Pottery Barn 2009 Annual Report Download - page 102

Download and view the complete annual report

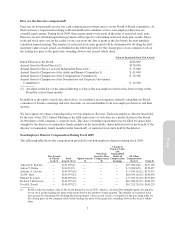

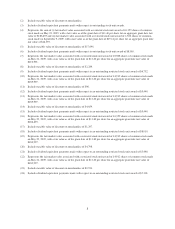

Please find page 102 of the 2009 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Includes taxable value of discount on merchandise.

(3) Includes dividend equivalent payments made with respect to outstanding stock unit awards.

(4) Represents the sum of (i) fair market value associated with a restricted stock unit award of 16,359 shares of common

stock made on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair

value of $186,493 and (ii) fair market value associated with a restricted stock unit award of 1,306 shares of common

stock made on September 9, 2009, with a fair value as of the grant date of $19.14 per share for an aggregate grant date

fair value of $24,997.

(5) Includes taxable value of discount on merchandise of $17,696.

(6) Includes dividend equivalent payments made with respect to outstanding stock unit award of $8,010.

(7) Represents the fair market value associated with a restricted stock unit award of 18,508 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$210,991.

(8) Includes taxable value of discount on merchandise of $2,284.

(9) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $6,752.

(10) Represents the fair market value associated with a restricted stock unit award of 14,912 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$169,997.

(11) Includes taxable value of discount on merchandise of $96.

(12) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $5,440.

(13) Represents the fair market value associated with a restricted stock unit award of 14,912 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$169,997.

(14) Includes taxable value of discount on merchandise of $4,659.

(15) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $5,440.

(16) Represents the fair market value associated with a restricted stock unit award of 16,359 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$186,493.

(17) Includes taxable value of discount on merchandise of $1,297.

(18) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $8,010.

(19) Represents the fair market value associated with a restricted stock unit award of 14,912 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$169,997.

(20) Includes taxable value of discount on merchandise of $4,798.

(21) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $5,440.

(22) Represents the fair market value associated with a restricted stock unit award of 14,912 shares of common stock made

on May 22, 2009, with a fair value as of the grant date of $11.40 per share for an aggregate grant date fair value of

$169,997.

(23) Includes taxable value of discount on merchandise of $2,931.

(24) Includes dividend equivalent payments made with respect to an outstanding restricted stock unit award of $7,301.

8