Samsung 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

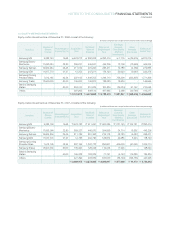

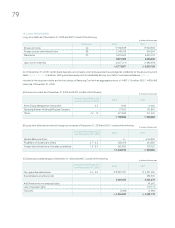

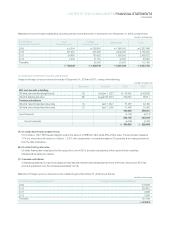

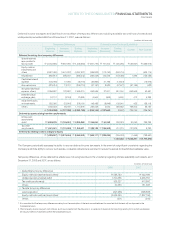

Samsung Card, a domestic subsidiary, accrues point reserves based on estimated expenses of future service to reward loyal

members and expand customer base.

Samsung Card, a domestic subsidiary, accrues allowance for undrawn commitment based on credit conversion factor and forward-

looking criteria according to regulations on supervision of credit-specialized financial business.

(D)

(E)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

CONTINUED

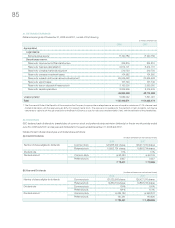

19. COMMITMENTS AND CONTINGENCIES

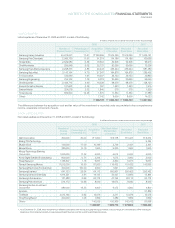

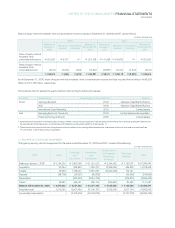

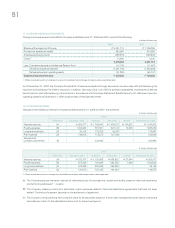

Europe SEUK and 18 other subsidiaries Citibank and another bank

Asia SAPL and 7 other subsidiaries Bank of America

Area Participating Subsidiaries Financial Institutions

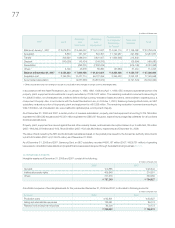

As of December 31, 2008, SEC is contingently liable for guarantees of indebtedness, principally for related parties, approximating

₩10,312 million in loans and US$2,297 million on drawn facilities which have a maximum limit of US$4,323 million.

As of December 31, 2008, SEC is contingently liable for guarantees of indebtedness up to a limit of ₩250,132 million for employees’

housing rental deposits.

As of December 31, 2008, SEC is contingently liable for guarantees amounting to US$21.6 million undertaken by Citibank relating to

the guarantees for Samsung Electronics Latinoamerica, one of SEC’s foreign subsidiaries.

As of December 31, 2008, SEC is providing a US$23 million guarantee for Samsung Electronics Hungarian relating to the investment

incentive contract with the Hungarian government.

In addition, as of December 31, 2008, the Company’s overseas subsidiaries enter into “Cash Pooling Arrangement” contracts and

“Banking Facility” agreements with overseas financial institutions to provide mutual guarantees of indebtedness.

(A)

As of December 31, 2008, SEC and its domestic subsidiaries have been insured against future contract commitments of up to

₩143,314 million. In addition, Samsung Card has been provided with a guarantee amounting to US$3 million from Woori Bank, in

relation to its payment to AMEX.

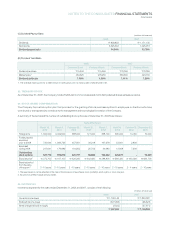

As of December 31, 2008, the Company has technical assistance agreements with certain companies requiring payment for use of the

technology or from sales of products manufactured using such technology.

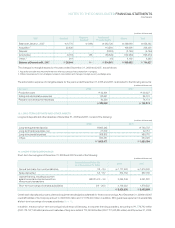

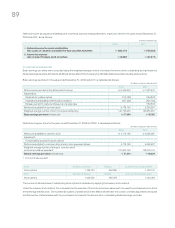

The Company leases certain property, plant and equipment under various finance lease arrangements. Assets recorded under finance lease

agreements are included in property, plant and equipment with a net book value of ₩52,857 million (2007: ₩41,787 million). Depreciation

expense for the finance lease assets amounted to ₩5,644 million (2007: ₩2,986 million) for the year ended December 31, 2008.

(B)

(C)

(D)

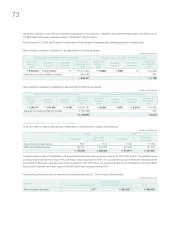

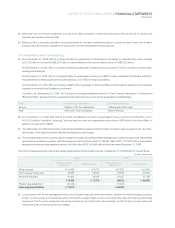

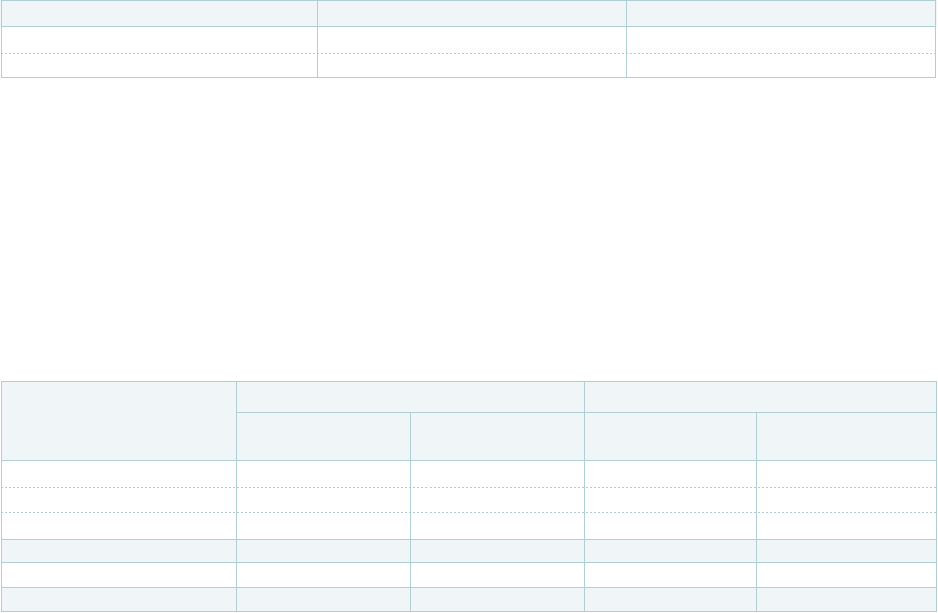

The minimum lease payments under finance lease agreements and their present value as of December 31, 2008 and 2007, are as follows:

(In millions of Korean won)

Within one year

₩

10,659

₩

8,770

₩

7,837

₩

6,240

From one year to five years 32,866 25,045 26,678 20,576

More than five years 70,403 38,564 55,297 31,489

113,928

₩

72,379 89,812

₩

58,305

Present value adjustment (41,549) (31,507)

Financing lease liabilities

₩

72,379

₩

58,305

Minimum Lease Present Values Minimum Lease Present Values

Payments Payments

2008 2007

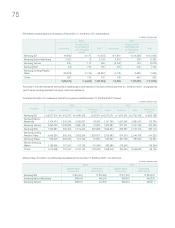

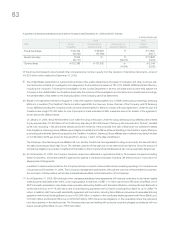

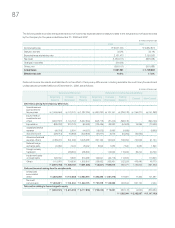

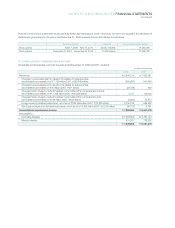

In accordance with its risk management policy, the Company uses derivative instruments, primarily forward exchange contracts,

foreign currency swap and interest rate swap contracts to hedge foreign currency exchange rate risks and floating interest rate

exposures. The Company designates the forward exchange contracts as fair value hedges, and the foreign currency swap and

interest rate swap contacts as cash flow hedges.

(E)