Samsung 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

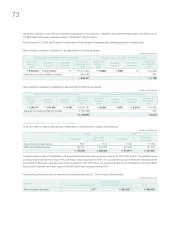

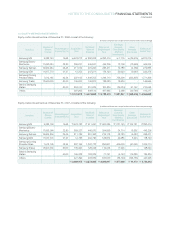

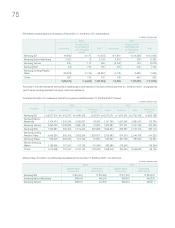

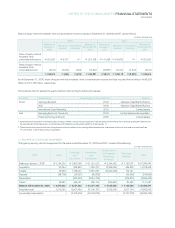

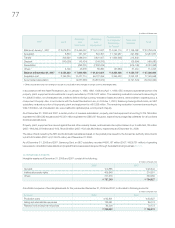

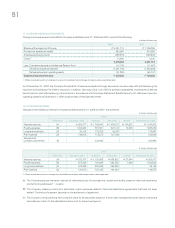

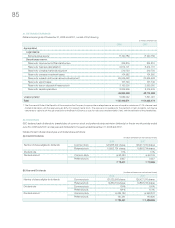

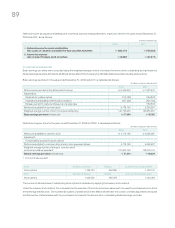

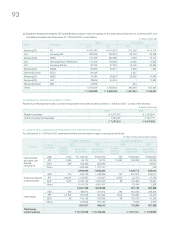

A summary of derivative transactions as of and for the year ended December 31, 2008 and 2007, follows:

(In millions of Korean won)

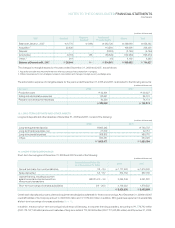

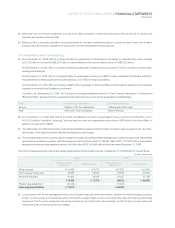

Of the amounts charged to accumulated other comprehensive income in equity from the valuation of derivative instruments, a loss of

₩3,603 million will be realized by December 31, 2009.

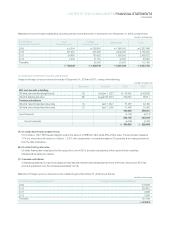

The United States Department of Justice Antitrust Division (the Justice Department), European Commission and other countries’ anti-

trust authorities initiated an investigation into alleged anti-trust violations by sellers of TFT-LCD, DRAM, SRAM and Flash Memory,

including the Company. Following the investigation by the Justice Department, several civil class actions were filed against the

Company in the United States. As of balance sheet date, the outcome of the investigation and civil actions is uncertain and accordingly,

the ultimate effect of this matter on the financial position of the Company cannot be determined.

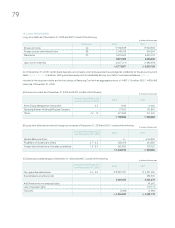

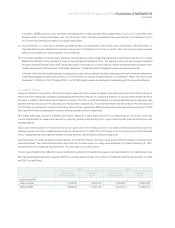

Based on the agreement entered on August 24, 1999, with respect to Samsung Motor Inc.’s (“SMI”) bankruptcy proceedings, Samsung

Motor Inc.’s creditors (“the Creditors”) filed a civil action against Mr. Kun Hee Lee, former chairman of the Company, and 28 Samsung

Group affiliates including the Company under joint and several liability for failing to comply with such agreement. Under the suit, the

Creditors have sought ₩2,450 billion for loss of principal on loans extended to SMI, a separate amount for breach of the agreement,

and an amount for default interest.

On January 31, 2008, Seoul Administrative Court made the ruling on this case. Under the ruling, Samsung Group affiliates were ordered

to pay approximately ₩1,634 billion to the Creditors by disposing 2,334,045 shares of Samsung Life Insurance (the “Shares”) donated

by Mr. Lee, excluding 1,165,955 shares already sold by the Creditors. If the proceeds from sale of Shares are not sufficient to satisfy

their obligations, Samsung Group affiliates were obligated to satisfy the shortfall by either participating in the Creditors’ equity offering or

purchasing subordinated debentures issued by the Creditors. In addition, Samsung Group affiliates were ordered to pay default interest

on ₩1,634 billion at 6% per annum for the period from January 1, 2001, to the date of settlement.

The Company, other Samsung Group affiliates, Mr. Lee, and the Creditors all have appealed the ruling, and currently, the second trial for

this case is pending at Seoul High Court. The ultimate outcome of this case can not be determined at this time. Since the amount of

Company’s obligation is uncertain, the effects of this matter on the Company’s financial statements can not be reasonably determined.

As of December 31, 2008, the Company has been named as a defendant in legal actions filed by 25 overseas companies including

Sharp Corporation, and as the plaintiff in legal actions against 4 overseas companies including ON Semiconductor Corporation for

alleged patent infringements.

In addition to cases mentioned above, the Company has been involved in various claims and proceedings pending in the normal course

of business as of December 31, 2008. The Company’s management believes that, although the outcome of these matters is uncertain,

the conclusion of these matters will not have a material adverse effect on financial position of the Company.

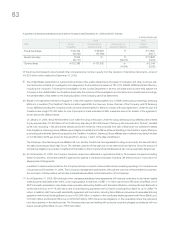

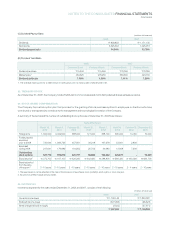

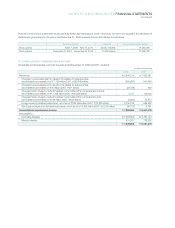

As of December 31, 2008, SEA and eight other overseas subsidiaries have agreements with financial institutions to sell certain eligible

trade accounts receivable under which, on an ongoing basis, a maximum of US$1,711 million can be sold. SEC and Living Plaza, one of

SEC’s domestic subsidiaries, have trade notes receivable discounting facilities with financial institutions, including Shinhan Bank with a

combined limit of up to ₩718,000 million and a trade financing agreement with 23 banks including Woori Bank for up to US$9,774

million. In addition, SEC has a credit sales facility agreement with two banks, including Woori Bank and an accounts receivable factoring

agreement with Korea Exchange Bank for up to ₩150,000 million. In relation to the credit sales facility agreement with Woori Bank (up to

₩70,000 million) and Kookmin Bank (up to ₩200,000 million), SEC has recourse obligations on the receivables where the extensions

have been granted on the credit periods. The Company also has loan facilities with accounts receivable pledged as collaterals with four

banks, including Woori Bank, for up to ₩875,000 million.

(F)

(H)

(G)

( I )

2008 2007

Asset Gain (Loss) on Gain (Loss) on Asset

(Liability) Valuation (I/S) Valuation (Equity) (Liability)

Forward exchange

₩

59,105

₩

58,383

₩ -

₩

14,825

(62,942) (61,888) - (9,417)

Interest rate swap

₩

502

₩ -

₩

-

₩

13,898

(39,717) - (39,216) (3,044)

Currency swap

₩

122,385

₩

131,832

₩

-

₩ 2,149

- - (14,645) (5,032)

Type