Pottery Barn 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

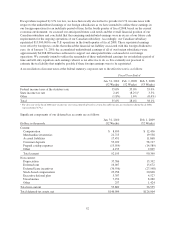

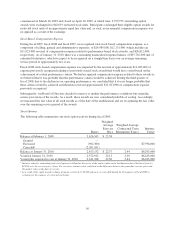

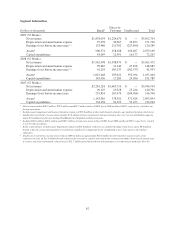

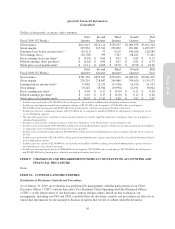

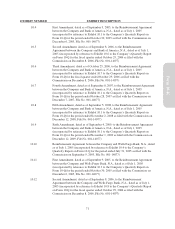

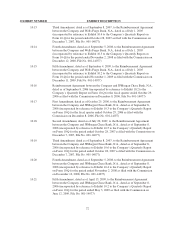

Segment Information

Dollars in thousands Retail1

Direct-to-

Customer Unallocated Total

2009 (52 Weeks)

Net revenues $1,878,034 $1,224,670 $ — $3,102,704

Depreciation and amortization expense 97,978 20,965 32,853 151,796

Earnings (loss) before income taxes2, 3 133,486 210,702 (223,899) 120,289

Assets4900,574 258,188 920,407 2,079,169

Capital expenditures 43,095 12,991 16,177 72,263

2008 (52 Weeks)

Net revenues $1,962,498 $1,398,974 $ — $3,361,472

Depreciation and amortization expense 99,065 21,142 27,876 148,083

Earnings (loss) before income taxes5, 6 41,293 183,237 (182,577) 41,953

Assets41,047,448 295,022 592,994 1,935,464

Capital expenditures 145,456 17,283 29,050 191,789

2007 (53 Weeks)

Net revenues $2,281,218 $1,663,716 $ — $3,944,934

Depreciation and amortization expense 96,129 19,328 25,244 140,701

Earnings (loss) before income taxes 253,834 267,470 (204,964) 316,340

Assets41,143,910 378,520 571,424 2,093,854

Capital expenditures 134,158 24,393 53,473 212,024

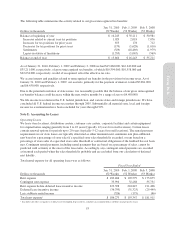

1Net revenues include $84.2 million, $79.9 million and $87.3 million in fiscal 2009, fiscal 2008 and fiscal 2007, respectively, related to our

foreign operations.

2Includes asset impairment and lease termination charges of $35.0 million in the retail channel related to our underperforming retail stores.

3Unallocated costs before income taxes includes $7.6 million in lease termination charges related to the exit of excess distribution capacity

and a $1.9 million benefit representing Visa/MasterCard litigation settlement income.

4Includes $29.6 million, $28.3 million and $30.7 million of long-term assets in fiscal 2009, fiscal 2008 and fiscal 2007, respectively, related

to our foreign operations.

5In the retail channel, includes asset impairment charges of $34.0 million related to our underperforming retail stores and a $9.4 million

benefit related to an incentive payment received from a landlord to compensate us for terminating a store lease prior to its original

expiration.

6Unallocated costs before income taxes in fiscal 2008 includes an approximate $16.0 million benefit related to a gain on sale of our

corporate aircraft, an $11.0 million benefit related to the reversal of expense associated with certain performance-based stock awards and

severance and lease termination related costs of $12.7 million associated with our infrastructure cost reduction program (See Note N).

62