Samsung 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies followed by the Company in the

preparation of its consolidated financial statements are summarized

below:

BASIS OF FINANCIAL STATEMENT PRESENTATION

The Company maintains its accounting records in Korean won and

prepares statutory financial statements in the Korean language in

conformity with accounting principles generally accepted in the

Republic of Korea. Certain accounting principles applied by the

Company that conform with financial accounting standards and

accounting principles in the Republic of Korea may not conform with

generally accepted accounting principles in other countries.

Accordingly, these financial statements are intended for use by those

who are informed about Korean accounting principles and practices.

The accompanying consolidated financial statements have been con-

densed, restructured and translated into English from the Korean lan-

guage consolidated financial statements. Certain information

attached to the Korean language consolidated financial statements,

but not required for a fair presentation of the Company’s financial posi-

tion, results of operations or cash flows or changes in equity, is not

presented in the accompanying consolidated financial statements.

APPLICATION OF THE STATEMENTS OF KOREAN

FINANCIAL ACCOUNTING STANDARDS

The Company’s consolidated financial statements were prepared in

conformity with accounting principles generally accepted in Korea,

including SKFAS No. 1 through No. 25.

NEW ACCOUNTING STANDARDS

AND ACCOUNTING CHANGES

The Company has changed the scope of its related parties in accor-

dance with revision of SKFAS No. 20, Related Party Disclosures.

Note 29 to consolidated financial statements as of and for the year

ended December 31, 2007 presented herein for comparative pur-

pose, has been restated to reflect this change.

USE OF ESTIMATES

The preparation of the financial statements requires management to

make estimates and assumptions that affect amounts reported

therein. Although these estimates are based on management’s best

knowledge of current events and actions that the Company may

undertake in the future, actual results may differ from those estimates.

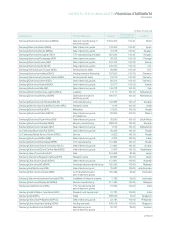

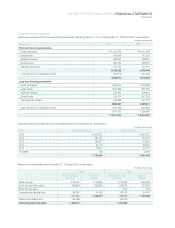

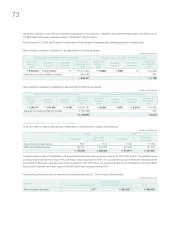

PRINCIPLES OF CONSOLIDATION

The Company records differences between the investment account

and corresponding capital account of subsidiaries as goodwill or

negative goodwill, and such differences are amortized over five

years using the straight-line method. However, differences which

occur from additional investments acquired in consolidated subsid-

iaries are reported in a separate component of equity, and are not

included in the determination of the results of operations. In accor-

dance with the SKFAS No. 25, Consolidated Financial Statements,

minority interests in consolidated subsidiaries are presented within

equity and identified separately from shareholders’ equity in the

consolidated balance sheet.

All significant intercompany transactions and balances have been

eliminated during consolidation. Unrealized profits included in inven-

tories, property, plant and equipment and other assets, as a result of

intercompany transactions, are eliminated. Unrealized profits, aris-

ing from sales by the consolidated subsidiaries, or equity-method

investees, to the controlling companies, or sales between consoli-

dated subsidiaries, or equity-method investees, are fully eliminated,

and charged to shareholders’ equity and minority interests, based

on the percentage of ownership.

The SEC and its consolidated subsidiaries follow the same fiscal

year end. Differences in accounting policies between the SEC and

its consolidated subsidiaries are adjusted during consolidation.

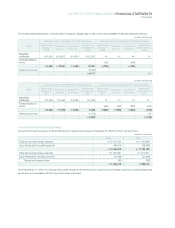

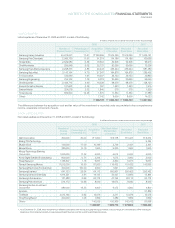

INVESTMENT IN SECURITIES

Investments in equity securities or debt securities are classified into

trading securities, available-for-sale securities and held-to-maturity

securities, depending on the acquisition and holding purpose. Trading

securities are classified as current assets while available-for-sale

securities and held-to-maturity securities are classified as long-term

investments, except those securities that mature or are certain to be

disposed of within one year, which are classified as current assets.

Cost is measured at the market value upon acquisition, including

incidental costs, and is determined using the average cost method.

Available-for-sale securities are stated at fair value, while non-mar-

ketable equity securities are stated at cost. Unrealized holding gains

and losses on available-for-sale securities are reported in equity

under accumulated other comprehensive income, which are to be

included in current operations upon the disposal or impairment of

the securities. In the case of available-for-sale debt securities, the

difference between the acquisition cost after amortization using the

effective interest rate method and the fair value is reported in equity

as a component of accumulated other comprehensive income.

Impairment resulting from a significant or prolonged decline in fair

value of the security below its acquisition cost, net of amortization is

recognized in current operations.

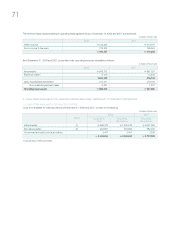

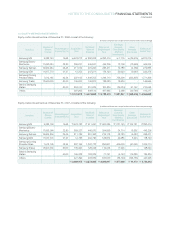

EQULTY-METHOD INVESTMENTS

Investments in business entities in which the Company has the abil-

ity to exercise significant influence over the operating and financial

policies are accounted for using the equity method of accounting.

Under the equity method, the original investment is recorded at cost

and adjusted by the Company’s share in the net book value of the

investee with a corresponding charge to current operations, a sepa-

rate component of equity, or retained earnings, depending on the

nature of the underlying change in the net book value. All significant

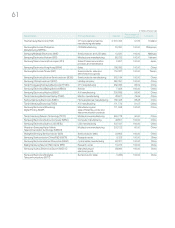

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

CONTINUED