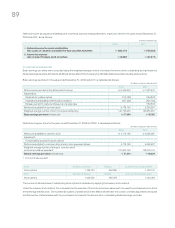

Samsung 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

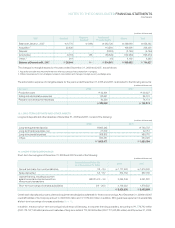

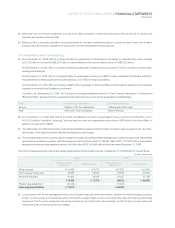

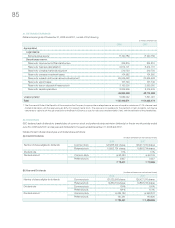

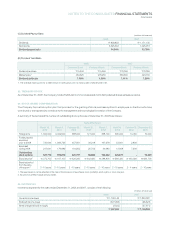

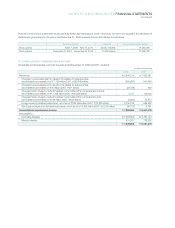

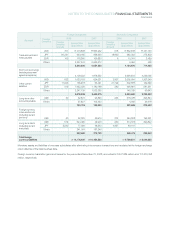

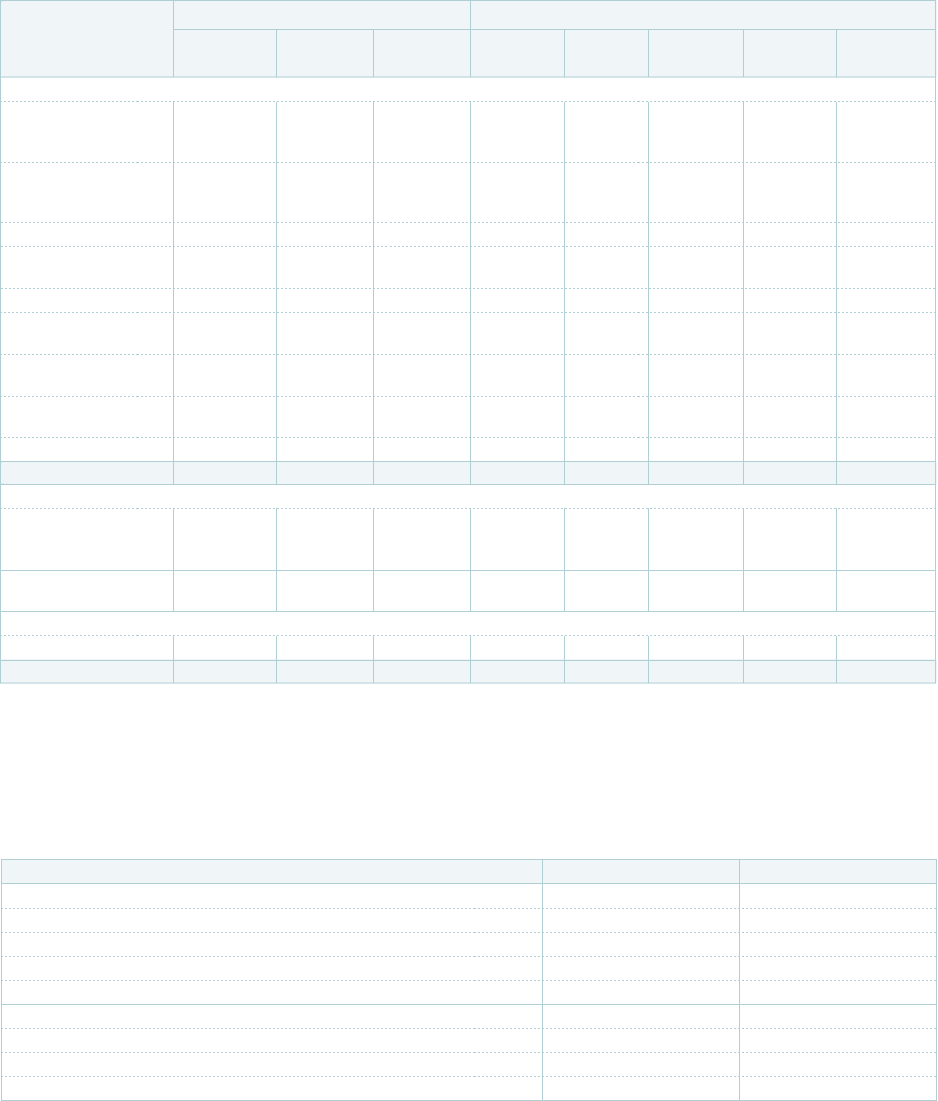

Deferred income tax assets and liabilities from tax effect of temporary differences including available tax credit carryforwards and

undisposed accumulated deficit as of December 31, 2007, were as follows:

(In millions of Korean won)

Temporary Differences Deferred Income Tax Asset (Liabilities)

Beginning Increase Ending Beginning Increase Ending

Balance (Decrease) Balance Balance (Decrease) Balance Current Non-Current

Deferred tax arising from temporary differences

Special reserves

appropriated for

tax purposes

₩

(2,042,850)

₩

587,286

₩

(1,455,564)

₩

(561,784)

₩

161,504

₩

(400,280)

₩

(36,667)

₩

(363,613)

Equity-method

investments and

others (2,627,490) (1,470,337) (4,097,827) (395,923) (112,792) (508,715) - (508,715)

Depreciation (865,817) 496,575 (369,242) (256,028) 132,543 (123,485) 1,598 (125,083)

Capitalized interest

expense (126,786) 77,068 (49,718) (34,866) 21,193 (13,673) - (13,673)

Accrued income (223,414) 13,701 (209,713) (61,157) 3,580 (57,577) (57,155) (422)

Allowance (technical

expense, others) 2,356,597 128,622 2,485,219 653,549 37,601 691,150 648,569 42,581

Deferred foreign

exchange gains 24,112 (3,153) 20,959 6,506 (666) 5,840 472 5,368

Impairment losses

on investments 532,066 (23,916) 508,150 149,489 (9,948) 139,541 425 139,116

Others 1,049,223 66,755 1,115,978 254,048 4,644 258,692 169,502 89,190

₩

(1,924,359)

₩

(127,399)

₩

(2,051,758)

₩

(246,166)

₩

237,659 (8,507) 726,744 (735,251)

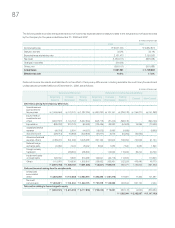

Deferred tax assets arising from the carryforwards

Undisposed

accumulated

deficit

₩

3,353,235

₩

(126,967)

₩

3,226,268

₩

246,060

₩

60,263 306,323 20,090 286,233

Tax credit

carryforwards

₩

1,341,941

₩

(101,330)

₩

1,240,611

₩

988,122

₩

(196,903) 791,219 787,929 3,290

Deferred tax relating to items charged to equity

₩

(1,283,947)

₩

(2,278,554)

₩

(3,562,501)

₩

(355,117)

₩

(399,886) (755,003) (1,456) (753,547)

₩

334,032

₩

1,533,307

₩

(1,199,275)

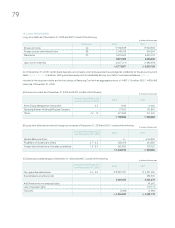

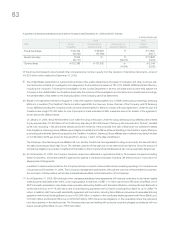

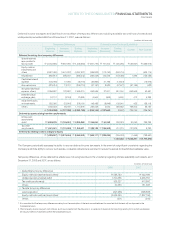

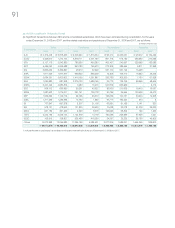

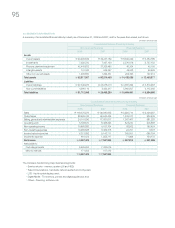

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a significant uncertainty regarding the

Company’s ultimate ability to recover such assets, a valuation allowance is recorded to reduce the assets to its estimated realizable value.

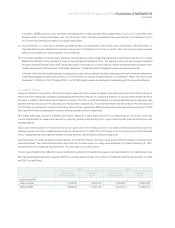

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

CONTINUED

Temporary differences, whose deferred tax effects were not recognized due to the uncertainty regarding ultimate realizability such assets, as of

December 31, 2008 and 2007, are as follows:

(In millions of Korean won)

1. It is uncertain that the temporary differences arising from the revaluation of the land are realizable as it is uncertain that the land will be disposed in the

foreseeable future.

2. The Company does not expect cash inflows, such as proceeds from the disposal of, or receipts of dividends from earnings arising from certain subsidiaries

and equity method investments within the foreseeable future.

Ⅰ. Deductible temporary differences

Equity-method investments and others 2

₩

588,783

₩

422,188

Undisposed accumulated deficit 1,700,465 2,235,756

Tax credit carryforwards 305,227 413,966

Others 50,383 161,308

Ⅱ. Taxable temporary differences

Land revaluation1 (397,985) (398,538)

Equity-method investments and others 2 (2,924,351) (1,807,196)

Others (201) (344)

2008 2007