Samsung 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

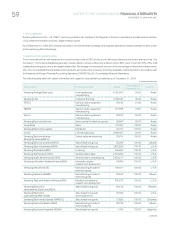

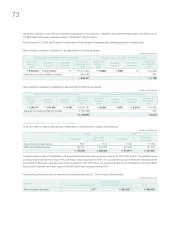

that is attributable to a particular risk. The effective portion of the

gain or loss on a derivative instrument designated as a cash flow

hedge is recorded as a accumulated other comprehensive income

and the ineffective portion is recorded in current operations. The

effective portion of the gain or loss recorded as accumulated other

comprehensive income is reclassified to current operations in the

same period during which the hedged forecasted transaction

affects earnings. If the hedged transaction results in the acquisition

of an asset or the incurrence of a liability, the gain or loss recognized

as accumulated other comprehensive income is added to or

deducted from the asset or the liability.

ASSET IMPAIRMENT

When the book value of an asset is significantly greater than its

recoverable value due to obsolescence, physical damage, or the

decline in the fair value of the asset, the decline in value is deducted

from the book value and recognized as an asset impairment loss in

the current period.

3. UNITED STATES DOLLAR AMOUNTS

The Company operates primarily in Korean won and its official

accounting records are maintained in Korean won. The U.S. dollar

amounts, provided herein, represent supplementary information solely

for the convenience of the reader. All won amounts are expressed in

U.S. dollars at the rate of ₩1,257 to US$1, the exchange rate in effect

on December 31, 2008. Such presentation is not in accordance with

generally accepted accounting principles in either the Republic of

Korea or the United States, and should not be construed as a repre-

sentation that the won amounts shown could be readily converted,

realized or settled in U.S. dollars at this or at any other rate.

The 2007 U.S. dollar amounts, which were previously expressed at

₩938 to US$1, the rate in effect on December 31, 2007, have been

restated to reflect the exchange rate in effect on December 31, 2008.

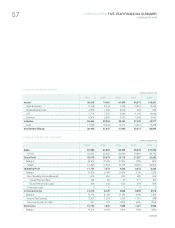

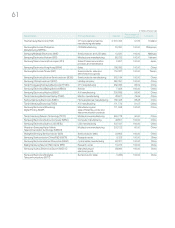

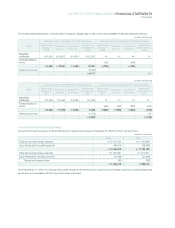

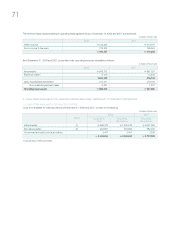

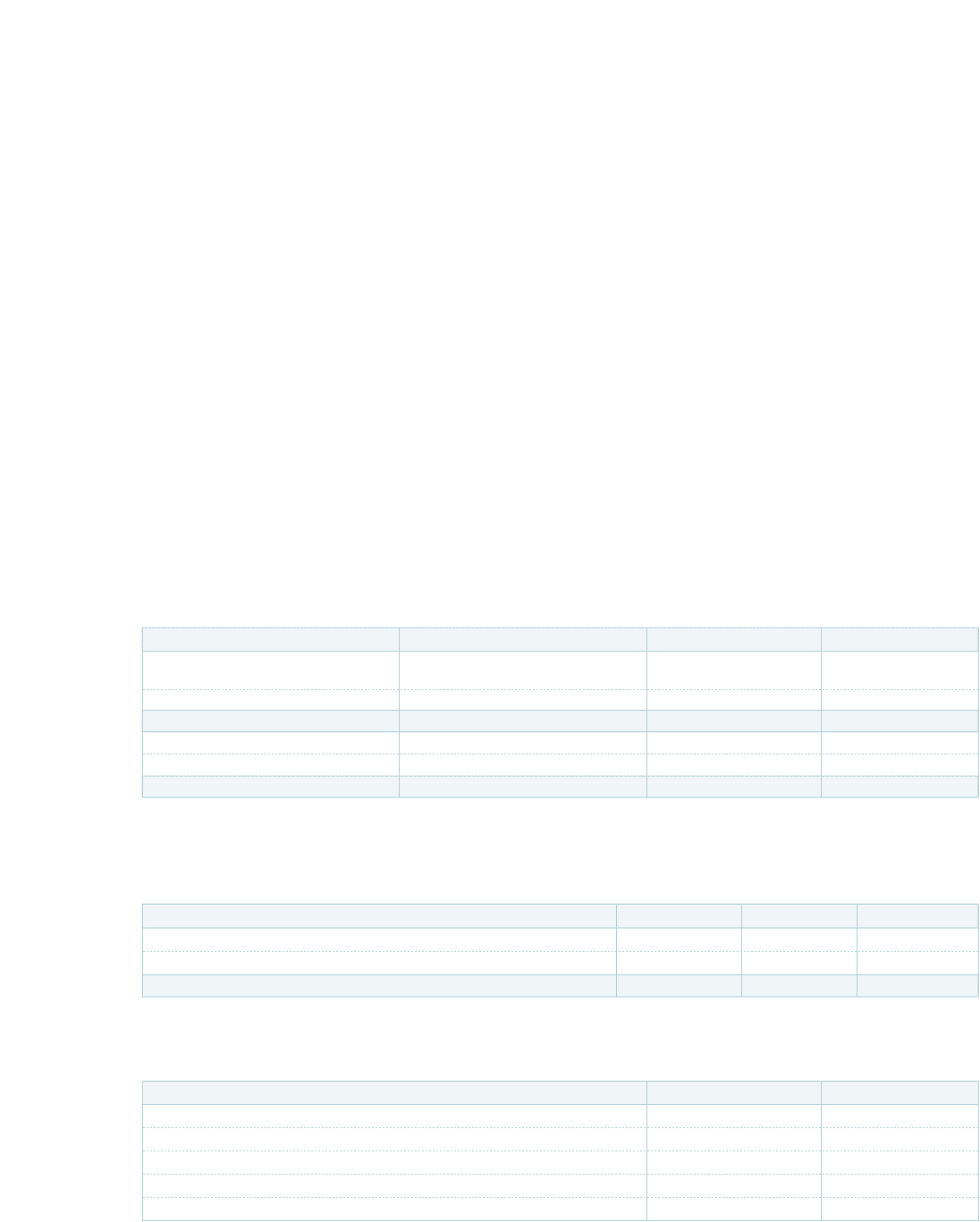

4. CASH SUBJECT TO WITHDRAWAL RESTRICTIONS

Cash deposits subject to withdrawal restrictions as of December 31, 2008 and 2007, consist of the following:

(In millions of Korean won)

2008 2007

Short-term financial instruments Government-sponsored

research and development projects

₩

24,505

₩

35,632

Other activities 36,228 34,548

₩

60,733

₩

70,180

Long-term deposits and other assets Special deposits

₩

60

₩

19

Other activities 9 374

₩

69

₩

393

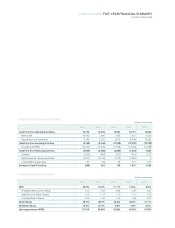

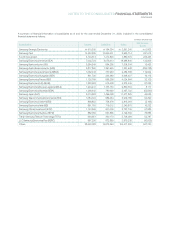

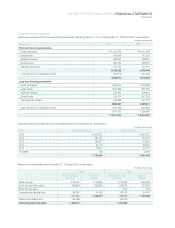

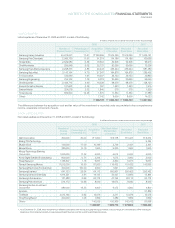

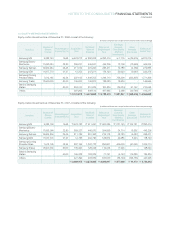

5. SHORT-TERM AVAILABLE-FOR-SALE SECURITIES

Short-term available-for-sale securities as of December 31, 2008 and 2007, consist of the following:

(In millions of Korean won)

1. Beneficiary certificates as of December 31, 2008 and 2007, consist of the following.

2. The Balance as of December 31, 2007, includes accrued interest income amounting to

₩

2,677 million.

(In millions of Korean won)

2008 2007 Maturity

Beneficiary certificates ¹

₩

982,067

₩

775,493 Within 1 year

Financial institution bonds ² - 147,340 Within 1 year

₩

982,067

₩

922,833

2008 2007

Call loan

₩

157

₩

9,151

Certificates of deposit 231,561 270,546

Bonds 622,911 392,414

Time deposits 127,307 101,500

Others 131 1,882