Samsung 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

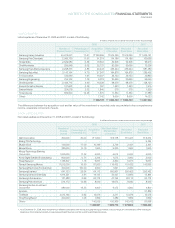

unrealized profits arising from intercompany transactions between

the Company and its equity-method investees are eliminated.

Differences between the investment amounts and corresponding

capital amounts of the investees at the date of acquisition of the

investment are recorded as part of investments and are amortized

over five years using the straight-line method.

Assets and liabilities of the Company’s foreign investees are trans-

lated at current exchange rates, while income and expense are

translated at average rates for the period. Adjustments resulting

from the translation process are reported as accumulated other

comprehensive income in a separate component of equity, and are

not included in the determination of the results of operations.

Certain equity-method investments are accounted for based on

unaudited or unreviewed financial statements as the audited or

reviewed financial statements of these entities are not available as

of the date of this audit report.

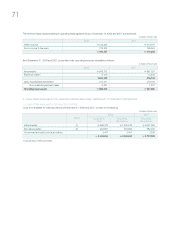

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The Company provides an allowance for doubtful accounts and

notes receivable based on the aggregate estimated collectibility of

the receivables.

INVENTORY

Inventories are stated at the lower of cost or net realizable value.

Cost is determined using the average cost method, except for

materials-in-transit which are stated at actual cost as determined

using the specific identification method. Losses on valuation of

inventories and losses on inventory obsolescence are recorded as

part of cost of sales.

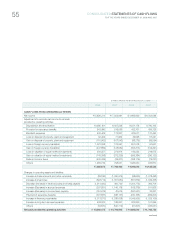

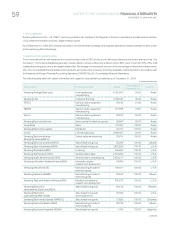

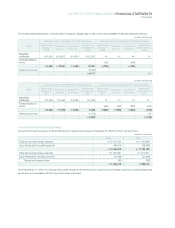

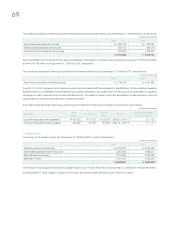

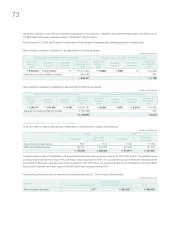

PROPERTY, PLANT AND EQUIPMENT,

NET OF ACCUMULATED DEPRECIATION

Property, plant and equipment are stated at cost, except for certain

assets subject to upward revaluation in accordance with the Asset

Revaluation Law of Korea. The revaluation presents production

facilities and other buildings at their depreciated replacement cost,

and land at the prevailing market price, as of the effective date of

revaluation. The revaluation increment, net of revaluation tax, is first

applied to offset accumulated deficit and deferred foreign exchange

losses, if any. The remainder may be credited to capital surplus or

transferred to raise common stock. A new basis for calculating

depreciation is established for revalued assets.

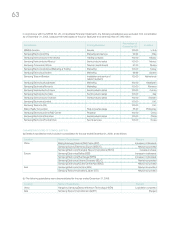

Depreciation is computed using the straight-line method over the

following estimated useful lives:

MAINTENANCE AND REPAIRS

Routine maintenance and repairs are charged to expense as

incurred. Expenditures which enhance the value or extend the use-

ful life of the related asset are capitalized.

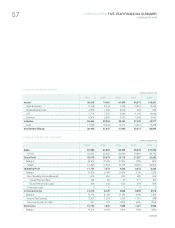

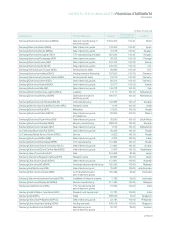

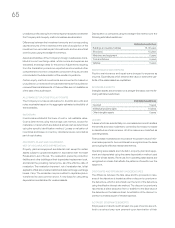

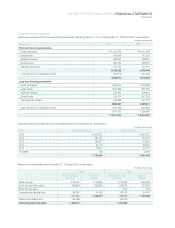

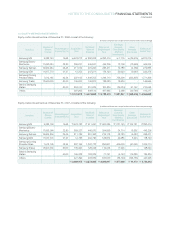

INTANGIBLE ASSETS

Intangible assets are amortized on a straight-line basis over the fol-

lowing estimated useful lives:

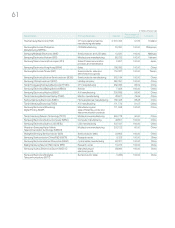

LEASES

A lease which has substantially non-cancelable terms and transfers

the benefits and risks incidental to ownership from lessor to lessee

is classified as a finance lease. All other leases are classified as

operating leases.

Finance lease receivables are recorded at the present value of mini-

mum lease payments. Accrued interest is recognized over the lease

period using the effective interest rate method.

Operating lease assets are included in property, plant and equip-

ment and depreciated using the same depreciation method used

for other similar assets. Revenues from operating lease assets are

recognized on a basis that reflects the patterns of benefits over the

lease term.

DISCOUNTS AND PREMIUMS ON DEBENTURES

The difference between the face value and the proceeds on issu-

ance of the debenture is treated as either a discount or premium on

the debenture, which is amortized over the term of the debenture

using the effective interest rate method. The discount or premium is

reported as a direct deduction from or addition to the face value of

the debenture in the balance sheet. Amortization of the discount or

premium is treated as part of interest expense.

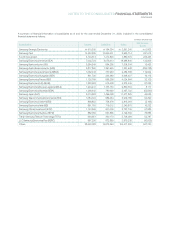

ACCRUED SEVERANCE BENEFITS

Employees and directors with at least one year of service are enti-

tled to receive a lump-sum payment upon termination of their

Estimated useful lives

Buildings and auxiliary facilities 15, 30 years

Structures 15 years

Machinery and equipment 5 years

Tools and fixtures 5 years

Vehicles 5 years

Estimated useful lives

Goodwill 5 years

Intellectual property rights 10 years

Other intangible assets 5 years