Pottery Barn 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

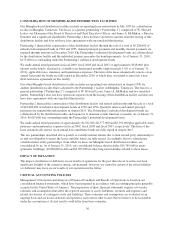

the closing price of our stock on the date prior to the date of issuance. Significant factors affecting the fair value

of option awards include the estimated future volatility of our stock price and the estimated expected term until

the option award is exercised or cancelled. The fair value of the award is amortized over the requisite service

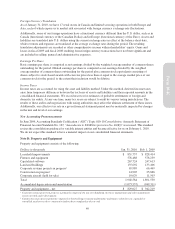

period. Total stock-based compensation expense was $24,989,000, $12,131,000 (which includes an $11,023,000

reversal of compensation expense related to performance-based stock awards, see Note H) and $26,812,000, in

fiscal 2009, fiscal 2008 and fiscal 2007, respectively, and is recorded as a component of selling, general and

administrative expenses.

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

consolidated financial statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Additionally, our effective tax rate in a given financial statement period may be materially impacted by changes

in the mix and level of our earnings.

In accordance with the accounting for income taxes and uncertain tax positions, we make estimates regarding the

likelihood that certain tax positions will be realized upon ultimate settlement and we record reserves where

necessary. It is reasonably possible that current income tax examinations involving uncertain tax positions could

be resolved within the next 12 months through administrative adjudicative procedures or settlement.

NEW ACCOUNTING PRONOUNCEMENTS

In June 2009, Accounting Standards Codification (“ASC”) Topic 810-10 Consolidation, (formerly Statement of

Financial Accounting Standards No. 167, “Amendments to FASB Interpretation No. 46(R))” was issued. This

standard revises the consolidation guidance for variable interest entities and became effective for us on

February 1, 2010. We do not expect this standard to have a material impact on our consolidated financial

statements.

39

Form 10-K