Pottery Barn 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

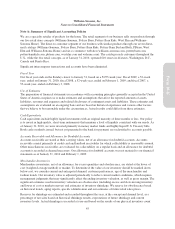

We believe the following critical accounting policies affect the significant estimates and assumptions used in the

preparation of our consolidated financial statements.

Merchandise Inventories

Merchandise inventories, net of an allowance for excess quantities and obsolescence, are stated at the lower of

cost (weighted average method) or market. To determine if the value of our inventory should be marked down

below cost, we consider current and anticipated demand, customer preferences, age of the merchandise and

fashion trends. Our inventory value is adjusted periodically to reflect current market conditions, which requires

management judgments that may significantly affect the ending inventory valuation, as well as gross margin. The

significant estimates used in inventory valuation are obsolescence (including excess and slow-moving inventory

and lower of cost or market reserves) and estimates of inventory shrinkage. We reserve for obsolescence based

on historical trends, aging reports, specific identification and our estimates of future retail sales prices.

Reserves for shrinkage are estimated and recorded throughout the year, at the concept and channel level, as a

percentage of net sales based on historical shrinkage results, expectations of future shrinkage and current

inventory levels. Actual shrinkage is recorded at year-end based on the results of our physical inventory count

and can vary from our estimates due to such factors as changes in operations within our distribution centers, the

mix of our inventory (which ranges from large furniture to small tabletop items) and execution against loss

prevention initiatives in our stores, distribution centers, off-site storage locations, and with our third-party

transportation providers. Accordingly, there is no remaining shrinkage reserve balance at year-end.

Due to these factors, our obsolescence and shrinkage reserves contain uncertainties. Both estimates have

calculations that require management to make assumptions and to apply judgment regarding a number of factors,

including market conditions, the selling environment, historical results and current inventory trends. If actual

obsolescence or shrinkage estimates change from our original estimate, we will adjust our reserves accordingly

throughout the year. Management does not believe that changes in the assumptions used in these estimates would

have a significant effect on our inventory balances. We have made no material changes to our assumptions included

in the calculations of the obsolescence and shrinkage reserves throughout the year. In addition, we do not believe a

10% change in our inventory reserves would have a material effect on net earnings. As of January 31, 2010 and

February 1, 2009, our inventory obsolescence reserves were $18,565,000 and $20,647,000, respectively.

Advertising and Prepaid Catalog Expenses

Advertising expenses consist of media and production costs related to catalog mailings, e-commerce advertising

and other direct marketing activities. All advertising costs are expensed as incurred, or upon the release of the

initial advertisement, with the exception of prepaid catalog expenses. Prepaid catalog expenses consist primarily

of third party incremental direct costs, including creative design, paper, printing, postage and mailing costs for all

of our direct response catalogs. Such costs are capitalized as prepaid catalog expenses and are amortized over

their expected period of future benefit. Such amortization is based upon the ratio of actual revenues to the total of

actual and estimated future revenues on an individual catalog basis. Estimated future revenues are based upon

various factors such as the total number of catalogs and pages circulated, the probability and magnitude of

consumer response and the assortment of merchandise offered. Each catalog is generally fully amortized over a

six to nine month period, with the majority of the amortization occurring within the first four to five months.

Prepaid catalog expenses are evaluated for realizability on a monthly basis by comparing the carrying amount

associated with each catalog to the estimated probable remaining future profitability (remaining net revenues less

merchandise cost of goods sold, selling expenses and catalog-related costs) associated with that catalog. If the

catalog is not expected to be profitable, the carrying amount of the catalog is impaired accordingly.

Property and Equipment

Property and equipment is stated at cost. Depreciation is computed using the straight-line method over the

estimated useful lives of the assets.

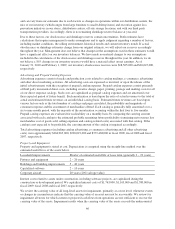

We review the carrying value of all long-lived assets for impairment, primarily at a store level, whenever events

or changes in circumstances indicate that the carrying value of an asset may not be recoverable. We review for

impairment all stores for which current or projected cash flows from operations are not sufficient to recover the

37

Form 10-K