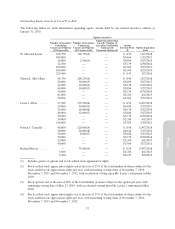

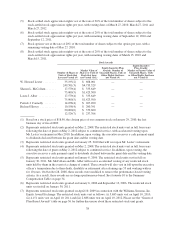

Pottery Barn 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

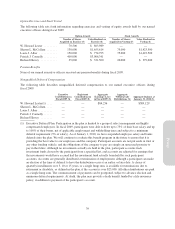

(4) Represents the maximum company matching contribution to the 401(k) plan for each fiscal year.

(5) Represents the maximum executive medical supplement payable by the company. Effective January 1, 2009, the company eliminated

the executive medical supplement.

(6) Represents the value of parking provided by the company, based on current estimated market rates. Effective January 1, 2009, the

company eliminated the parking subsidy. Individual executives are now personally responsible for paying for parking on site.

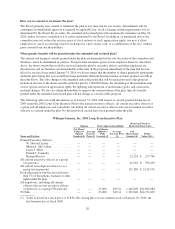

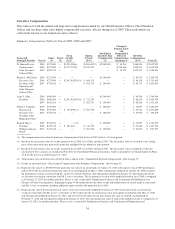

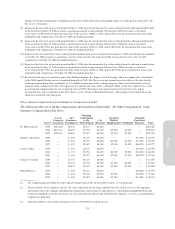

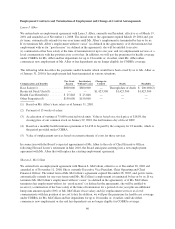

Grants of Plan-Based Awards

This table sets forth certain information regarding all grants of plan-based awards made to the named executive

officers during fiscal 2009.

Grant

Date

Estimated Future

Payouts Under

Non-Equity Incentive

Plan Awards

Estimated Future

Payouts Under

Equity Incentive

Plan Awards

All

Other

Stock

Awards;

Number

of Shares

of Stock

or Units

(#)

All Other

Option

Awards;

Number of

Securities

Underlying

Options

(#)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant Date

Fair Value

of Stock and

Option

Awards ($)

Threshold

($)

Target

($)

Maximum

($)

Threshold

($)

Target

($)

Maximum

($)

W. Howard Lester ........... 1/25/2010 — — — — — — 249,501(1) — — $5,000,000

— — $975,000(2) $2,925,000(3) — — — — — — —

SharonL.McCollam ......... — — $362,500(2) $2,175,000(3) — — — — — — —

Laura J. Alber .............. — — $400,000(2) $2,400,000(3) — — — — — — —

Patrick J. Connolly .......... — — $285,000(2) $1,710,000(3) — — — — — — —

Richard Harvey ............. 4/10/2009 — — — — — — 12,524(6) — — $ 155,423

— — $262,496(4) — (5) — — — — — — —

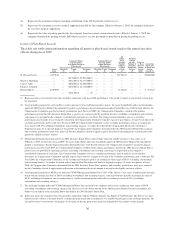

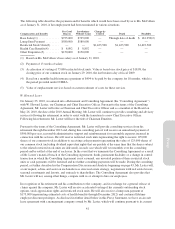

(1) Represents shares of restricted stock units granted in connection with fiscal 2009 performance. This award is subject to accelerated vesting upon

his retirement.

(2) Target potential payment for each eligible executive pursuant to our established incentive targets. To ensure deductibility under our shareholder-

approved 2001 Incentive Bonus Plan (intended to qualify as performance-based compensation under Internal Revenue Code Section 162(m)), the

Compensation Committee specified a primary performance goal. For fiscal 2009, the Compensation Committee established the primary

performance goal for the 2001 Incentive Bonus Plan as positive net cash provided by operating activities (excluding extraordinary non-recurring

cash charges) as provided on the company’s consolidated statements of cash flows. The Compensation Committee also set a secondary

performance goal to guide its use of negative discretion; the Compensation Committee typically expects to pay bonuses at target levels only if the

secondary performance goal is fully met. For fiscal 2009, the Compensation Committee set the secondary performance goal as an earnings per

share target of $0.19 (excluding extraordinary non-recurring charges). As further described in the Compensation Discussion and Analysis

beginning on page 43, in the first quarter of fiscal 2010, the Compensation Committee determined that the 2001 Incentive Bonus Plan’s primary

and secondary performance goals were achieved, but the Committee elected to apply negative discretion in determining the actual amount to be

paid to the eligible executive officers.

(3) Maximum potential payment pursuant to our 2001 Incentive Bonus Plan is equal to three times the eligible executive’s base salary as of

February 2, 2009, the first day of fiscal 2009. To ensure deductibility under our shareholder-approved 2001 Incentive Bonus Plan (intended to

qualify as performance-based compensation under Internal Revenue Code Section 162(m)), the Compensation Committee specified a primary

performance goal. For fiscal 2009, the Compensation Committee established the primary performance goal for the 2001 Incentive Bonus Plan as

positive net cash provided by operating activities (excluding extraordinary non-recurring cash charges) as provided on the company’s

consolidated statements of cash flows. The Compensation Committee also set a secondary performance goal to guide its use of negative

discretion; the Compensation Committee typically expects to pay bonuses at target levels only if the secondary performance goal is fully met. For

fiscal 2009, the Compensation Committee set the secondary performance goal as an earnings per share target of $0.19 (excluding extraordinary

non-recurring charges). As further described in the Compensation Discussion and Analysis beginning on page 43, in the first quarter of fiscal

2010, the Compensation Committee determined that the 2001 Incentive Bonus Plan’s primary and secondary performance goals were achieved,

but the Committee elected to apply negative discretion in determining the actual amount to be paid to the eligible executive officers.

(4) Target potential payment for Mr. Harvey under the FY2009 Management Bonus Plan is 50% of Mr. Harvey’s base salary. Funding under this plan

began with an earnings per share of $0.04 (excluding extraordinary non-recurring charges), with target bonuses payable at earnings per share of

$0.19 (excluding extraordinary non-recurring charges), and the maximum payout achievable at earnings per share of $0.39 (excluding

extraordinary non-recurring charges).

5) The maximum funding under the FY2009 Management Bonus Plan occurred if the company achieved an earnings per share target of $0.39

(excluding extraordinary non-recurring charges). Mr. Harvey received a bonus outside of the 2001 Incentive Bonus Plan and, accordingly, his

bonus was not subject to the maximum bonus threshold of the 2001 Incentive Bonus Plan.

(6) Represents shares of restricted stock units granted in connection with the Williams-Sonoma, Inc. Equity Award Exchange. Mr. Harvey was not a

named executive officer at the time that the exchange program began and accordingly he was eligible to participate in the exchange program. The

fair market value is based on the closing price of our stock on the day prior to the grant date multiplied by the number of units granted.

36