Sara Lee 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ANNUAL REPORT

Table of contents

-

Page 1

2013 ANNUAL REPORT -

Page 2

... new line extensions to keep our brands fresh. COMPANY PROFILE The Hillshire Brands Company is a leader in focused food solutions for the retail and foodservice markets. The company generated approximately $4 billion in annual sales in fiscal 2013. The company's more than 9,000 employees work... -

Page 3

THE HILLSHIRE BRANDS COMPANY HAD A GREAT FIRST YEAR. BUILT LEAN AND DRIVEN BY INNOVATION, WE HAVE THE RIGHT ATTITUDE, THE RIGHT PEOPLE AND THE RIGHT ASSETS IN PLACE TO ACHIEVE SUSTAINABLE, LONG-TERM RESULTS. GOING FORWARD, HILLSHIRE BRANDS IS POISED FOR SUCCESS - BUT WILL NEVER BE SATISFIED. WE ARE ... -

Page 4

..., they also identified new efficiency opportunities. DRIVING GROWTH BEHIND BRAND-BUILDING AND INNOVATION In the marketplace, our overall consumption trends improved meaningfully in fiscal 2013. Jimmy Dean, Ball Park, Gallo and Aidells were standout performers. Hillshire Farm and State Fair need... -

Page 5

... by fiscal 2015. In fiscal 2013, we stepped up our investment to 4.4 percent. This increase was highly focused against a small number of brands - most notably Jimmy Dean. I'm very pleased to report that we are seeing attractive returns, with each of these investments delivering very good growth... -

Page 6

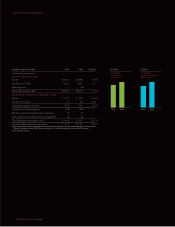

... 2013 Retail Foodservice/Other Operating segment income General corporate expenses Mark-to-market derivatives gains/(losses) Amortization of trademarks and intangibles Total adjusted operating income 1 Adjusted diluted earnings per share 1 12.5ï¬ 18.6ï¬ Adjusted amounts are non-GAAP financial... -

Page 7

... balance sheets Consolidated statements of equity Consolidated statements of cash flows Notes to financial statements Report of independent registered public accounting firm Management's report Performance graph Directors and senior corporate officers Investor information The Hillshire Brands... -

Page 8

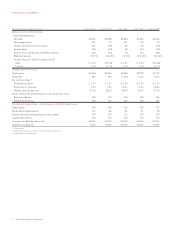

... 29, 2013 June 30, 2012 July 2, 2011 July 3, 2010 1 June 27, 2009 Continuing operations Net sales Operating income Income (loss) before income taxes Income (loss) Income (loss) attributable to Hillshire Brands Effective tax rate Income (loss) per share of common stock 2 Basic Diluted FINANCIAL... -

Page 9

.... These products are sold primarily to supermarkets, warehouse clubs and national chains. The company also sells a variety of meat and bakery products to foodservice customers. The company's portfolio of brands includes Jimmy Dean, Ball Park, Hillshire Farm, State Fair, Sara Lee frozen bakery and... -

Page 10

..., manage and evaluate our businesses, in planning for and forecasting financial results for future periods, and as one factor in determining achievement of incentive compensation. Two of the five performance measures under Hillshire Brands' annual incentive plan are net sales and earnings before... -

Page 11

... items, lower commodity costs net of pricing actions and higher volumes, partially offset by increased investments in MAP spending. Operating income decreased by $151 million, or 66.5% in 2012 from 2011. The year-over-year net impact of the change in significant items and the business dispositions... -

Page 12

... of general corporate expenses. In 2011, the company recognized a $15 million impairment charge, which related to the writedown of manufacturing equipment associated with the North American foodservice bakery reporting unit. Additional details regarding these impairment charges are discussed in Note... -

Page 13

... information. INCOME (LOSS) FROM CONTINUING OPERATIONS AND DILUTED EARNINGS PER SHARE (EPS) FROM CONTINUING OPERATIONS The results of the company's North American fresh bakery, refrigerated dough and foodservice beverage businesses and the international coffee and tea, household and body care... -

Page 14

... spin-off. OPERATING RESULTS BY BUSINESS SEGMENT The company's structure is currently organized around two business segments, which are described below: Retail sells a variety of packaged meat and frozen bakery products to retail customers in North America. Foodservice/Other sells a variety of meat... -

Page 15

...-to-market accounting with changes in fair value recorded in the Consolidated Statements of Income. The company excludes these unrealized mark-to-market gains and losses from the operating segment results until such time that the exposure being hedged affects the earnings of the business segment. At... -

Page 16

...large retail customer, softness in Hillshire Farm lunchmeat and declining volumes for Ball Park hot dogs, sweet goods, and Sara Lee deli meats. Pricing actions decreased sales by 0.2%. Operating segment income, which excludes the impact of restructuring charges and other significant items, increased... -

Page 17

...Increased investments in MAP were offset by lower SG&A costs. 2012 versus 2011 Net sales increased by $24 million, or 2.4%. The impact of price increases in response to higher commodity costs and an increase in sales of commodity products offset lower foodservice bakery volumes. The pricing actions... -

Page 18

... 2012 related primarily to the disposition of its North American fresh bakery, refrigerated dough and foodservice beverage businesses and its international bakery businesses. In 2011, the company received $2.3 billion related to the disposition of the majority of the international household and body... -

Page 19

... in the financial statements. This tax benefit increased net cash provided by financing activities. Dividends paid during 2013 were $46 million as compared to $271 million in 2012. The dividends paid in 2013 represent the first three quarterly dividends of Hillshire Brands. Cash from stock issuances... -

Page 20

..., the company closed on the sale of its North American food service beverage operations to J. M. Smucker for $350 million. In August 2011, the company also made the decision to divest its Spanish bakery business to Grupo Bimbo for â,¬115 million and closed on this sale in the second quarter of 2012... -

Page 21

... on these earnings. In 2012, the discontinued operations of the international coffee and tea business recognized $15.5 million of expense for repatriating a portion of 2012 and prior year foreign earnings to the U.S. In addition, the company has recognized $25 million of tax expense in 2012 related... -

Page 22

..., deferred income, sales and other incentives. The company has employee benefit obligations consisting of pensions and other postretirement benefits, including medical; pension and postretirement obligations, including any contingent amounts that may be due related to multi-employer pension plans... -

Page 23

...financial performance. The risks and challenges described below have impacted our performance and are likely to impact our future results as well. The food and consumer products businesses are highly competitive. In many product categories, we compete not only with widely advertised branded products... -

Page 24

... analysis technique to evaluate the effect that a 10% change in the underlying commodity price would have on the market value of the company's commodity derivative instruments. The impact is not significant compared with the earnings and equity of the company. In millions 2013 2012 RISK MANAGEMENT... -

Page 25

... Impact on income from continuing operations before income taxes Cost of sales Selling, general and administrative expenses Exit and business dispositions Impairment charges Impact on operating income Debt extinguishment costs Total Diluted earnings per share - continuing operations As reported Less... -

Page 26

... is carried on the balance sheet at the lower of cost or market. Obsolete, damaged and excess inventories are carried at net realizable value. Historical recovery rates, current market conditions, future marketing, sales plans and spoilage rates are key factors used by the company in assessing the... -

Page 27

...the reporting units. In making this assessment, management relies on a number of factors to determine anticipated future cash flows including operating results, business plans and present value techniques. Rates used to discount cash flows are dependent upon interest rates and the cost of capital at... -

Page 28

... of capital, tax rates, the company's stock price, and the allocation of shared or corporate items. Many of the factors used in assessing fair value are outside the control of management and it is reasonably likely that assumptions and estimates can change in future periods. These changes can result... -

Page 29

... factors result from finalization of tax audits and review and changes in estimates and assumptions regarding tax obligations and benefits. STOCK BASED COMPENSATION The company issues restricted stock units (RSUs) and stock options to employees in exchange for employee services. See Note 9 - Stock... -

Page 30

...rate of return on plan assets, the company assumes that the historical long-term compound growth rate of equity and fixed-income securities will predict the future returns of similar investments in the plan portfolio. Investment management and other fees paid out of plan assets are factored into the... -

Page 31

...and other business risks associated with customers operating in a highly competitive retail environment; • Hillshire Brands' spin-off of its international coffee and tea business in June 2012, including potential tax liabilities and other indemnification obligations; and • Other factors, such as... -

Page 32

... STATEMENTS OF INCOME In millions except per share data CONTINUING OPERATIONS Years ended June 29, 2013 June 30, 2012 July 2, 2011 Net sales Cost of sales Selling, general and administrative expenses Net charges for exit activities, asset and business dispositions Impairment charges Operating... -

Page 33

...STATEMENTS OF COMPREHENSIVE INCOME In millions Years ended June 29, 2013 June 30, 2012 July 2, 2011 Net income (loss) Translation adjustments, net of tax of $(6), $(17), $47 respectively Net unrealized gain (loss) on qualifying cash flow hedges, net of tax of $4, nil, $(5) respectively Pension... -

Page 34

... BALANCE SHEETS In millions ASSETS June 29, 2013 June 30, 2012 Cash and equivalents Trade accounts receivable, less allowances of $2 in 2013 and $11 in 2012 Inventories Finished goods Work in process Materials and supplies Current deferred income taxes Income tax receivable Other current assets... -

Page 35

...off of International Coffee and Tea business Stock issuances - restricted stock Stock option and benefit plans ESOP tax benefit, redemptions and other BALANCES AT JUNE 29, 2013 The accompanying Notes to Financial Statements are an integral part of these statements. The Hillshire Brands Company 33 -

Page 36

... of year Cash and equivalents at end of year Supplemental Cash Flow Data Cash paid for restructuring charges Cash contributions to pension plans Cash paid for income taxes The accompanying Notes to Financial Statements are an integral part of these statements. 34 The Hillshire Brands Company -

Page 37

... coffee and tea, North American foodservice beverage, European bakery, North American fresh bakery, North American refrigerated dough, and international household and body care businesses had previously been reported as discontinued operations in the company's 2012 annual report. The results... -

Page 38

... of the spin-off. If a business component is reported as a discontinued operation, the results of operations through the date of sale are presented on a separate line of the income statement. Interest on corporate level Advertising costs, which include the development and production of advertising... -

Page 39

... by which the carrying value exceeds the fair value of the asset. In making this assessment, management relies on a number of factors to discount estimated future cash flows including operating results, business plans and present value techniques. Rates used to The Hillshire Brands Company 37 -

Page 40

... the fair values of the reporting units. In making this assessment, management relies on a number of factors to discount anticipated future cash flows, including operating results, business plans and present value techniques. The fair value of reporting units is estimated based on a discounted... -

Page 41

... are rendered. STOCK-BASED COMPENSATION The company recognizes the cost of employee services received in exchange for awards of equity instruments over the vesting period based upon the grant date fair value of those awards. INCOME TAXES as a retiree health care plan, the benefit obligation is the... -

Page 42

...value of trademarks and brand names and customer relationships is primarily due to the impact of amortization during the year. The amortization expense reported in continuing operations for intangible assets subject to amortization was $17 million in 2013, $21 million in 2012 and $31 million in 2011... -

Page 43

... coffee and tea business as part of the spin-off. The company performed an updated impairment analysis for the remaining assets for sale in North American foodservice beverage and recognized a pretax impairment charge of $6 million in 2012 which has been recognized in the operating results... -

Page 44

... TO FINANCIAL STATEMENTS INTERNATIONAL OPERATIONS Australian Bakery In February 2013, the company completed the sale of its Australian Bakery business. Using foreign currency exchange rates on the date of the transaction, the company received cash proceeds of $85 million and reported an after tax... -

Page 45

...Bakery Total 2011 Global Body Care and European Detergents Air Care Products Australia/New Zealand Bleach Shoe Care Products Other Household and Body Care Businesses Total North American Fresh Bakery North American Refrigerated Dough North American Foodservice Beverage International Coffee and Tea... -

Page 46

...operational performance and reduce cost. Details on exited businesses is provided in Note 5 - Discontinued Operations, of these financial statements. In addition, in June 2012, the company completed the spin-off of its international coffee and tea operations into a new public company, which resulted... -

Page 47

...2, 2011 Business dispositions Amortization of net actuarial loss and prior service credit Net actuarial loss arising during the period Pension plan curtailments/ settlements Spin-off of International Coffee and Tea business Other comprehensive income (loss) activity Balance at June 30, 2012 Business... -

Page 48

...FINANCIAL STATEMENTS NOTE 9 - STOCK-BASED COMPENSATION In millions except per share data 2013 2012 2011 The company has various stock option and stock award plans. At June 29, 2013, 20.3 million shares were available for future grant in the form of options, stock unit awards, restricted shares... -

Page 49

... of June 29, 2013, the company had $12 million of total unrecognized compensation expense related to stock unit plans that will be recognized over the weighted average period of 1.8 years. In millions except per share data 2013 2012 2011 Stock Unit Awards Fair value of share-based units that vested... -

Page 50

... follows: Operating Leases In millions 2014 2015 2016 2017 2018 Thereafter Total minimum lease payments $÷19 15 11 10 9 77 $141 In millions 2013 2012 2011 Depreciation of capital lease assets Rental expense under operating leases $÷2 23 $÷1 22 $÷1 27 48 The Hillshire Brands Company -

Page 51

... validate. Any public information available relative to multi-employer pension plans may be dated as well. In the event a withdrawal or partial withdrawal was to occur with respect to the MEPP to which the company makes contributions, the impact to our consolidated financial statements could be... -

Page 52

... to leveraged derivatives. More information concerning accounting for financial instruments can be found in Note 2, Summary of Significant Accounting Policies in the company's 2013 Annual Report. Prior to the spin-off of its international coffee and tea business, the company used non-derivative... -

Page 53

...the company may be exposed to credit losses in the event of Long-term debt, including current portion $981 $951 $1,004 $945 Information on the location and amounts of derivative fair values in the Consolidated Balance Sheet at June 29, 2013 and June 30, 2012 is as follows: Assets Other Current... -

Page 54

... is reported in Retained Earnings as a result of the spin-off. NOTE 16 - DEFINED BENEFIT PENSION PLANS The company sponsors two U.S. and one Canadian pension plans to provide retirement benefits to certain employees. The benefits provided under these plans are based primarily on years of service... -

Page 55

... exchange End of year Fair value of plan assets Beginning of year Actual return on plan assets Employer contributions Benefits paid Foreign exchange End of year Funded status Amounts recognized on the consolidated balance sheets Noncurrent asset Accrued liabilities Pension obligation Net asset... -

Page 56

... See Note 15 - Financial Instruments for additional information as to the fair value hierarchy. The percentage allocation of pension plan assets based on a fair value basis as of the respective year-end measurement dates is as follows: 2013 2012 Asset category Equity securities Debt securities Real... -

Page 57

... were $1 million in 2013, $2 million in 2012 and $3 million in 2011. Assets contributed to such plans are not segregated or otherwise restricted to provide benefits only to the employees of the company. The future cost of these plans is dependent on a number of factors including the funded status... -

Page 58

...plan assets and obligations for the company's postretirement health-care and life-insurance plans pursuant to the accounting rules. The weighted average actuarial assumptions used in measuring the net periodic benefit cost and plan obligations for the three years ending June 29, 2013 were: 2013 2012... -

Page 59

... in 2013, $26 million in 2012 and $36 million in 2011. Hillshire Brands and eligible subsidiaries file a consolidated U.S. federal income tax return. The company uses the asset-and-liability method to provide income taxes on all transactions recorded in the consolidated financial statements. This... -

Page 60

... 19 - BUSINESS SEGMENT INFORMATION The following are the company's two business segments and the types of products and services from which each reportable segment derives its revenues. • Retail sells a variety of packaged meat and frozen bakery products to retail customers in North America. It... -

Page 61

... non-current assets. Net sales by product type within each business segment are as follows: In millions SALES 2013 2012 2011 Net sales for a business segment may include sales between segments. Such sales are at transfer prices that are equivalent to market value. Retail Meat Meat-centric Bakery... -

Page 62

... stock split on June 28, 2012. A portion of the original market price was allocated to Hillshire Brands (approximately 30%) and a portion to the international coffee and tea business (approximately 70%) based on the same percentages to be used to allocate the cost of a share of common stock for tax... -

Page 63

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE BOARD OF DIRECTORS AND STOCKHOLDERS OF THE HILLSHIRE BRANDS COMPANY In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, comprehensive income, equity and cash flows present ... -

Page 64

...over financial reporting. Based on the company's assessment, management has concluded that, as of June 29, 2013, the company's internal control over financial reporting was effective. The effectiveness of the company's internal control over financial reporting as of June 29, 2013 has been audited by... -

Page 65

... The JM Smucker Company, and Tyson Foods Inc. The returns for periods prior to Sara Lee's spin-off of D.E. MASTER BLENDERS 1753 N.V. in June 2012 were calculated as follows: Hillshire Brands' percentage of market equity value at the time of Sara Lee's spin-off of D.E. MASTER BLENDERS 1753 N.V. was... -

Page 66

..., 46 Senior Vice President, Chief Customer Officer As of September 1, 2013 â˜... Executive Committee Audit Committee â-† Corporate Governance, Nominating and Policy Committee â- Compensation and Employee Benefits Committee â-² Red symbol indicates committee chair 64 The Hillshire Brands Company -

Page 67

... ANNUAL MEETING OF STOCKHOLDERS The Hillshire Brands Company's 2013 annual report and proxy statement together contain substantially all the information presented in the corporation's annual report on Form 10-K filed with the Securities and Exchange Commission. Individuals interested in receiving... -

Page 68

The Hillshire Brands Company 400 S. Jefferson Street, Chicago, IL 60607 P: (312) 614-6000 W: www.hillshirebrands.com