Pottery Barn 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

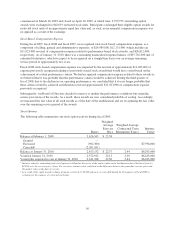

future cash flows over the remaining life of the lease. Our estimate of undiscounted future cash flows over the

store lease term (generally 5 to 22 years) is based upon our experience, historical operations of the stores and

estimates of future store profitability and economic conditions. The future estimates of store profitability and

economic conditions require estimating such factors as sales growth, gross margin, employment rates, lease

escalations, inflation on operating expenses and the overall economics of the retail industry, and are therefore

subject to variability and difficult to predict. If a long-lived asset is found to be impaired, the amount recognized

for impairment is equal to the difference between the net carrying value and the asset’s fair value. Long-lived

assets are measured at fair value on a nonrecurring basis using Level 3 inputs as defined in the fair value

hierarchy. The fair value is estimated based upon future cash flows (discounted at a rate that is commensurate

with the risk and approximates our weighted average cost of capital).

For any store or facility closure where a lease obligation still exists, we record the estimated future liability

associated with the rental obligation on the cease use date.

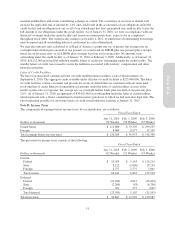

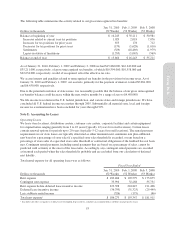

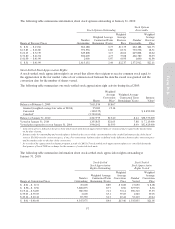

During fiscal 2009, we recorded expense of approximately $35,024,000 associated with asset impairment and

early lease termination charges for underperforming retail stores, of which $32,898,000 is recorded within

selling, general and administrative expenses, and the remainder of which is recorded within cost of goods sold.

We also recorded charges of $7,580,000 associated with the exit of excess distribution capacity, of which

$5,981,000 is recorded within selling, general and administrative expenses, and the remainder of which is

recorded within cost of goods sold.

During fiscal 2008, we recorded expense of approximately $33,995,000 associated with asset impairment charges

for underperforming retail stores, all of which is recorded within selling, general and administrative expenses. In

addition, during fiscal 2008, we recorded a benefit of approximately $9,350,000 within selling, general and

administrative expenses related to an incentive payment received from a landlord to compensate us for

terminating a store lease prior to its expiration.

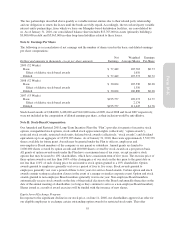

Self-Insured Liabilities

We are primarily self-insured for workers’ compensation, employee health benefits and product and general

liability claims. We record self-insurance liabilities based on claims filed, including the development of those

claims, and an estimate of claims incurred but not yet reported. Factors affecting this estimate include future

inflation rates, changes in severity, benefit level changes, medical costs and claim settlement patterns. Should a

different amount of claims occur compared to what was estimated, or costs of the claims increase or decrease

beyond what was anticipated, reserves may need to be adjusted accordingly. We determine our workers’

compensation liability and product and general liability claims reserves based on an actuarial analysis of

historical claims data. Self-insurance reserves for employee health benefits, workers’ compensation and product

and general liability claims were $20,111,000 and $21,006,000 as of January 31, 2010 and February 1, 2009,

respectively, and are recorded within accrued salaries, benefits and other.

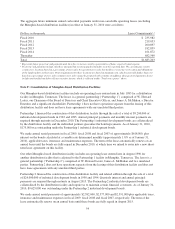

Customer Deposits

Customer deposits are primarily comprised of unredeemed gift cards, gift certificates, and merchandise credits

and deferred revenue related to undelivered merchandise. We maintain a liability for unredeemed gift cards, gift

certificates, and merchandise credits until the earlier of redemption, escheatment or four years as we have

concluded that the likelihood of our gift cards and gift certificates being redeemed beyond four years from the

date of issuance is remote.

Deferred Rent and Lease Incentives

For leases that contain fixed escalations of the minimum annual lease payment during the original term of the

lease, we recognize rental expense on a straight-line basis over the lease term, including the construction period,

and record the difference between rent expense and the amount currently payable as deferred rent. We record

rental expense during the construction period. Deferred lease incentives include construction allowances received

from landlords, which are amortized on a straight-line basis over the lease term, including the construction

period.

47

Form 10-K