Pottery Barn 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

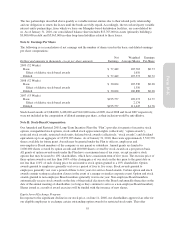

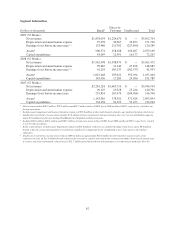

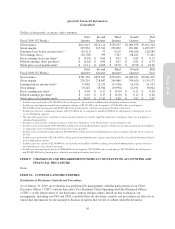

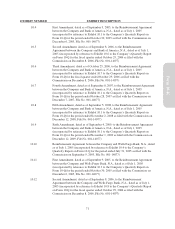

Quarterly Financial Information

(Unaudited)

Dollars in thousands, except per share amounts

Fiscal 2009 (52 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter1

Full

Year

Net revenues $611,615 $672,114 $729,297 $1,089,678 $3,102,704

Gross margin 183,963 215,341 252,852 451,081 1,103,237

Earnings (loss) before income taxes2, 3 (29,511) 57 9,115 140,628 120,289

Net earnings (loss) (18,705) 399 7,327 88,421 77,442

Basic earnings (loss) per share4$ (0.18) $ 0.00 $ 0.07 $ 0.83 $ 0.73

Diluted earnings (loss) per share4$ (0.18) $ 0.00 $ 0.07 $ 0.81 $ 0.72

Stock price (as of quarter-end)5$ 13.11 $ 14.06 $ 18.78 $ 18.98 $ 18.98

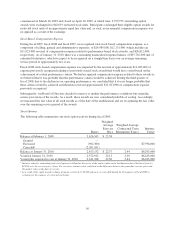

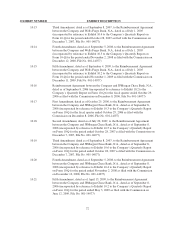

Fiscal 2008 (52 Weeks)

First

Quarter6

Second

Quarter7

Third

Quarter8

Fourth

Quarter9

Full

Year

Net revenues $781,784 $819,621 $752,052 $1,008,015 $3,361,472

Gross margin 276,219 278,847 240,480 339,626 1,135,172

Earnings before income taxes10 17,062 25,233 (19,536) 19,194 41,953

Net earnings 10,447 18,384 (10,998) 12,191 30,024

Basic earnings per share4$ 0.10 $ 0.17 $ (0.10) $ 0.12 $ 0.28

Diluted earnings per share4$ 0.10 $ 0.17 $ (0.10) $ 0.12 $ 0.28

Stock price (as of quarter-end)5$ 26.10 $ 17.47 $ 8.28 $ 7.92 $ 7.92

1Includes a pre-tax benefit of $1,900,000 in the fourth quarter representing Visa/MasterCard litigation settlement income.

2Includes pre-tax impairment and lease termination charges of $6,127,000 in the first quarter, $7,246,000 in the second quarter,

$12,156,000 in the third quarter and $9,495,000 in the fourth quarter related to our underperforming retail stores.

3Includes pre-tax lease termination charges of $1,335,000 in the second quarter and $6,245,000 in the third quarter related to the exit of

excess distribution capacity

4The sum of the quarterly net earnings per share amounts will not necessarily equal the annual net earnings per share as each quarter is

calculated independently.

5Stock prices represent our common stock price at the close of business on the Friday before our fiscal quarter-end.

6Includes a net pre-tax benefit of $9,350,000 in selling, general and administrative expense related to an incentive payment from a landlord

to compensate us for terminating a store lease prior to its expiration.

7Includes a pre-tax benefit of approximately $16,000,000 in selling, general and administrative expense related to the sale of our corporate

aircraft.

8Includes a pre-tax benefit of $11,023,000 in selling, general and administrative expense associated with the reversal of performance-based

stock compensation expense.

9Includes a pre-tax expense of $2,390,000 in cost of goods sold and $10,344,000 in selling, general and administrative expense related to

our infrastructure cost reduction program.

10 Includes pre-tax impairment charges of $596,000 in the first quarter, $1,474,000 in the second quarter, $12,280,000 in the third quarter

and $19,645,000 in the fourth quarter related to our underperforming retail stores.

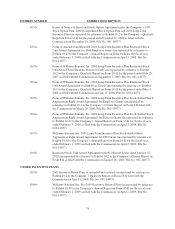

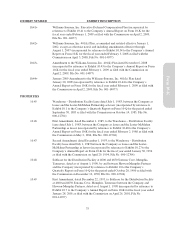

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As of January 31, 2010, an evaluation was performed by management, with the participation of our Chief

Executive Officer (“CEO”) and our Executive Vice President, Chief Operating and Chief Financial Officer

(“CFO”), of the effectiveness of our disclosure controls and procedures. Based on that evaluation, our

management, including our CEO and CFO, concluded that our disclosure controls and procedures are effective to

ensure that information we are required to disclose in reports that we file or submit under the Securities

65

Form 10-K