Samsung 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

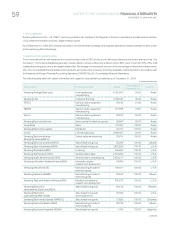

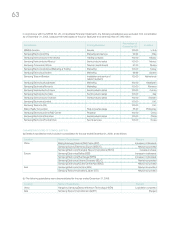

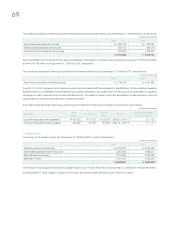

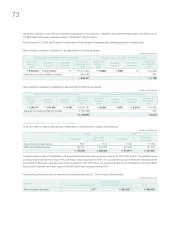

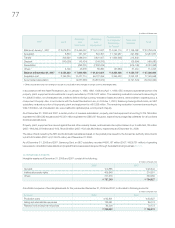

The outstanding balance of trade accounts and notes receivable sold to financial institutions as of December 31, 2008 and 2007, are as follows:

As a consolidation entry to account for the sale of subsidiaries’ receivables, the Company has recognized borrowings of ₩

3,055,270 million

and ₩

4,384,783 million as of December 31, 2008 and 2007, respectively.

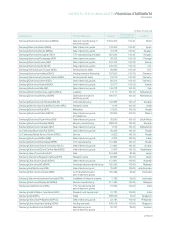

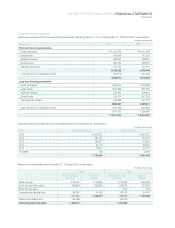

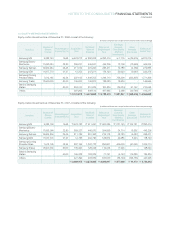

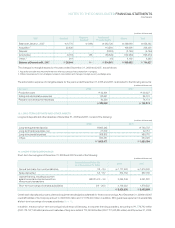

The outstanding balances of financing receivables sold to financial institutions as of December 31, 2008 and 2007, are as follows:

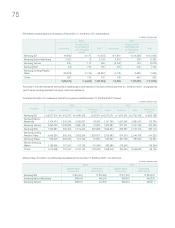

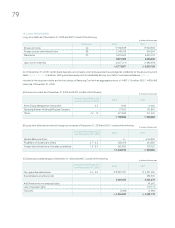

Accounts that are valued at present value under long-term installment transactions, including current portions, are as follows:

From 2003 to 2005, Samsung Card transferred credit card receivables and financial assets to SangRokSoo 1st Securitization Specialty,

Badbank Harmony and Badbank Heemang Moah Securitization Specialty in accordance with the “personal credit rehabilitation” program in

exchange for cash, preferred stock and subordinated bonds. The preferred stock is recorded as available-for-sale securities, while the

subordinated bonds are recorded as held-to-maturity securities.

(In millions of Korean won)

2008 2007

Asset-backed securities with limited recourse

₩

3,795,418

₩

4,037,885

(In millions of Korean won)

Accounts

Face Present Weighted-Average

Value Discount Value Period Interest Rate (%)

Long-term loans and other receivables

₩

169,022

₩

13,761

₩

155,261 2004.5 ~ 2014.11 3.1 ~ 8.7

Long-term payables and other payables 444,602 87,301 357,301 2002.12 ~ 2017.3 7.7 ~ 8.7

(In millions of Korean won)

2008 2007

Asset-backed securities with recourse

₩

1,380,735

₩

1,396,041

Trade accounts receivable with recourse 567,121 446,770

Trade accounts receivable without recourse 843,032 1,206,320

₩

2,790,888

₩

3,049,131

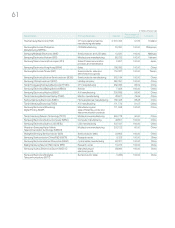

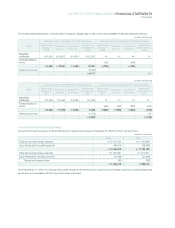

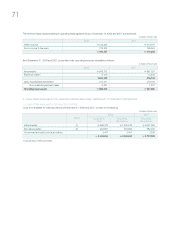

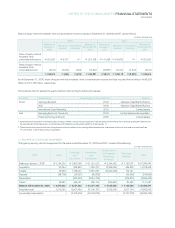

7. INVENTORIES

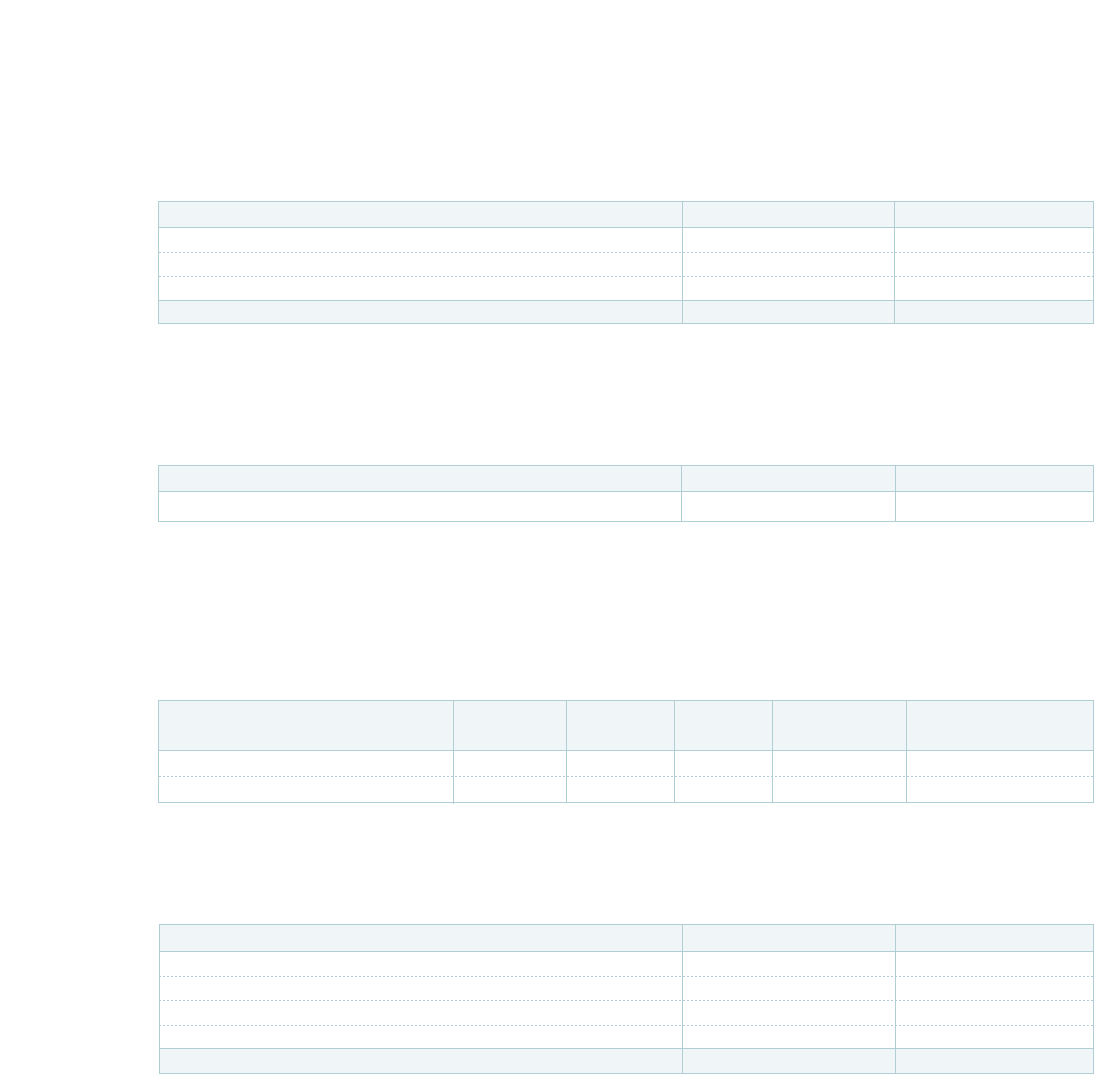

Inventories, net of valuation losses, as of December 31, 2008 and 2007, consist of the following:

Inventories are insured against fire and other casualty losses for up to ₩7,853,380 million as of December 31, 2008 (2007: ₩6,258,083 million).

As of December 31, 2008, losses on valuation of inventories, amounted to ₩651,296 million (2007: ₩258,787 million).

(In millions of Korean won)

2008 2007

Finished goods and merchandise

₩

3,049,834

₩

2,340,066

Semi-finished goods and work-in-process 2,067,935 1,695,511

Raw materials and supplies 3,113,563 2,309,980

Materials-in-transit 1,261,275 1,623,246

₩

9,492,607

₩

7,968,803