Pottery Barn 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

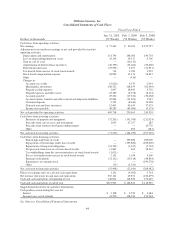

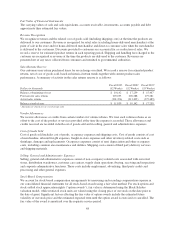

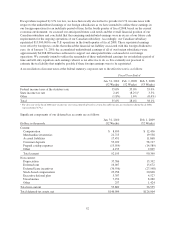

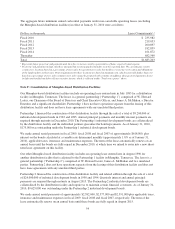

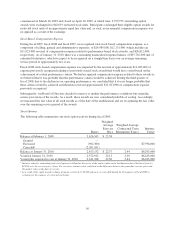

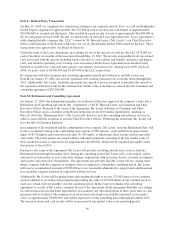

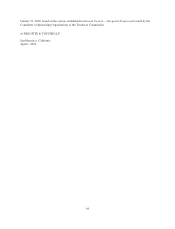

The aggregate future minimum annual cash rental payments under non-cancelable operating leases (excluding

the Memphis-based distribution facilities) in effect at January 31, 2010 were as follows:

Dollars in thousands Lease Commitments1,2

Fiscal 2010 $ 235,982

Fiscal 2011 219,053

Fiscal 2012 200,897

Fiscal 2013 182,839

Fiscal 2014 161,872

Thereafter 682,560

Total $1,683,203

1Represents future projected cash payments and, therefore, is not necessarily representative of future expected rental expense.

2Projected cash payments include only those amounts that are fixed and determinable as of the reporting date. We currently pay rent for

certain store locations based on a percentage of store sales if a specified store sales threshold is or is not met or if contractual obligations

of the landlord have not been met. Projected payments for these locations are based on minimum rent, which is generally higher than rent

based on a percentage of store sales, as future store sales cannot be predicted with certainty. In addition, these projected payments do not

include any benefit from deferred lease incentive income, which is reflected within “Total rent expense” above.

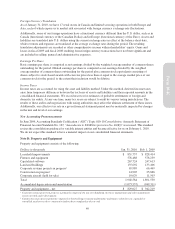

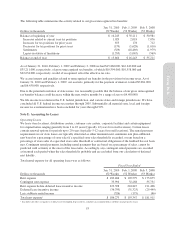

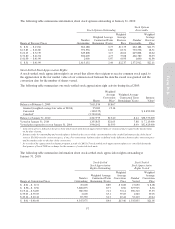

Note F: Consolidation of Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of W. Howard

Lester, our Chairman of the Board of Directors and Chief Executive Officer, and James A. McMahan, a Director

Emeritus and a significant shareholder. Partnership 1 does not have operations separate from the leasing of this

distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. Annual principal payments and monthly interest payments are

required through maturity in December 2010. The Partnership 1 industrial development bonds are collateralized

by the distribution facility and the individual partners guarantee the bond repayments. As of January 31, 2010,

$175,000 was outstanding under the Partnership 1 industrial development bonds.

We made annual rental payments in fiscal 2009, fiscal 2008 and fiscal 2007 of approximately $618,000, plus

interest on the bonds calculated at a variable rate determined monthly (approximately 1.8% as of January 31,

2010), applicable taxes, insurance and maintenance expenses. The term of the lease automatically renews on an

annual basis until the bonds are fully repaid in December 2010, at which time we intend to enter into a new short-

term lease agreement on this facility.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of W. Howard Lester, James A. McMahan and two unrelated

parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and does not

have lease agreements with any unrelated third parties.

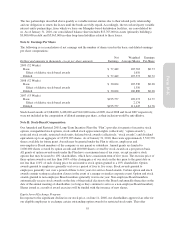

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

collateralized by the distribution facility and require us to maintain certain financial covenants. As of January 31,

2010, $9,625,000 was outstanding under the Partnership 2 industrial development bonds.

We made annual rental payments of approximately $2,582,000, $2,577,000 and $2,591,000 plus applicable taxes,

insurance and maintenance expenses in fiscal 2009, fiscal 2008 and fiscal 2007, respectively. The term of the

lease automatically renews on an annual basis until these bonds are fully repaid in August 2015.

54