Pottery Barn 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

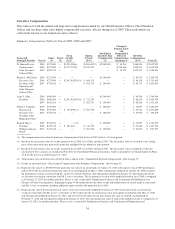

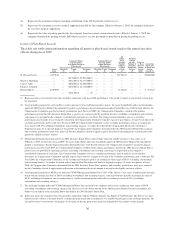

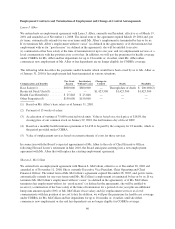

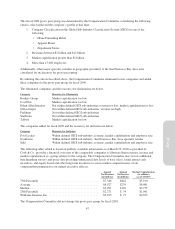

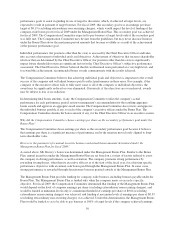

The following table describes the payments and/or benefits which would have been owed by us to Ms. McCollam

as of January 31, 2010, if her employment had been terminated in various situations.

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-in-

Control Death Disability

Base Salary(1) .............. $725,000 $725,000 — Through date of death $ 181,250(2)

Lump Sum Payment ......... $580,000 $580,000 — — —

Restricted Stock Units(3) ..... — — $1,423,500 $1,423,500 $1,423,500

Health Care Benefits(4) ...... $ 8,892 $ 8,892 — — —

Other Perquisites(5) ......... $150,000 $150,000 — — —

(1) Based on Ms. McCollam’s base salary as of January 31, 2010.

(2) Payment of 13 weeks of salary.

(3) Acceleration of vesting of 75,000 restricted stock units. Value is based on a stock price of $18.98, the

closing price of our common stock on January 29, 2010, the last business day of fiscal 2009.

(4) Based on a monthly health insurance premium of $494 to be paid by the company for 18 months, which is

the period provided under COBRA.

(5) Value of outplacement services based on current estimate of costs for these services.

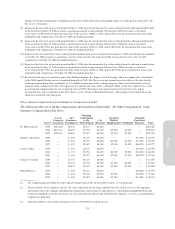

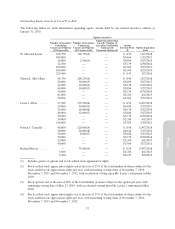

W. Howard Lester

On January 25, 2010, we entered into a Retirement and Consulting Agreement (the “Consulting Agreement”)

with W. Howard Lester, our Chairman and Chief Executive Officer. Pursuant to the terms of the Consulting

Agreement, Mr. Lester will retire as Chairman and Chief Executive Officer and as a member of the Board on

May 26, 2010, the date of the 2010 Annual Meeting. Mr. Lester will continue to provide consulting and advisory

services following his retirement in order to assist with the transition to a new Chief Executive Officer.

Following his retirement, Mr. Lester will have the title of Chairman Emeritus.

Pursuant to the terms of the Consulting Agreement, Mr. Lester will provide consulting services from his

retirement through December 2012 and, during this consulting period, will receive an annualized payment of

$500,000 per year, reasonable administrative support and reimbursement for reasonable expenses incurred in

connection with his services. He will receive restricted stock units representing the right to receive 125,000

shares of our common stock in addition to receiving cash payments representing the value of 125,000 shares of

our common stock (including dividend equivalent rights that are payable at the same time that the shares subject

to the related restricted stock units are delivered), in each case which will vest monthly over the consulting

period and be settled at the end of each year. In the event that we terminate the Consulting Agreement as a result

of Mr. Lester’s material breach of the Consulting Agreement, death, permanent disability or a change in control

transaction in which the Consulting Agreement is not assumed, any unvested portion of these restricted stock

units or cash payments will be forfeited and no further consulting payments will be made. During the consulting

period, as further described in the Compensation Discussion and Analysis beginning on page 43, Mr. Lester will,

at our request, advise and assist on such matters as store real estate strategy, negotiations with real estate lessors,

seasonal assortments and layouts, and outreach to shareholders. The Consulting Agreement also provides that

Mr. Lester will not, among other things, compete with us or attempt to hire our employees.

In recognition of his retirement and his contributions to the company, and in exchange for a general release of

claims against the company, Mr. Lester will receive accelerated vesting of his currently outstanding stock

options, stock appreciation rights and restricted stock units. He will also receive a lump sum payment of

$175,000 (representing estimated costs of health benefits through December 2012) and continued lifetime

employee discount privileges. As disclosed in further detail below in this Proxy Statement, we have an aircraft

lease agreement with a management company owned by Mr. Lester, which will continue pursuant to its current

41

Proxy