Samsung 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

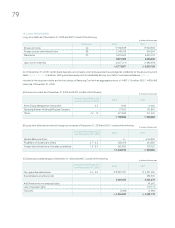

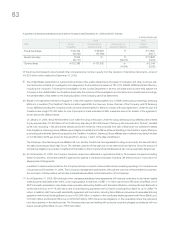

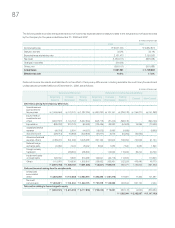

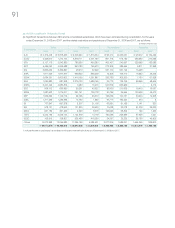

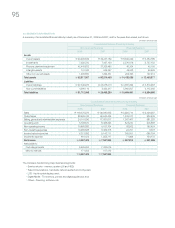

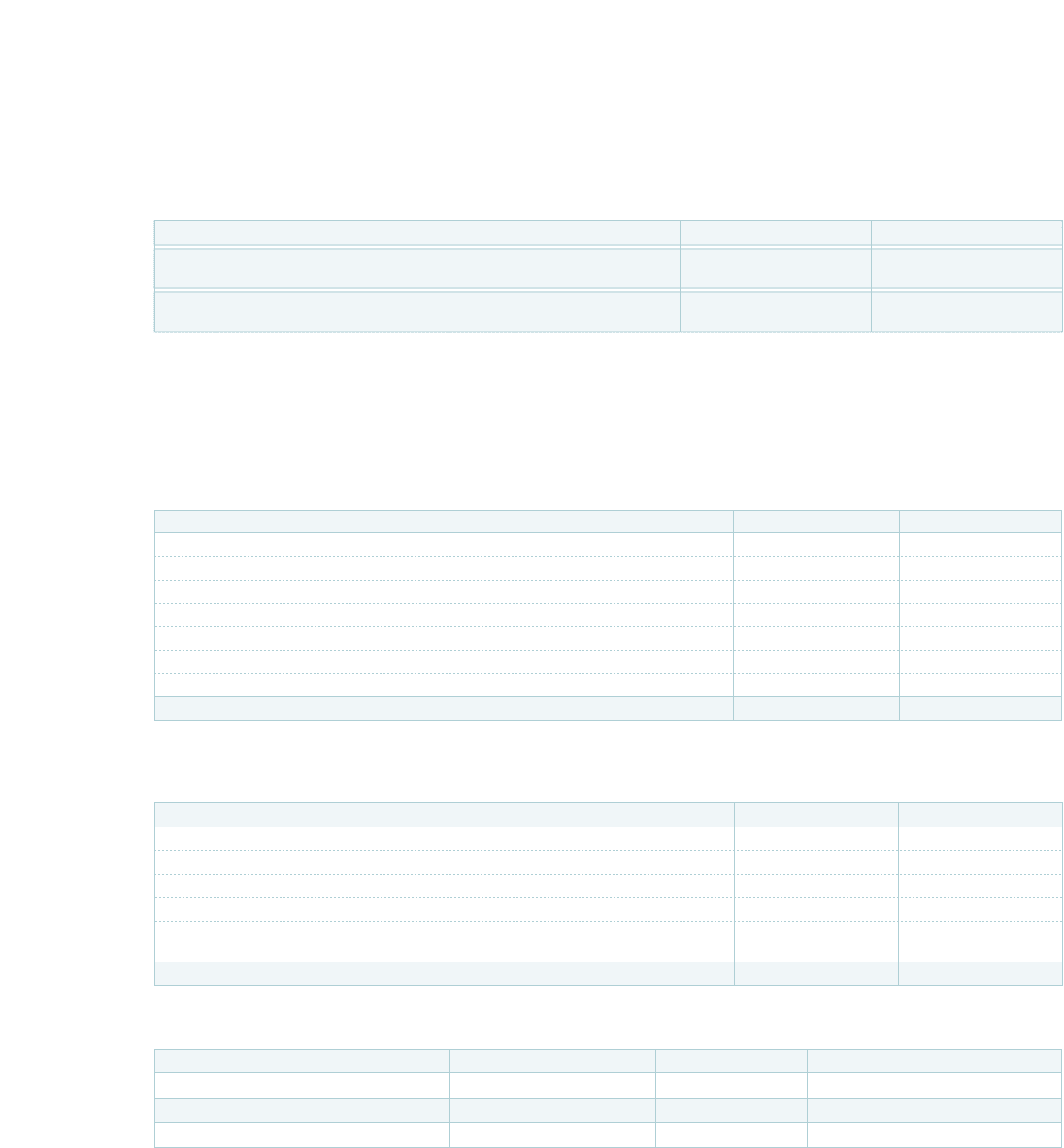

Deferred income tax assets and liabilities and income tax expense charged directly to equity as of and for the years ended December 31,

2008 and 2007, are as follows:

(In millions of Korean won)

Ⅰ. Deferred income tax assets and liabilities

Gain (Loss) on valuation of available-for-sale securities and others

₩

(682,172)

₩

(755,003)

Ⅱ. Income tax expense

Gain on sale of treasury stock and others

₩

(2,622)

₩

(27,671)

2008 2007

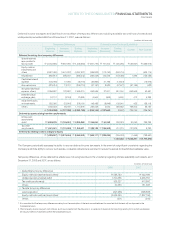

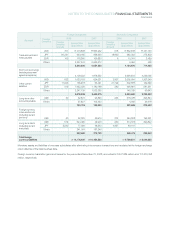

(In millions, except per share amounts)

(In millions, except per share amounts)

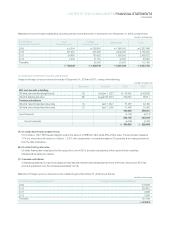

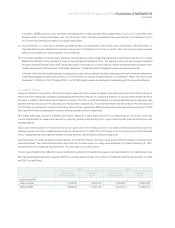

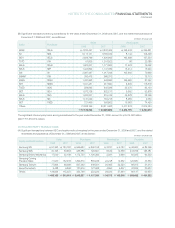

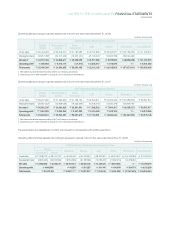

26. EARNINGS PER SHARE

Basic earnings per share were computed using the weighted average number of shares of common stock outstanding during the period.

Diluted earnings per share include the additional dilutive effect of the Company’s potentially dilutive securities including stock options.

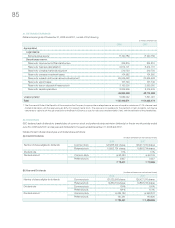

Basic earnings per share for the years ended December 31, 2008 and 2007, is calculated as follows:

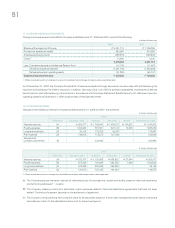

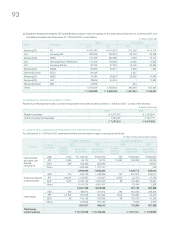

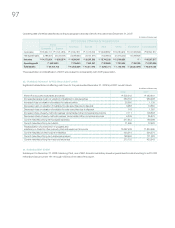

The number of dilutive shares of outstanding stock options is calculated by applying the treasury stock method.

Under the treasury stock method, the proceeds from the exercise of the stock options are assumed to be used to purchase common stock

at the average market price. The incremental number of shares which is the difference between the number of shares assumed to be issued

and the number of shares assumed to be purchased, is included in the denominator in calculating diluted earnings per share.

1. Common shares equivalent

Net income as reported on the statements of income

₩

5,525,904

₩

7,420,579

Adjustments:

Dividends for preferred stock (110,188) (159,823)

Undeclared participating preferred stock dividend (637,556) (825,162)

Excess payment for preferred shares over carrying value - (169,607)

Net income available for common stock 4,778,160 6,265,987

Weighted-average number of common shares outstanding 126,795,572 126,580,267

Basic earnings per share (in Korean won)

₩

37,684

₩

49,502

2008 2007

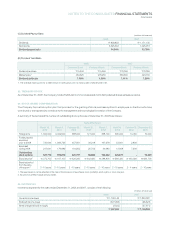

Stock options 1,168,130 366/366 1,168,130

Stock options 1,494,909 365/365 1,494,909

2008 Number of Shares Weight Common Stock Equivalent

2007 Number of Shares Weight Common Stock Equivalent

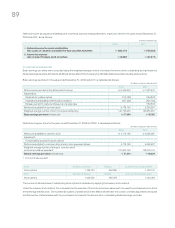

Diluted earnings per share for the years ended December 31, 2008 and 2007, is calculated as follows:

Net income available for common stock

₩

4,778,160

₩

6,265,987

Adjustment:

Compensation expense for stock options - -

Net income available for common stock and common equivalent shares 4,778,160 6,265,987

Weighted-average number of shares of common stock

and common shares equivalent 1 127,963,702 128,075,176

Diluted earnings per share (in Korean won)

₩

37,340

₩

48,924

2008 2007