Pottery Barn 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

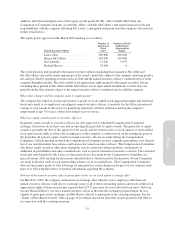

This fiscal 2009 proxy peer group was determined by the Compensation Committee considering the following

criteria, which reflected the company’s profile at that time:

1. Company Classification in the Global Sub-Industry Classification System (GICS) in one of the

following:

• Home Furnishing Retail

• Apparel Retail

• Department Stores

2. Revenues between $1 billion and $12 billion

3. Market capitalization greater than $1 billion

4. More than 15,000 employees

Additionally, other major specialty retailers in geographic proximity to the San Francisco Bay Area were

considered for inclusion in the proxy peer group.

By utilizing the criteria described above, the Compensation Committee eliminated seven companies and added

three companies to the proxy peer group for fiscal 2009.

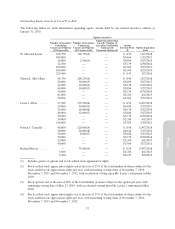

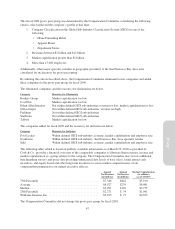

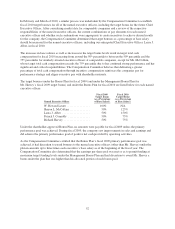

The eliminated companies and the reason(s) for elimination are below:

Company Reason(s) for Elimination

Borders Group Market capitalization too low

Cost Plus Market capitalization too low

Ethan Allen Interiors Not within defined GICS sub-industries; revenue too low; market capitalization too low

Office Depot Not within defined GICS sub-industries; revenue too high

PetSmart Not within defined GICS sub-industries

Starbucks Not within defined GICS sub-industries

Talbots Market capitalization too low

The companies added for fiscal 2009 and the reason(s) for inclusion are below:

Company Reason(s) for Inclusion

Foot Locker Within defined GICS sub-industry, revenue, market capitalization and employee size

Gymboree Within defined GICS sub-industry; San Francisco Bay Area specialty retailer

Saks Within defined GICS sub-industry, revenue, market capitalization and employee size

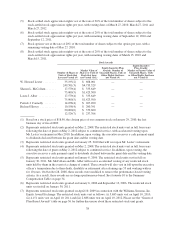

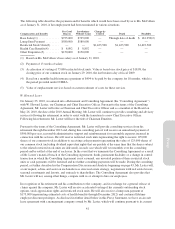

The following table, which is based on publicly available information as of March 29, 2010 as provided by

Cook & Co., provides a financial overview of the comparable companies to illustrate their revenues, income and

market capitalization as a group relative to the company. The Compensation Committee may review additional

benchmarking surveys and proxy data providing summarized data levels of base salary, target annual cash

incentives, and equity-based and other long-term incentives to assess market competitiveness of our

compensation programs for our named executive officers.

Annual

Net Revenue

(in millions)

Annual

Net Income

(in millions)

Market Capitalization

(in millions)

(as of 1/29/10)

75th Percentile ........................................ $7,346 $442 $5,910

Average ............................................. $4,927 $239 $4,081

Median .............................................. $2,991 $102 $2,775

25th Percentile ........................................ $2,271 $ 34 $1,041

Williams-Sonoma, Inc. .................................. $3,103 $ 77 $2,015

The Compensation Committee did not change the proxy peer group for fiscal 2010.

47

Proxy