Pottery Barn 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(ii) to determine the time or times of grant, and the extent, if any, of Incentive Stock Options,

Non-Qualified Stock Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights,

Dividend Equivalents and Deferred Stock Awards, or any combination of the foregoing, granted to any one

or more Participants;

(iii) to determine the number of shares of Stock to be covered by any Award;

(iv) Subject to Section 2(d), to determine and modify from time to time the terms and conditions,

including restrictions, consistent with the terms of the Plan, of any Award, which terms and conditions may

differ among individual Awards and Participants, and to approve the form of written instruments evidencing

the Awards;

(v) Subject to Section 2(d) and to the minimum vesting provisions of Sections 8(d), 9(d) and 10(a), to

accelerate at any time the exercisability or vesting of all or any portion of any Award;

(vi) subject to the provisions of Sections 6(a)(iii) and 7(a)(iii), to extend at any time the post-

termination period in which Stock Options or Stock Appreciations Rights may be exercised;

(vii) to determine at any time whether, to what extent, and under what circumstances Stock and other

amounts payable with respect to an Award shall be deferred either automatically or at the election of the

Participant and whether and to what extent the Company shall pay or credit amounts constituting deemed

interest (at rates determined by the Administrator) or dividends or deemed dividends on such deferrals;

(viii) to develop, approve and utilize forms of notices, Award Agreements and similar materials for

administration and operation of the Plan;

(ix) to determine if any Award shall be accompanied by the grant of a corresponding Dividend

Equivalent; and

(x) at any time to adopt, alter and repeal such rules, guidelines and practices for administration of the

Plan and for its own acts and proceedings as the Administrator shall deem advisable; to interpret the terms

and provisions of the Plan and any Award (including related written instruments); to make all

determinations it deems necessary or advisable for the administration of the Plan; to decide all disputes

arising in connection with the Plan; and to otherwise supervise the administration of the Plan.

All decisions and interpretations of the Administrator shall be made in the Administrator’s sole and

absolute discretion and shall be final and binding on all persons, including the Company and Plan

Participants.

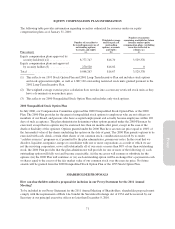

(d) Limitations on Vesting and Acceleration. Full Value Awards that result in issuing up to 5% of the

maximum aggregate number of shares of Stock authorized for issuance under the Plan (the “5% Limit”) may be

granted to any one or more employees or Non-employee Directors without respect to any minimum vesting

provisions included in the Plan. Awards granted to Non-employee Directors pursuant to a formula approved by

the Board shall not count towards the 5% Limit and shall not be subject to any minimum vesting requirements

under the Plan. Further, all Full Value Awards that have their vesting discretionarily accelerated by the

Administrator, and, all Options and SARs that have their vesting discretionarily accelerated in full by the

Administrator, in each case other than pursuant to (i) a transaction described in Section 17 hereof (which for this

purpose shall be deemed to include acceleration in connection with the occurrence of an additional or subsequent

event), (ii) a Participant’s death, (iii) a Participant’s Disability (as defined in the Plan or relevant Award

Agreement), or (iv) a Participant’s Retirement, are subject to the 5% Limit. Notwithstanding the foregoing, the

Administrator may, in its discretion, accelerate the vesting of Full Value Awards such that the Plan minimum

vesting requirements still must be met, without such vesting acceleration counting toward the 5% Limit. The 5%

Limit shall be considered as one aggregate limit applying to the granting of Full Value Awards to employees or

Non-employee Directors without respect to Plan minimum vesting requirements and to the discretionary vesting

acceleration of Awards.

A-4