Pottery Barn 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

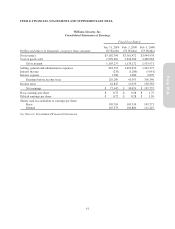

Net cash provided by operating activities in fiscal 2009 increased compared to fiscal 2008 primarily due to an

increase in income taxes payable, an increase in accrued salaries, benefits and other expenses and an increase in

accounts payable.

In fiscal 2008, net cash provided by operating activities was $230,163,000 compared to net cash provided by

operating activities of $245,539,000 in fiscal 2007. Cash provided by operating activities in fiscal 2008 was

primarily attributable to a decrease in merchandise inventories due to our inventory reduction initiatives

throughout fiscal 2008, an increase in deferred rent and lease incentives due to the opening of new stores and a

decrease in our prepaid catalog costs due to our catalog circulation optimization strategy. This was partially

offset by a decrease in income taxes payable due to the payment of our fiscal 2007 income taxes and a

significantly reduced income tax obligation due to reduced earnings in the back half of fiscal 2008.

Net cash used in investing activities was $71,230,000 for fiscal 2009 compared to $144,039,000 in fiscal 2008.

Fiscal 2009 purchases of property and equipment were $72,263,000, comprised of $40,717,000 for 9 new and 8

remodeled or expanded stores, $26,163,000 for systems development projects (including e-commerce websites)

and $5,383,000 for distribution center and other infrastructure projects. Net cash used in investing activities for

fiscal 2009 decreased compared to fiscal 2008 primarily due to a reduction in our purchases of property and

equipment resulting from a decrease in the number of new and remodeled stores we opened during fiscal 2009

and an overall reduction in all other capital expenditures, partially offset by proceeds received from the sale of a

corporate aircraft during fiscal 2008 that did not recur in fiscal 2009.

Net cash used in investing activities was $144,039,000 for fiscal 2008 compared to $197,250,000 in fiscal 2007.

Fiscal 2008 purchases of property and equipment were $191,789,000, comprised of $131,792,000 for 29 new and

23 remodeled or expanded stores, $45,847,000 for systems development projects (including e-commerce

websites) and $14,150,000 for distribution center and other infrastructure projects. Net cash used in investing

activities in fiscal 2008 was partially offset by proceeds from the sale of a corporate aircraft of $46,787,000.

In fiscal 2010, we anticipate investing $70,000,000 to $75,000,000 in the purchase of property and equipment,

primarily for systems development projects (including e-commerce websites), the construction of 4 new stores

and 6 remodeled or expanded stores, and distribution center and other infrastructure projects.

For fiscal 2009, net cash used in financing activities was $55,498,000 compared to $52,160,000 in fiscal 2008.

Net cash used in financing activities in fiscal 2009 was primarily attributable to the payment of dividends and the

repayment of long-term obligations predominantly associated with the remaining outstanding balance on our

Mississippi industrial development bonds, partially offset by net proceeds from the exercise of stock-based

awards. Net cash used in financing activities in fiscal 2009 increased compared to fiscal 2008 primarily due to

the repayment of the remaining outstanding balance on our Mississippi industrial development bonds, partially

offset by net proceeds from the exercise of stock-based awards during fiscal 2009.

For fiscal 2008, net cash used in financing activities was $52,160,000 compared to $208,482,000 in fiscal 2007.

Net cash used in financing activities in fiscal 2008 was primarily attributable to the payment of dividends. Net

cash used in financing activities in fiscal 2008 decreased from fiscal 2007 primarily due to the repurchase of

$190,378,000 of common stock in fiscal 2007 that did not recur in fiscal 2008.

Stock Repurchase Program

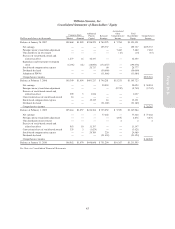

We did not repurchase any shares of our common stock during fiscal 2009 or fiscal 2008 and there currently is no

stock repurchase program authorized by our Board of Directors.

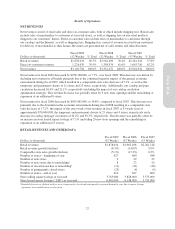

Dividends

During fiscal 2009 and fiscal 2008, total cash dividends declared were approximately $51,424,000 and

$51,189,000, respectively, or $0.12 per common share per quarter. Subsequent to year end, in March 2010, our

Board of Directors authorized an increase in our quarterly cash dividend from $0.12 to $0.13 per common share,

subject to capital availability, payable on May 24, 2010 to shareholders of record as of the close of business on

April 27, 2010. Our quarterly cash dividend may be limited or terminated at any time.

33

Form 10-K