Samsung 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

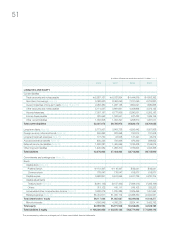

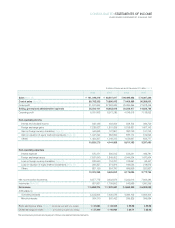

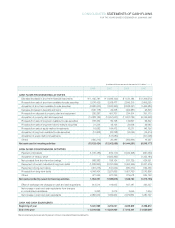

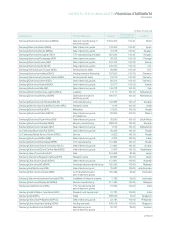

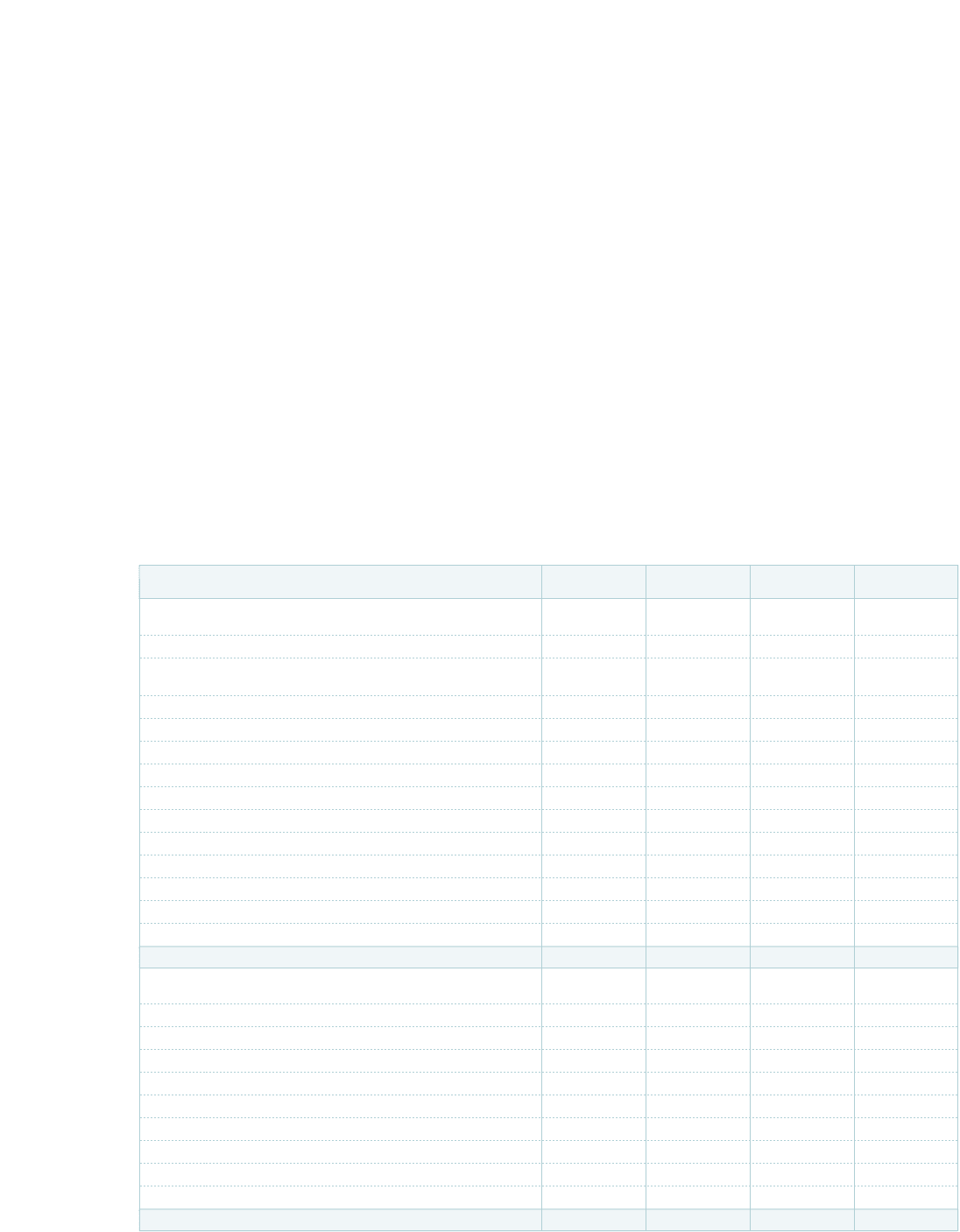

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007

2008 2007 2008 2007

CASH FLOWS FROM OPERATING ACTIVITIES

Net income

₩

5,890,214

₩

7,922,981 $ 4,685,930 $ 6,303,088

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation and amortization 10,095,191 8,497,528 8,031,178 6,760,165

Provision for severance benefits 543,980 615,586 432,761 489,726

Bad debt expenses 532,429 172,827 423,571 137,492

Loss on disposal of property, plant and equipment 62,292 71,964 49,556 57,251

Gain on disposal of property, plant and equipment (110,962) (107,542) (88,275) (85,554)

Loss on foreign currency translation 1,070,358 122,597 851,518 97,531

Gain on foreign currency translation (447,885) (128,580) (356,313) (102,291)

Loss on valuation of equity-method investments 209,357 274,874 166,553 218,675

Gain on valuation of equity-method investments (748,398) (372,239) (595,384) (296,133)

Deferred income taxes (500,435) (99,601) (398,119) (79,237)

Others 1,289,732 798,031 1,026,040 634,870

17,885,873 17,768,426 14,229,016 14,135,583

Changes in operating assets and liabilities

Increase in trade accounts and notes receivable (86,180) (1,355,615) (68,560) (1,078,453)

Increase in inventories (693,712) (1,301,580) (551,879) (1,035,465)

Decrease (Increase) in trade accounts and notes payable (1,514,400) 464,720 (1,204,773) 369,706

Increase (Decrease) in accrued expenses (207,881) 1,146,178 (165,379) 911,836

Increase (Decrease) in income taxes payable (751,619) 43,576 (597,947) 34,667

Payment of severance benefits (301,887) (338,137) (240,165) (269,003)

Increase in financing receivables (1,313,573) (1,288,638) (1,045,006) (1,025,169)

Increase in long-term accrued expenses 408,324 198,601 324,840 157,995

Others (64,870) (546,719) (51,607) (434,941)

Net cash provided by operating activities

₩

13,360,075

₩

14,790,812 $ 10,628,540 $ 11,766,756

(In millions of Korean won and in thousands of U.S. dollars (Note 3))

continued