Pottery Barn 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

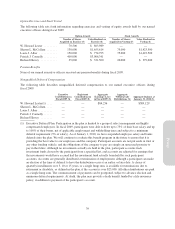

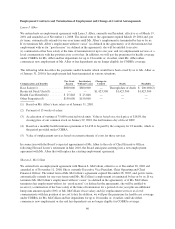

economic terms through May 2011. Under the Consulting Agreement, Mr. Lester has agreed to give us an option

to purchase this aircraft at its fair market value at the time we entered into the Consulting Agreement.

Also, in conjunction with its review of fiscal 2009 performance and Mr. Lester’s contribution to the company’s

performance, and as part of its consideration of executive equity grants (as further described in the Compensation

Discussion and Analysis beginning on page 43), on January 25, 2010, the Compensation Committee approved an

award of 249,501 restricted stock units to Mr. Lester (representing an initial value of $5,000,000, based on the

closing price of our stock on the preceding business day). This award will vest upon his retirement, which is

defined in the award agreement as leaving the company’s employment having attained the age of 70 with at least

10 years of service (which criteria he has met). The award contains dividend equivalent rights that are only

payable on the vesting of the related restricted stock units.

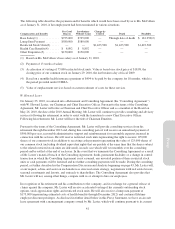

Restricted Stock Unit Grants

Ms. Alber and Ms. McCollam each received a grant of 150,000 restricted stock units in fiscal 2005. Each of these

executives will receive accelerated vesting of such awards in the event of a change of control. These executive

officers will also have such awards vest in full upon a termination due to their death, disability or retirement after

attaining age 55 and working with us for at least 10 years. These awards were granted on January 6, 2006 and

modified on October 28, 2008 to remove a performance-based vesting criterion. In addition, 75,000 of each of

the grants vested in fiscal 2009. Based on a stock price of $18.98, the closing price of our common stock on

January 29, 2010, each of the remaining unvested portions of these awards has an estimated value of $1,423,500.

42