Samsung 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

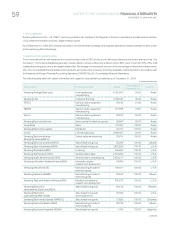

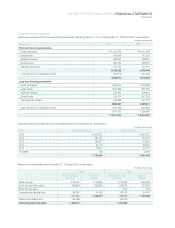

employment with the Company based on their length of service and

rate of pay at the time of termination. Accrued severance benefits

represent the amount which would be payable assuming all eligible

employees and directors were to terminate their employment as of

the balance sheet date.

A portion of the accrued severance benefits of the Company are

funded through a group severance insurance plan with Samsung

Life Insurance Co., Ltd., and the amounts funded under this insur-

ance plan are classified as a deduction from the accrued severance

benefits liability.

In accordance with the National Pension Act, a certain portion of the

accrued severance benefits is deposited with the National Pension

Fund and deducted from the accrued severance benefits liability.

REVENUE RECOGNITION

Sales of products and merchandise are recognized upon delivery

when the significant risks and rewards of ownership of goods are

transferred to the buyer. Revenue from rendering services is recog-

nized using the percentage-of-completion method.

FOREIGN CURRENCY TRANSLATION

Assets and liabilities denominated in foreign currencies are trans-

lated into Korean won at the rate of exchange in effect as of the bal-

ance sheet date. Gains and losses resulting from the translation are

reflected as either income or expense for the period.

Foreign currency convertible debentures are translated at the

exchange rate that will be used at the time of conversion as pre-

scribed in the terms of such debentures.

TRANSLATION OF FOREIGN OPERATIONS

Accounts of foreign subsidiaries are maintained in the currencies of

the countries in which they operate. In translating the foreign currency

financial statements of these subsidiaries into Korean won, income

and expenses are translated at the average rate for the year and

assets and liabilities are translated at the rate prevailing on the bal-

ance sheet date. Resulting translation gains or losses are recorded as

other comprehensive income presented as part of equity.

DEFERRED INCOME TAX ASSETS AND LIABILITIES

Deferred income tax assets and liabilities are recognized based on

estimated future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets

and liabilities and their respective tax bases, and operating loss and

tax credit carryforwards.

Deferred income tax assets and liabilities are computed on such

temporary differences by applying statutory tax rates applicable to

the years when such differences are expected to be reversed. Tax

assets related to tax credits and exemptions are recognized to the

extent of the Company’s certain taxable income.

The balance sheet distinguishes the current and non-current por-

tions of the deferred tax assets and liabilities, whose balances are

offset against each other by tax jurisdiction.

LONG-TERM RECEIVABLES AND PAYABLES

Long-term receivables and payables that have no stated interest rate

or whose interest rate are different from the market rate are recorded

at their present values using the market rate of discount. The differ-

ence between the nominal value and present value of the long-term

receivables and payables are amortized using the effective interest

rate method with interest income or expense adjusted accordingly.

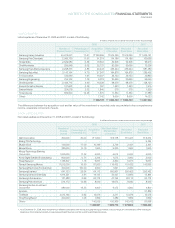

STOCK-BASED COMPENSATION

The Company uses the fair-value method in determining compen-

sation costs of stock options granted to its employees and direc-

tors. The compensation cost is estimated using the Black-Scholes

option-pricing model and is accrued and charged to expense over

the vesting period, with a corresponding increase in a separate

component of equity.

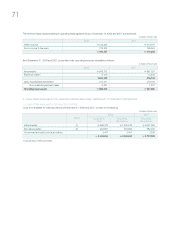

EARNINGS PER SHARE

Basic earnings per share is calculated by dividing net income avail-

able to common shareholders by the weighted-average number of

common shares outstanding during the year. Diluted earnings per

share is calculated using the weighted-average number of common

shares outstanding adjusted to include the potentially dilutive effect

of common equivalent shares outstanding.

PROVISIONS AND CONTINGENT LIABILITIES

When there is a probability that an outflow of economic benefits will

occur due to a present obligation resulting from a past event, and

whose amount is reasonably estimable, a corresponding amount of

provision is recognized in the financial statements. However, when

such outflow is dependent upon a future event, is not certain to

occur, or cannot be reliably estimated, a disclosure regarding the

contingent liability is made in the notes to the financial statements.

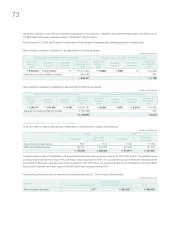

DERIVATIVE INSTRUMENTS

All derivative instruments are accounted for at fair value with the

resulting valuation gain or loss recorded as an asset or liability. If the

derivative instrument is not designated as a hedging instrument, the

gain or loss is recognized in earnings in the period of change.

Fair value hedge accounting is applied to a derivative instrument

with the purpose of hedging the exposure to changes in the fair

value of an asset or a liability or a firm commitment (hedged item)

that is attributable to a particular risk. The gain or loss, both on the

hedging derivative instrument and on the hedged item attributable

to the hedged risk, is reflected in current operations.

Cash flow hedge accounting is applied to a derivative instrument

with the purpose of hedging the exposure to variability in expected

future cash flows of an asset or a liability or a forecasted transaction

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

CONTINUED