Samsung 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

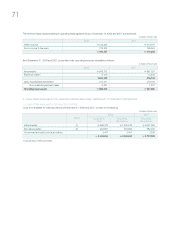

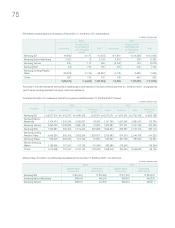

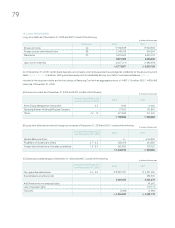

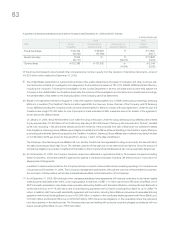

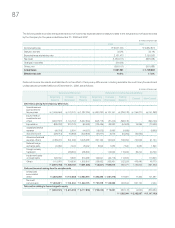

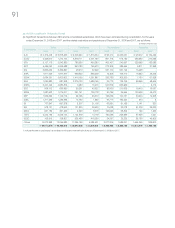

17. ACCRUED SEVERANCE BENEFITS

Change in accrued severance benefits for the years ended December 31, 2008 and 2007, consist of the following:

As of December 31, 2008, the Company funded 60% of severance payable through severance insurance deposits with Samsung Life

Insurance and Samsung Fire & Marin Insurance. In addition, Samsung Card, one of SEC’s domestic subsidiaries, implemented a defined

benefit pension plan with Samsung Life Insurance in accordance with Employee Retirement Benefit Security Act. Retirement pension

operating assets as of December 31, 2008 consist mostly of financial instruments.

(In millions of Korean won)

1. Others include amounts from changes in scope of consolidation and changes in foreign currency exchange rates.

Balance at the beginning of the year

₩

2,041,713

₩

1,769,385

Provision for severance benefits 543,980 615,586

Actual severance payments (286,875) (346,803)

Others 1 14,605 3,545

2,313,423 2,041,713

Less: Cumulative deposits to the National Pension Fund (10,190) (11,467)

Severance insurance deposits (1,391,194) (1,239,563)

Retirement pension operating assets (61,806) (50,747)

Balance at the end of the year

₩

850,233

₩

739,936

2008 2007

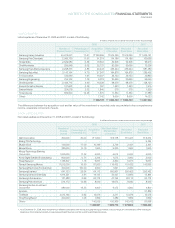

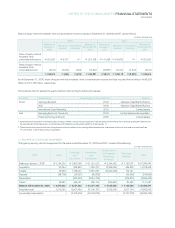

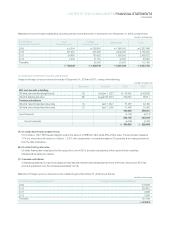

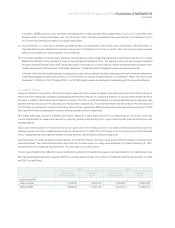

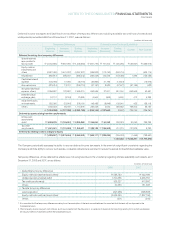

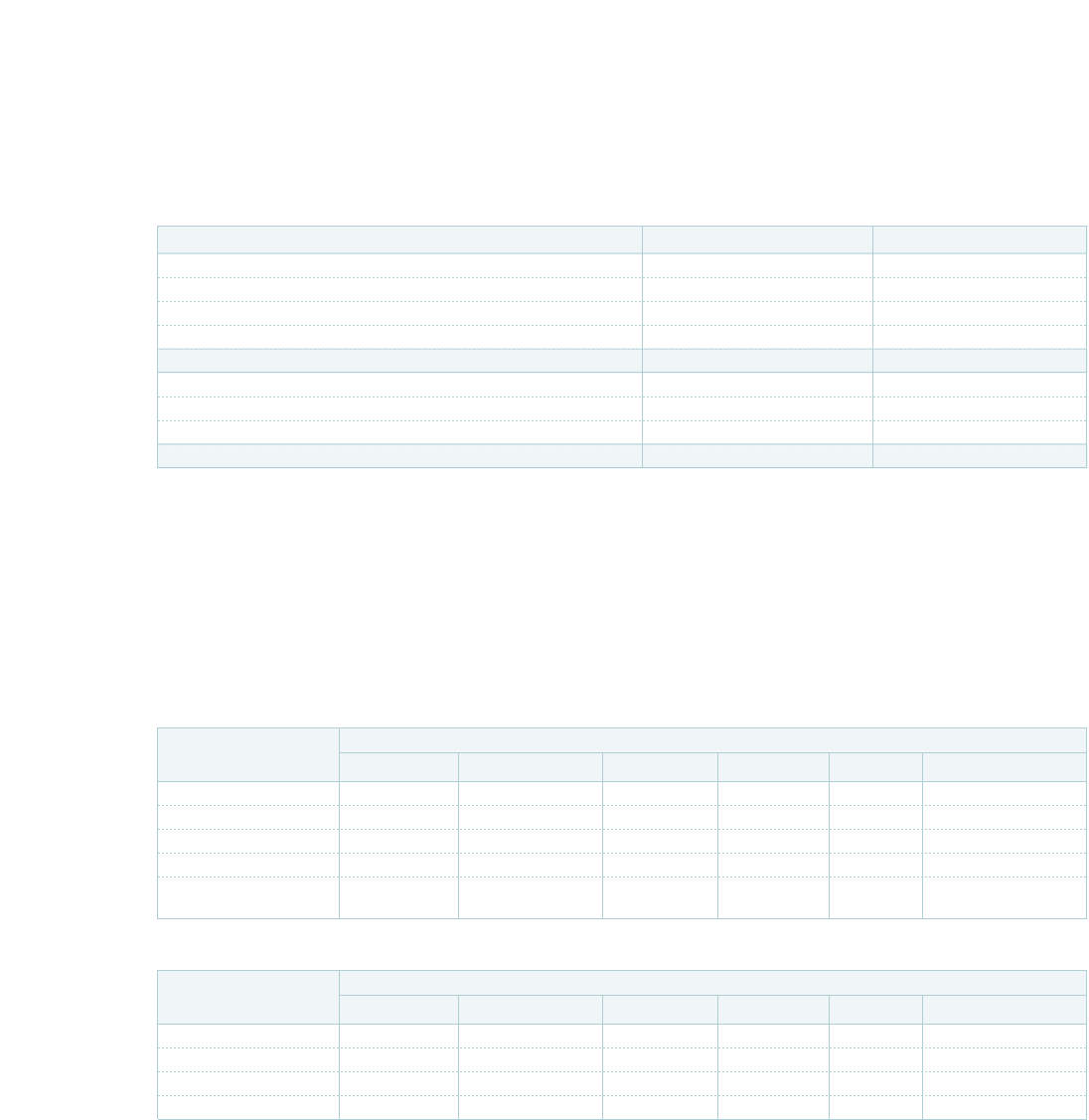

18. ACCRUED EXPENSE

Changes in main liability provisions for the years ended December 31, 2008 and 2007, are as follows:

(In millions of Korean won)

(In millions of Korean won)

2008

Warranty reserves (A)

₩

929,077

₩

1,756,994

₩

1,489,231

₩

146,852

₩

1,343,692

Royalty expenses (B) 1,342,932 661,551 691,147 12,903 1,326,239

Long-term incentives (C) 39,145 178,329 40,587 - 176,887

Point reserves (D) 146,875 173,573 157,349 - 163,099

Allowance for

undrawn commitment (E) - 232,880 - - 232,880

Reference January 1, 2008 Increase Decrease Others1 December 31, 2008

2007

Warranty reserves (A)

₩

703,797

₩

1,126,488

₩

938,852

₩

37,644

₩

929,077

Royalty expenses (B) 975,238 706,384 340,328 1,638 1,342,932

Long-term incentives (C) 274,358 220,635 455,848 - 39,145

Point reserves (D) 124,870 156,445 134,440 - 146,875

Reference January 1, 2007 Increase Decrease Others1 December 31, 2007

1. Others include amounts from changes in consolidated subsidiaries and foreign currency exchange rates.

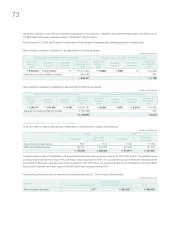

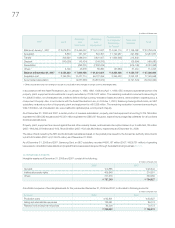

The Company accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience

and terms of guarantees (1 ~ 4 years).

The Company makes provisions for estimated royalty expenses related to technical assistance agreements that have not been

settled. The timing of payment depends on the settlement of agreement.

The Company introduced long-term incentive plans for its executives based on a three-year management performance criteria and

has made a provision for the estimated incentive cost for the accrued period.

(A)

(B)

(C)