Pottery Barn 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

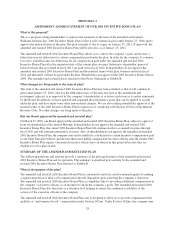

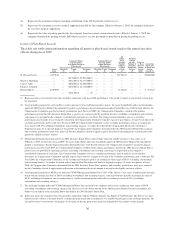

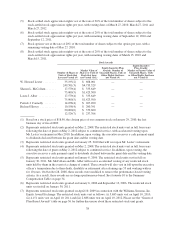

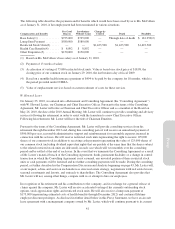

(5) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with vesting dates of March 27, 2010, March 27, 2011 and

March 27, 2012.

(6) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with remaining vesting dates of September 12, 2010 and

September 12, 2011.

(7) Stock options vest at the rate of 20% of the total number of shares subject to the option per year, with a

remaining vesting date of May 27, 2010.

(8) Stock-settled stock appreciation rights vest at the rate of 20% of the total number of shares subject to the

stock-settled stock appreciation rights per year, with remaining vesting dates of March 15, 2010 and

March 15, 2011.

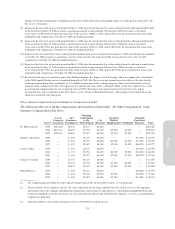

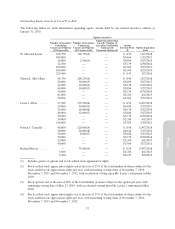

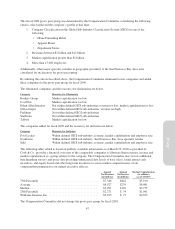

Stock Awards

Number of Shares or

Units of Stock that

have not Vested (#)

Market Value of

Shares or Units of

Stock that have

not Vested ($)(1)

Equity Incentive Plan

Awards: Number of

Unearned Shares, Units or

Other Rights that have

not Vested (#)

Equity Incentive

Plan Awards:

Market or Payout Value of

Unearned Shares, Units

or Other Rights that have

not Vested ($)

W. Howard Lester ......... 35,195(2) $ 668,001 — —

249,501(3) $4,735,529

Sharon L. McCollam ....... 17,579(4) $ 333,649 — —

75,000(5) $1,423,500

Laura J. Alber ............ 17,579(4) $ 333,649 — —

75,000(5) $1,423,500

Patrick J. Connolly ........ 14,078(4) $ 267,200 — —

Richard Harvey ........... 10,558(4) $ 200,391 — —

20,000(6) $ 379,600

12,524(7) $ 237,706

(1) Based on a stock price of $18.98, the closing price of our common stock on January 29, 2010, the last

business day of fiscal 2009.

(2) Represents restricted stock units granted on May 2, 2008. The restricted stock units vest in full four years

following the date of grant on May 2, 2012 subject to continued service, with accelerated vesting upon

Mr. Lester’s retirement in May 2010. In addition, upon vesting, the executive receives a cash payment equal

to dividends declared between the grant date and the vesting date.

(3) Represents restricted stock units granted on January 25, 2010 that will vest upon Mr. Lester’s retirement.

(4) Represents restricted stock units granted on May 2, 2008. The restricted stock units vest in full four years

following the date of grant on May 2, 2012 subject to continued service. In addition, upon vesting, the

executive receives a cash payment equal to dividends declared between the grant date and the vesting date.

(5) Represents restricted stock units granted on January 6, 2006. The restricted stock units vest in full on

January 30, 2011. Ms. McCollam and Ms. Alber will receive accelerated vesting of any restricted stock

units held by them in the event of a change of control. These awards will also vest in full upon the executive

officer’s termination due to their death, disability or retirement after attaining age 55 and working with us

for 10 years. On October 28, 2008, these awards were modified to remove the performance-based vesting

criteria. As a result, these awards are no longer performance-based. See footnote 10 to the Summary

Compensation Table on page 34.

(6) Represents restricted stock units granted on January 6, 2006 and September 12, 2006. The restricted stock

units vest in full on January 30, 2011.

(7) Represents restricted stock units granted on April 10, 2009 in connection with the Williams-Sonoma, Inc.

Equity Award Exchange. The restricted stock units vest as follows: (i) 5,685 units vest on April 10, 2010,

(ii) 4,151 units vest on April 10, 2011 and (iii) 2,688 units vest on April 10, 2012. Please see the “Grants of

Plan-Based Awards” table on page 36 for further discussion about these restricted stock unit grants.

38