customer relationships. It does not include software

amortization, a portion of which is recognized in the earnings of

the segments and a portion is recognized as part of general corpo-

rate expenses.

Beginning in 2013, the reported results for the business segments

exclude significant items and the impact of businesses that have been

exited or disposed. The company believes that these results are more

indicative of the company’s core operating results and improve the

comparability of the underlying results from period to period. The

business segment results reflect the above changes for all periods pre-

sented. See the Non-GAAP Financial Measures section in the Financial

Review for additional information regarding these exclusions.